Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2016

Week Ahead Economic Overview

The week sees important updates on final third quarter GDP numbers for the US, France and the UK, while the Bank of Japan gathers to determine its latest course of monetary policy. Meanwhile, US Flash Services PMI data will provide a useful gauge of the economic performance of the world's largest economy during the final month of 2016.

It came as no surprise when the US Federal Reserve raised interest rates by 0.25% at its December meeting, only the second increase in a decade. Stronger economic growth and rising employment led central bankers to unanimously vote in favour of lifting the benchmark lending rate to between 0.5% and 0.75%.

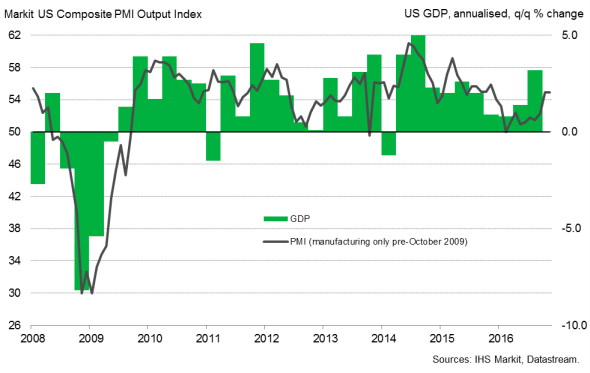

However, Fed chair Janet Yellen sought to downplay any shift to a more hawkish stance, declaring the economic outlook as "highly uncertain". Consequently, analysts will be looking out for deviations in the final Q3 US GDP figure when published next Thursday. The second estimate signalled a 3.2% increase in GDP, up from the previously reported 2.9% and the strongest since Q2 2014. Moreover, Flash US services PMI will provide an early indication to the economy's performance during the fourth quarter.

US GDP and the PMI

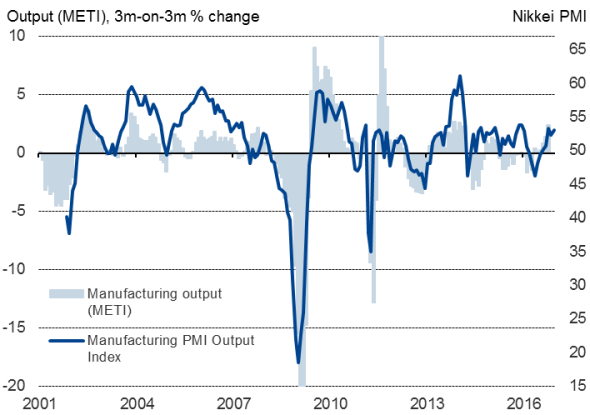

When policymakers at the Bank of Japan meet next Tuesday, the likelihood of a change from current monetary policy appears remote. With recent survey data suggesting GDP growth quickening to 1.0% for the fourth quarter after Japanese manufacturers reported a strong end to the year, the bank may start to feel more comfortable that current stimulus is working.

Japanese manufacturing output vs PMI

Nikkei Flash Japan PMI data for December signalled stronger upturns in output, new orders and employment, with growth fuelled by both stronger global demand and the depreciation of the yen. Moreover, the weakening exchange rate has led to rising costs for imported goods, with central bankers hopeful this will lead to a pick-up in inflation, rather than becoming a constraint on the current recovery.

With Japan's upturn being supported by stronger export growth, trade data released early next week will provide a further economic assessment of the world's third largest economy.

The Eurozone sees a number of important economic data releases next week including final Q3 GDP numbers for France and the Netherlands, eurozone wage figures, an update on the Italian unemployment rate and producer price data for Germany. The currency bloc's economy showed a strong end to 2016 during December, with Flash PMI data signalling 0.4% growth in the region. Business activity grew at an identical rate to November's 11-month high and inflationary pressures intensified to the sharpest extent for five-and-a-half years. ECB policymakers will be pleased with this scenario and will look for further positive news from next week's data announcements.

Meanwhile, the UK will also issue final GDP figures for the third quarter, after the second estimate pointed to 0.5% growth. So far there have been no signs from the official data to suggest that the growth rate will be revised.

Monday 19 December

Japanese trade data and the latest unemployment rate are issued.

In Russia, an announcement is made on retail sales numbers, wage data and the unemployment rate.

Eurozone wages figures are announced.

Germany sees the release of Ifo business climate data.

US Flash PMI data are released.

Tuesday 20 December

The Bank of Japan makes a decision on its future monetary policy.

Monthly GDP figures for Russia are out.

In Germany, producer price numbers are issued.

Polish industrial output, producer prices and retail sales figures are published.

Italy provides an update on its latest unemployment rate.

Wholesale trade figures are released in Canada.

Wednesday 21 December

Japan's all industry activity index is updated.

The Bank of Thailand announces its latest monetary policy decision.

In India, money supply figures are made available.

Consumer confidence data are issued in the eurozone.

France sees the publication of producer price numbers, while wage inflation figures are out in Italy.

Current account numbers are meanwhile updated in Greece.

In the UK, public sector borrowing data are issued.

An announcement on payroll job growth, federal tax revenue and foreign capital flows data are scheduled in Brazil.

Thursday 22 December

An announcement is made in Italy on latest industrial orders and retail sales numbers.

Canadian and Mexican inflation figures are released, with retail sales data out in Canada.

A third estimate of Q3 GDP numbers are made in the US, alongside the release of durable goods, export sales and jobless claims data.

Friday 23 December

Bank lending and foreign reserve numbers are published in India.

Meanwhile, Germany's GfK consumer confidence indicator is released.

In France, the Netherlands and the UK, the final Q3 GDP figures are issued, along with latest French consumer spending data.

Consumer confidence numbers are released in Brazil.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16122016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}