Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 21, 2015

Japan manufacturing PMI rebounds in May

Business activity picked up in Japan's manufacturing sector in May, providing hope that the economy may have retained moderate growth momentum in the second quarter.

However, export growth has almost stalled so far in the second quarter and price pressures weakened, suggesting further stimulus from the Bank of Japan should not be ruled out.

PMI revives from 11-month low

The Markit Japan Manufacturing PMI rose from an 11-month low of 49.9 in April to reach a three-month high of 50.9 in May, according to the preliminary 'flash' estimate which is based on approximately 85% of usual monthly replies.

Production levels rose, having slipped briefly into decline in April, and new orders increased for the first time in three months.

The survey data suggest that manufacturing output - which fell for a second successive month in March according to the latest official data - has picked up slightly, therefore painting a brighter picture for the overall economy in the second quarter. GDP rose 0.6% in the first quarter, according to initial estimates, but after stripping out a large inventory build-up, growth was a less impressive 0.4%.

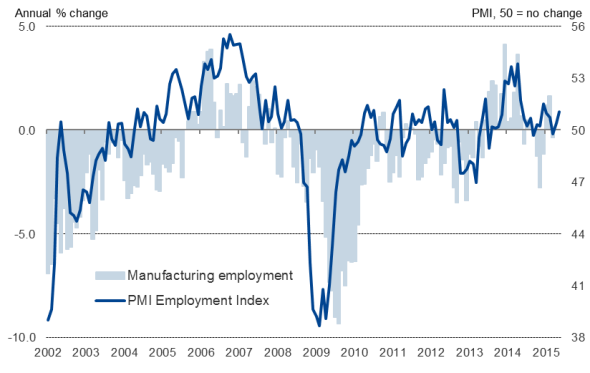

The upturn in demand in May was also sufficient to encourage factory owners to take on extra staff to the greatest extent seen so far this year.

Still in a soft patch

However, although reviving, the rate of growth of output, order books and employment all remained well below the robust rates seen early last year, prior to the sales tax rise.

Employment

The survey, therefore, suggests that the manufacturing sector remains stuck in a soft patch that has followed the tax rise, with weak domestic demand accompanied by sluggish export sales arising from lacklustre demand in key overseas markets such as China.

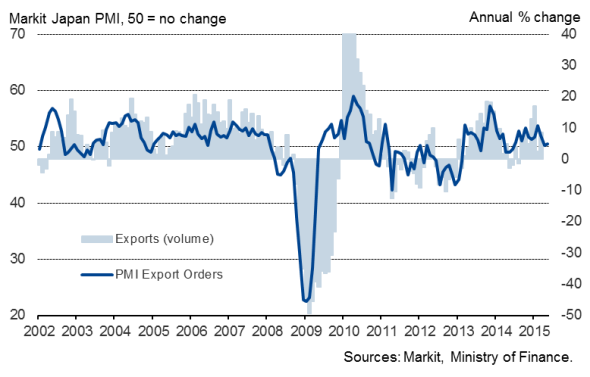

Goods exports

The May survey showed new export orders barely rising for a second consecutive month, the rate of growth having slowed to near-stagnation in April.

The lack of overseas sales growth is a particular concern given the yen's depreciation, with the currency having held fairly steady so far this year but trading down almost 10% on a year ago in May on a trade-weighted basis.

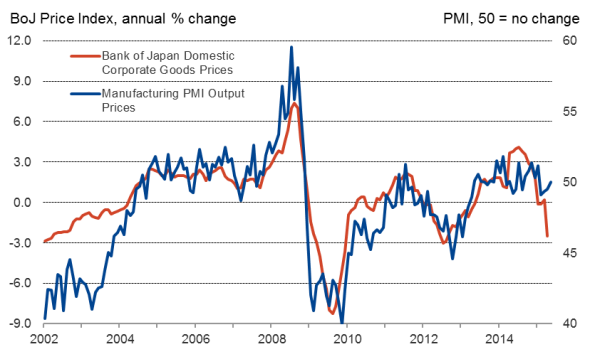

Don't rule out further stimulus

The survey also brought disappointing news for a government chasing a target of 2.0% inflation. After stripping out the sales tax rise, the central bank estimates the core consumer price index was flat in March, and the manufacturing data point to a weakening of core price pressures in both April and May. Manufacturers' input costs rose only marginally in May, showing the smallest monthly increase since December 2012. Prices charged by factories were unchanged during the month.

Corporate goods prices

With underlying inflation well below the central bank's target and the economy struggling amid weak domestic demand and stalling export growth, the chances of the Bank of Japan sanctioning further stimulus cannot be ruled out, but the big question is what form such stimulus would take. Interest rates are at zero and the bank is already engaged in a quantitative easing plan of unprecedented scale, intended to double the country's monetary base.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Japan-manufacturing-PMI-rebounds-in-May.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Japan-manufacturing-PMI-rebounds-in-May.html&text=Japan+manufacturing+PMI+rebounds+in+May","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Japan-manufacturing-PMI-rebounds-in-May.html","enabled":true},{"name":"email","url":"?subject=Japan manufacturing PMI rebounds in May&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Japan-manufacturing-PMI-rebounds-in-May.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+manufacturing+PMI+rebounds+in+May http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Japan-manufacturing-PMI-rebounds-in-May.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}