Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 18, 2014

Week Ahead Economic Overview

In the US and UK, third quarter GDP numbers are updated, with the US also seeing the release of durable goods orders data. Meanwhile, industrial output, unemployment and inflation data are released in Japan.

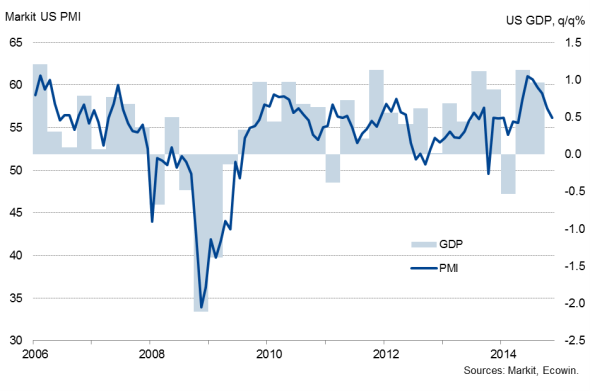

Third quarter GDP numbers are updated in the US, though little change is expected after the second estimate showed the US economy expanding at an annualised rate of 3.9%, but any material revisions could affect the policy outlook. The robust third quarter expansion followed growth of 4.6% in the second quarter, meaning the US has undergone its strongest growth phase for 11 years. Such buoyant growth has the Fed to signpost that interest rates will start rising in mid-2015. However, the Fed has also stressed that it will be "patient" in terms of tightening policy, a cautious approach vindicated by recent business surveys. The Markit Flash US Composite PMI" Output Index fell to its lowest level since October 2013, suggesting that economic growth in the fourth quarter could come in below 2%.

US GDP and the PMI

An update on durable goods orders will add to the policy debate. Orders for durable goods rose 0.4% in October, but once the volatile transportation sector is stripped out, orders fell 0.9%. Economists polled by Reuters are expecting a 1.8% rise in durable goods orders for November.

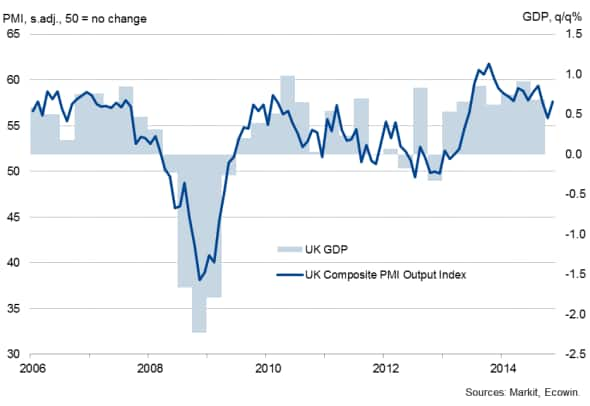

The final estimate of third quarter GDP for the UK is meanwhile provided by the Office for National Statistics. The second estimate showed the UK economy growing by 0.7%, unchanged from the initial estimate, but down from 0.9% in the second quarter. Recent data, notably a doubling in the expansion recorded in the construction sector compared to the initial estimate, means we expect growth to be revised up to at least 0.8%. There are signs, however, that economic growth will slow further in the final three months of the year. Despite picking up in November, the weighted average Output Index from the three Markit/CIPS PMI" surveys is currently pointing to GDP growth of around 0.6%.

UK GDP and the PMI

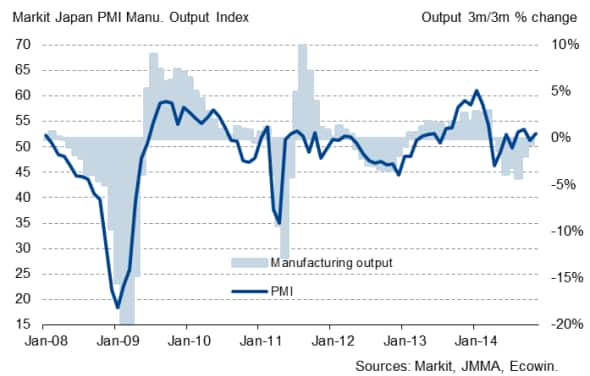

In Japan, a preliminary estimate of industrial output numbers for November will give an all-important insight into fourth quarter GDP growth. The data will provide clues as to whether the Japanese economy has pulled out of the recession caused by the sales tax rise earlier in the year. Japan's flash Manufacturing PMI" signalled an increase in production in December, adding to hopes that the economy has returned to growth, albeit tentatively.

Japan's inflation numbers will also be closely watched for indications as to whether the government is succeeding in its plan to defeat deflation amid signs that core price pressures are easing. Prices rose 2.9% on a year ago in October, though partly as a result of April's sales tax hike. Meanwhile, unemployment data are also issued. The jobless rate in Japan fell to 3.5% in October, from 3.6% in the previous month, withstanding any ill effects from weak GDP data.

Japanese industrial production and the PMI

Monday 22 December

Germany sees the release of import price data, while consumer confidence numbers are issued for the eurozone.

In Italy, trade balance figures are out and Greece sees an update on current account numbers.

Russia meanwhile updates its monthly GDP data.

In the US, the Chicago Fed National Activity Index is released alongside an update on existing home sales numbers.

Tuesday 23 December

Final third quarter GDP numbers and current account data are out in the UK.

France sees the release of consumer spending data, revised GDP numbers and producer price figures.

Retail sales are meanwhile issued in Italy.

In Canada, monthly GDP data are released.

Durable goods orders, building permits numbers and final third quarter GDP data are published in the US.

Wednesday 24 December

M3 money supply information are released in India.

Third quarter labour productivity data are released for the UK by the Office for National Statistics.

In the US, initial jobless claims data are out.

Thursday 25 December

Housing starts numbers for November are issued in Japan.

Friday 26 December

A fleet of data are released in Japan, including inflation numbers, unemployment and retail sales data and the latest industrial production figures.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18122014-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}