Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 20, 2015

Japanese factories report stronger exports but selling prices fall amid weak domestic demand

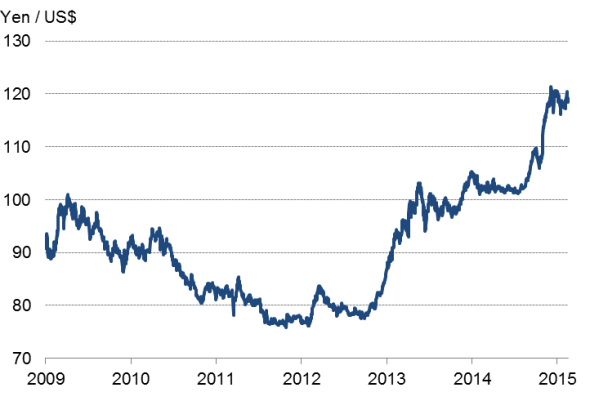

Having lifted out of recession late last year, Japan's economy looks to have continued to expand in the first quarter so far, according to flash PMI survey data. However, growth remains weak and too dependent on exports, buoyed in turn by the yen's depreciation. The weakened currency is also driving up costs but selling prices are falling, in what is a further set-back for policymakers' efforts to boost inflation.

Investor sentiment has shifted away from safe-haven government bonds towards equities in recent months, as highlighted by Markit ETF data, a trend which looks likely to continue given the ongoing orientation of growth towards exporters. However, with corporates struggling to raise prices while costs rise, earnings may come under pressure in coming months.

Export-led growth

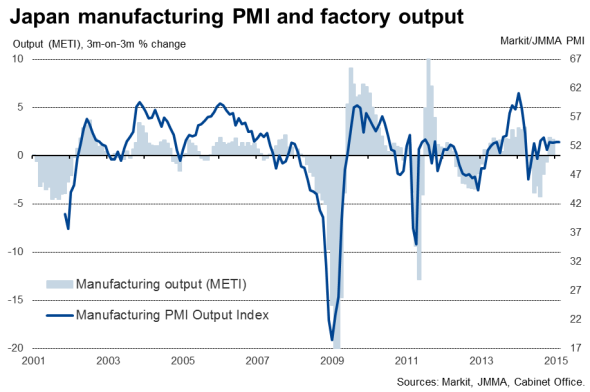

Manufacturers' operating conditions improved for a ninth consecutive month in February, according to Markit's flash Manufacturing PMI. However, the rate of improvement was the weakest for seven months, with the headline PMI falling from 52.2 in January to 51.5.

Although production continued to rise at a pace unchanged on January, the rate of expansion remains only modest at just over 1% per quarter.

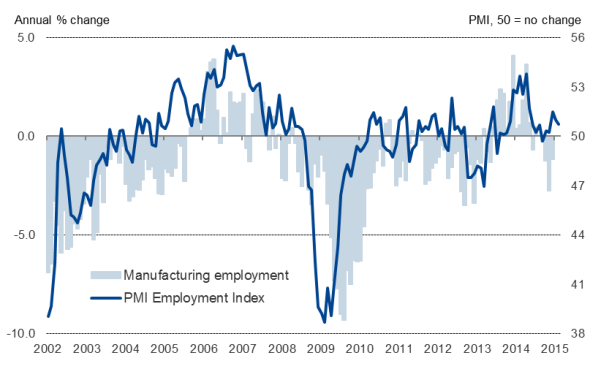

Future prospects also look somewhat bleak after growth of new orders fell to the lowest since May of last year, pointing to a renewed weakening of domestic demand. Employment growth likewise eased, down to a three-month low, as firms grew increasingly reticent to take on extra staff in the face of sluggish demand.

Employment

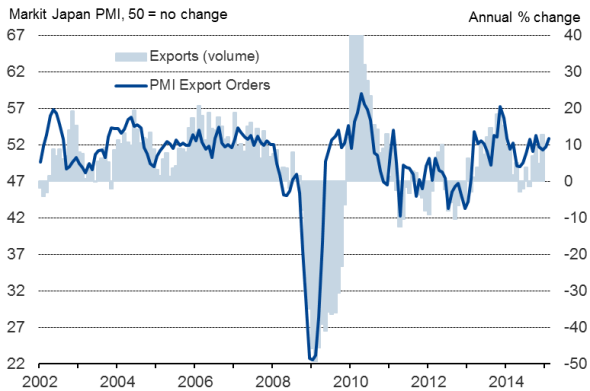

There was better news on the export front, where the survey recorded the largest monthly rise in overseas new orders since October. Exports have now risen for eight successive months, rising at an annual rate of approximately 10% according to the flash PMI results for February, buoyed by the yen's marked depreciation following central bank stimulus.

Goods exports

Wrong type of inflation

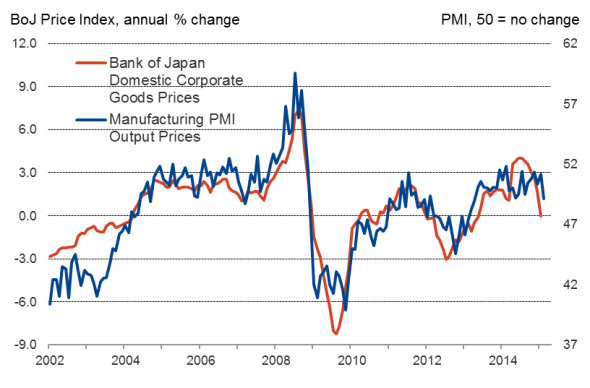

The survey brought disappointing news in relation to the government's struggle to drive inflation up to 2.0%. Manufacturers reported that the weaker yen continued to drive up input costs by making imports more expensive, but their selling prices were cut on average for the first time since last August as producers competed on price in the face of weak demand.

The divergence between rising costs and falling selling prices clearly indicates that margins are being squeezed.

From the government's perspective, the weakened yen is therefore still generating the wrong sort of inflation: costs are rising but selling prices are not. As such, there is likely to be little scope for wages to be negotiated higher, as this will only exacerbate the squeeze on profit margins.

Corporate goods prices

Exchange rate

Source: Ecowin.

Stimulus doubts

The survey data add to the sense that the Bank of Japan will be cautious against any further expansion of its asset purchase programme beyond its current size, amid worries that quantitative easing is merely driving up costs rather than feeding through to higher wages and inflation.

Back in October, the central bank upped its QE programme from "60-70 trillion per year to "80 trillion such that, starting in 2015, the bank's balance sheet will expand by 15% of GDP each year.

To provide a genuine boost to the economy and to stoke higher inflation, there is a growing realisation that the government will need to look at alternative measures to persuade employers to raise wages.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Japanese-factories-report-stronger-exports-but-selling-prices-fall-amid-weak-domestic-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Japanese-factories-report-stronger-exports-but-selling-prices-fall-amid-weak-domestic-demand.html&text=Japanese+factories+report+stronger+exports+but+selling+prices+fall+amid+weak+domestic+demand","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Japanese-factories-report-stronger-exports-but-selling-prices-fall-amid-weak-domestic-demand.html","enabled":true},{"name":"email","url":"?subject=Japanese factories report stronger exports but selling prices fall amid weak domestic demand&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Japanese-factories-report-stronger-exports-but-selling-prices-fall-amid-weak-domestic-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japanese+factories+report+stronger+exports+but+selling+prices+fall+amid+weak+domestic+demand http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20022015-Economics-Japanese-factories-report-stronger-exports-but-selling-prices-fall-amid-weak-domestic-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}