Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 19, 2016

US flash PMI surveys signal soft end to 2016 but brighter outlook

December's flash PMI surveys showed a slowing in the pace of economic growth at the end of the year, but the economy nevertheless notched up another quarter of solid expansion. Hiring and business confidence picked up, suggesting the slowdown may prove short-lived, as did inflationary pressures, adding to the belief that the Fed will continue to hike interest rates in 2017.

Slower end to robust fourth quarter

At 53.7, the flash Markit Composite PMI fell from 54.9 in the prior two months to signal the slowest expansion of business activity since September. Both manufacturing output and service sector activity grew at the weakest rates for three months.

However, although the pace of expansion cooled in December, the PMI surveys indicate that the economy continued to show solid, steady growth at the end of the year. The surveys are consistent with GDP rising at an annualised rate of 2.0% in the fourth quarter.

Markit PMI v US GDP

The upturn is being fuelled mainly by improving domestic demand, with exports being stymied by the dollar's recent strength. Exports rose only marginally in December, but rising demand from the domestic market led to the second-largest increase in new order inflows across both manufacturing and services seen in 2016.

Increased hiring

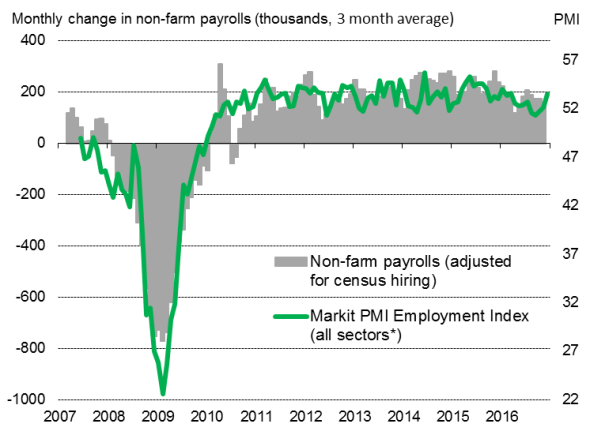

The December slowdown looks likely to be a temporary blip, not least because firms took on staff in increasing numbers in the expectation of rising workloads in 2017. The two flash PMI surveys are signalling a respectable 190,000 increase in non-farm payrolls in December.

Service sector employment rose to the greatest extent for nine months while factory headcounts showed the largest increase for one-and-a-half years.

Employment

Sources: IHS Markit, BEA.

Although down on October's high, business optimism about the year ahead in the service sector rose to the second-highest seen for over a year.

Cost pressures at 18-month high

The expansion has been accompanied by rising prices. Average prices charged for goods and services showed the second-largest increase in 18 months, the rate of inflation almost matching October's peak. The latest rise reflected the steepest rise in costs for one-a-a-half years, in turn commonly linked to the rising price of oil and other commodities.

Manufacturers were hardest hit, seeing raw material prices jump higher to the greatest extent for just over two years. However, the survey pointed to few capacity constraints (suppliers' delivery times, for example, were once again broadly unchanged), suggesting there is scant evidence of any significant demand-pull inflationary pressures and that much of the latest increase in prices stems from higher traded commodity prices.

2017 outlook

With the New Year bringing a change of government and a shift in emphasis towards fiscal stimulus, economic growth and the labour market look set to strengthen further in 2017. We expect GDP growth to accelerate to steady but unexciting 2.3% in 2017, accompanied by three further quarter point rate hikes by the Fed.

Faster growth of 2.6%, as increased infrastructure spending and tax cuts have an increased impact, and three further Fed hikes, are then anticipated for 2018.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122016-Economics-US-flash-PMI-surveys-signal-soft-end-to-2016-but.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122016-Economics-US-flash-PMI-surveys-signal-soft-end-to-2016-but.html&text=US+flash+PMI+surveys+signal+soft+end+to+2016+but+brighter+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122016-Economics-US-flash-PMI-surveys-signal-soft-end-to-2016-but.html","enabled":true},{"name":"email","url":"?subject=US flash PMI surveys signal soft end to 2016 but brighter outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122016-Economics-US-flash-PMI-surveys-signal-soft-end-to-2016-but.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+surveys+signal+soft+end+to+2016+but+brighter+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f19122016-Economics-US-flash-PMI-surveys-signal-soft-end-to-2016-but.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}