Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 21, 2015

Eurozone export boost contrasts with disappointment in US, China and Japan

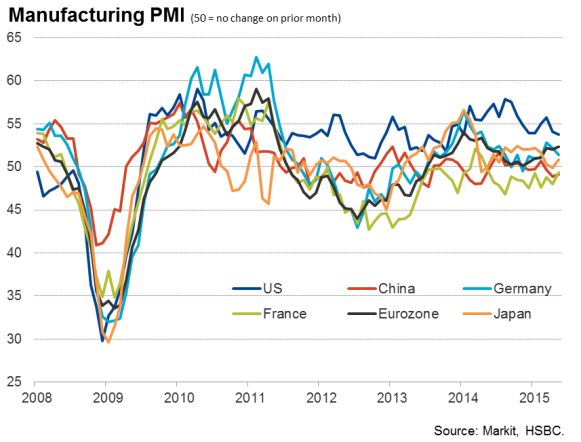

May's flash PMI survey data painted a downbeat picture of worldwide manufacturing trends, with economies struggling in the face of sluggish global trade flows. However, eurozone exporters, benefitting from the single currency's depreciation, are outperforming in terms of export gains.

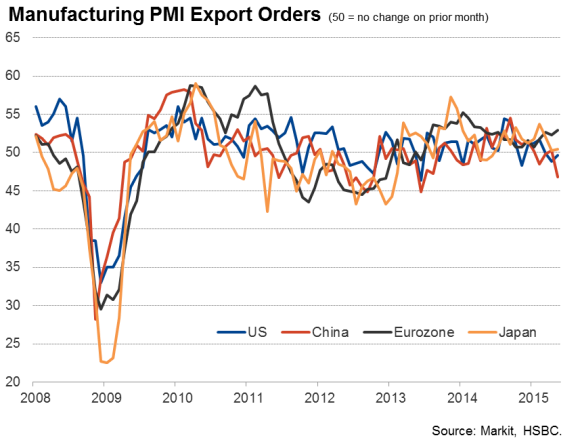

Weak exports were the key to disappointing manufacturing trends in both China and Japan. At 49.1, the flash PMI for China signalled a deterioration in business conditions for a third successive month, fuelled by the steepest drop in export orders for almost two years. Factory output fell for the first time since December as a result. The survey paints a picture of industrial production growth weakening in China from the already sluggish 5.6% annual rate seen in April, edging closer to the low of 5.4% seen at the height of the global financial crisis.

In Japan, the flash PMI rose from 49.9 to 50.9, signalling a modest return to growth. However, although inflows of new order books picked up for the first time in three months, the increase was only modest due to a near-stagnation of export orders for a second successive month. The poor export performance is a major disappointment, given the weakness of the yen, and suggests further stimulus should not be ruled out from the Bank of Japan.

It wasn't only in Asia where exports were a notable weak spot in the PMI result. In the US, the flash PMI fell to a 16-month low of 53.8, with growth in the manufacturing economy dragged down by a second successive monthly downturn in export orders. The strong dollar was widely cited as a key cause of disappointing export sales, alongside weak demand, especially from Asia.

There was a brighter picture in the eurozone, however, where the manufacturing PMI rose to a 13-month high of 52.3. The improvement was driven in part by an upturn in new exports orders, which likewise hit a 13-month high (though note this measure includes intra-eurozone trade flows). Companies commonly reported that exports were being buoyed by the euro's depreciation. Especially welcome was the first (albeit minor) increase in exports from France, which has lagged the wider-region's recovery, since April of last year.

Less positively, the upturn in the euro area's manufacturing sector was offset by slower growth in the services economy, though the region remains on track for a 0.4% expansion of GDP in the second quarter.

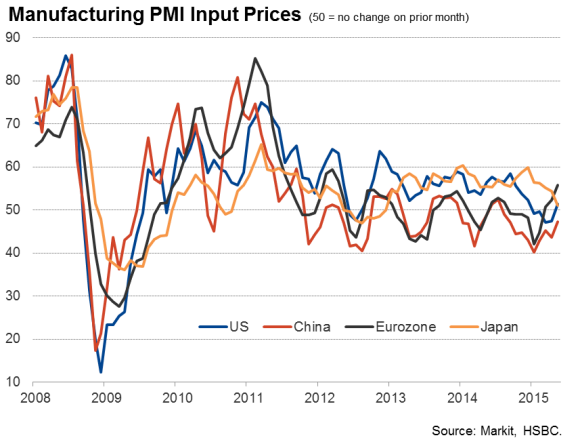

The impact of currency movement was not confined to exports. The weaker euro was partly to blame for eurozone goods producers reporting that steepest rise in input costs for three years. In contrast, input costs fell in China and rose only very modestly in the US and Japan, despite upward pressure from rising oil prices.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Eurozone-export-boost-contrasts-with-disappointment-in-US-China-and-Japan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Eurozone-export-boost-contrasts-with-disappointment-in-US-China-and-Japan.html&text=Eurozone+export+boost+contrasts+with+disappointment+in+US%2c+China+and+Japan","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Eurozone-export-boost-contrasts-with-disappointment-in-US-China-and-Japan.html","enabled":true},{"name":"email","url":"?subject=Eurozone export boost contrasts with disappointment in US, China and Japan&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Eurozone-export-boost-contrasts-with-disappointment-in-US-China-and-Japan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+export+boost+contrasts+with+disappointment+in+US%2c+China+and+Japan http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f21052015-Economics-Eurozone-export-boost-contrasts-with-disappointment-in-US-China-and-Japan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}