Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 21, 2015

Mixed picture of eurozone economy as growth slows but job gains hit four-year high

The eurozone's recovery lost some of its vigour in May, with growth slowing slightly for a second successive month, according to the latest flash PMI survey data. However, the survey also showed that the rate of expansion remained sufficiently robust to encourage firms to take on extra staff at the fastest rate for four years, with particular strong growth and job creation being seen outside of France and Germany. Price indices meanwhile hit three-year highs, adding to signs that deflationary pressures are receding.

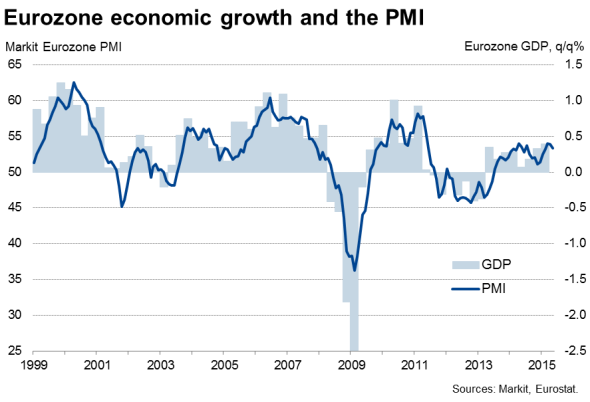

Markit's Eurozone PMI registered 53.4 in May, according to the flash reading (based on around 85% of usual monthly survey replies), down from 53.9 in April and the recent peak of 54.0 seen back in March. Analysts were expecting a reading of 53.8 on average.

The average PMI reading for the second quarter so far points to GDP growth similar to the 0.4% expansion seen in the first three months of the year, suggesting the region is on course to expand by 2.0% this year, which would be the best performance since 2010.

Job creation at four-year high

Employment rose at the fastest rate since May 2011, but the survey suggests that the pace of both economic growth and job creation could weaken in coming months, as new business inflows moderated for a second month running to register the smallest monthly gain since February.

Weaker order book growth was signalled by service providers, with manufacturers reporting the strongest inflows of new orders for just over a year, linked in part to an improved export performance (which is in turn being driven by the weak euro). Expectations of future growth in the service sector also slipped, dropping to a five month low.

Price indices hit three-year highs

The survey also brought some encouraging news to a region thought by many to be facing the potential threat of deflation. Companies' average input costs rose at the steepest rate since April 2012, driven up by a combination of higher oil prices, increased wage bills and rising import costs due to the euro's depreciation in recent months.

Although average selling prices for goods and services continued to fall, the decline was only marginal and the smallest recorded since March 2012.

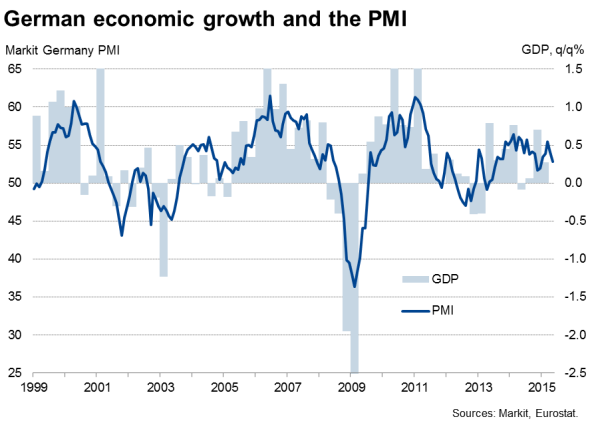

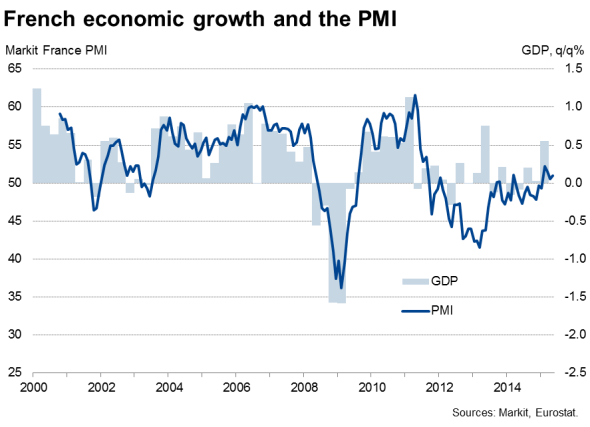

By country, the survey results suggest the German economy is on course for a reasonable expansion of 0.4% in the second quarter, but France is likely to struggle to see growth exceed 0.3%. However, it's outside of these two 'core' countries where the main action appears to be, with the rest of the region enjoying its best quarter of economic growth and job creation for almost eight years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Mixed-picture-of-eurozone-economy-as-growth-slows-but-job-gains-hit-four-year-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Mixed-picture-of-eurozone-economy-as-growth-slows-but-job-gains-hit-four-year-high.html&text=Mixed+picture+of+eurozone+economy+as+growth+slows+but+job+gains+hit+four-year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Mixed-picture-of-eurozone-economy-as-growth-slows-but-job-gains-hit-four-year-high.html","enabled":true},{"name":"email","url":"?subject=Mixed picture of eurozone economy as growth slows but job gains hit four-year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Mixed-picture-of-eurozone-economy-as-growth-slows-but-job-gains-hit-four-year-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mixed+picture+of+eurozone+economy+as+growth+slows+but+job+gains+hit+four-year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Mixed-picture-of-eurozone-economy-as-growth-slows-but-job-gains-hit-four-year-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}