Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2015

Retail sales fall but surge in tax receipts highlights a healthier UK economy

UK consumers pulled back on their retail spending in January, but it looks like the underlying trend remains firm amid low prices, falling fuel bills and rising wages.

Separate data meanwhile revealed that a surge in income tax receipts has helped push the government deficit down 7.5% on a year ago.

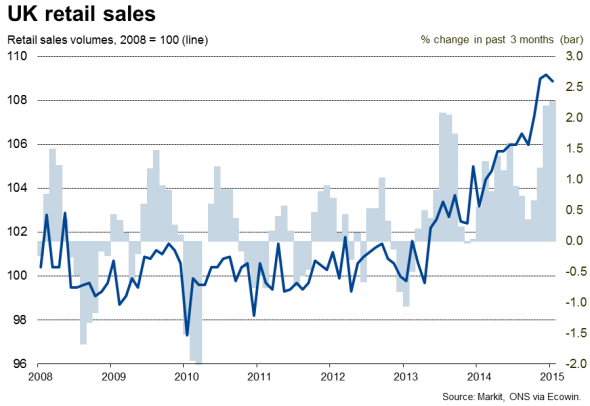

Retail sales fell 0.3% in January, slightly steeper than the 0.2% fall economists polled by Reuters had been expecting. However, the decline comes on the back of strong spending growth in the closing months of 2014, fuelled in part by consumers embracing the first major 'Black Friday' promotions in the UK. Sales had risen 1.6% in November and 0.2% in December, resulting in a 2.2% increase in sales in the fourth quarter as a whole, which was the largest rise since the spring of 2002. To have some payback as households rested their wallets in January is therefore no big surprise. Let's not forget that sales were still 5.4% higher than a year ago in January.

The big question is whether this represents the start of an easing trend in spending. The Bank of England certainly expects improvements in consumer spending to be a big driver of stronger economic growth this year and next.

The Bank's optimism seems well placed. Consumer mood has indeed brightened so far this year. Markit's Household's Finance Index remains close to its January post-crisis high in February, buoyed by rising incomes, greater job security and falling prices. Official data are likewise showing wage growth slowly reviving amid record employment and falling joblessness.

It's difficult to see why consumer spending shouldn't improve further against this backdrop of rising wages, fuller employment and low prices.

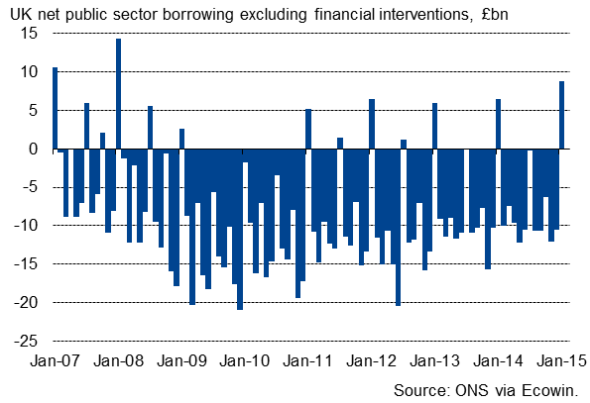

UK government borrowing

Tax boost

It's also encouraging to see that the recovery in incomes is starting to have a material impact on the government's deficit reduction plans.

Data from the Office for National Statistics showed a surge in income tax receipts helped boost the public finances in January, reflecting a long-awaited inflow of self-employed income tax revenues to the exchequer. Government borrowing for the first 10 months of the current tax year fell to "74.0 billion as a result, down "6 billion (7.5%) on last year.

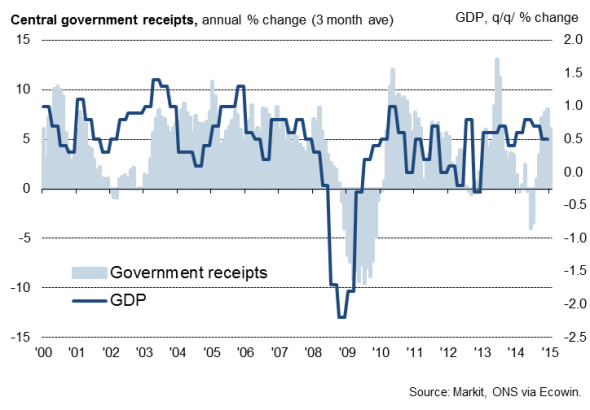

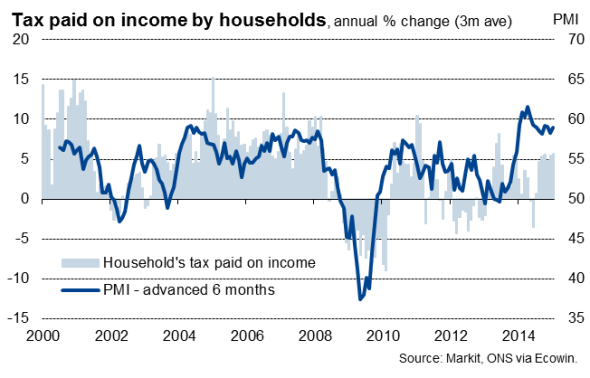

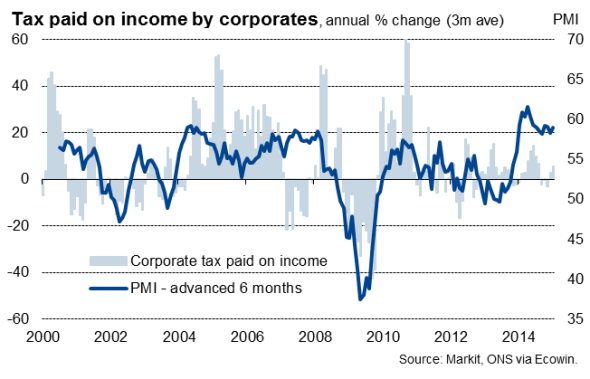

Tax revenues and economic growth

January is usually a good month for tax receipts due to the deadline for self-assessment tax returns, and this year was the best for seven years with coffers boosted in part by high-rate tax payers deferring payments from 2013-14 into 2014-15 to take advantage of the drop in the top tax band from 50% to 45% in April 2013.

The improvement is a boon to the coalition government ahead of May's General Election, putting the Chancellor on course to hit his target of a "6 billion cut to the deficit this year.

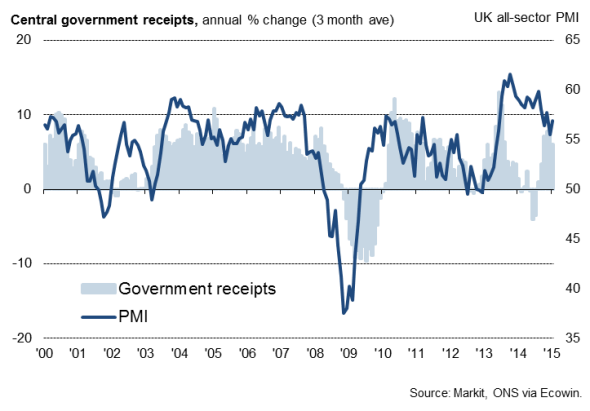

The boost to tax revenues in January goes some way to address the unusual shortfall of tax receipts relative to indicators of economic growth (both GDP and PMI measures) over the past year. However, tax revenues still remain lower than one would have expected, given the pace of economic growth.

Tax revenues and the PMI

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Retail-sales-fall-but-surge-in-tax-receipts-highlights-a-healthier-UK-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Retail-sales-fall-but-surge-in-tax-receipts-highlights-a-healthier-UK-economy.html&text=Retail+sales+fall+but+surge+in+tax+receipts+highlights+a+healthier+UK+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Retail-sales-fall-but-surge-in-tax-receipts-highlights-a-healthier-UK-economy.html","enabled":true},{"name":"email","url":"?subject=Retail sales fall but surge in tax receipts highlights a healthier UK economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Retail-sales-fall-but-surge-in-tax-receipts-highlights-a-healthier-UK-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retail+sales+fall+but+surge+in+tax+receipts+highlights+a+healthier+UK+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Retail-sales-fall-but-surge-in-tax-receipts-highlights-a-healthier-UK-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}