Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2015

"All-sector' PMI signals weakest growth for over one-and-a-half years

The PMI" survey data provide policymakers with a mixed bag of news on the health of the economy at the end of last year, adding further uncertainty about the outlook for interest rates.

Renewed fragility

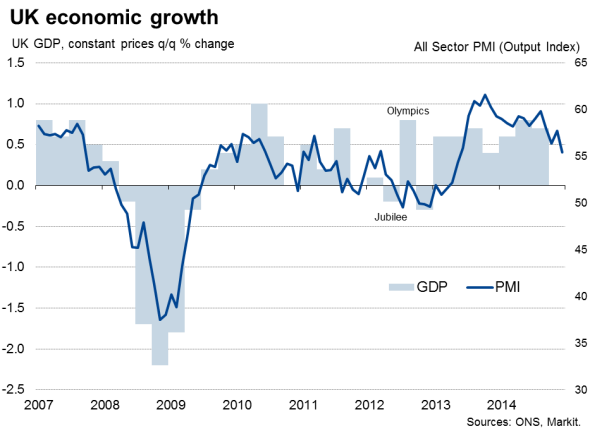

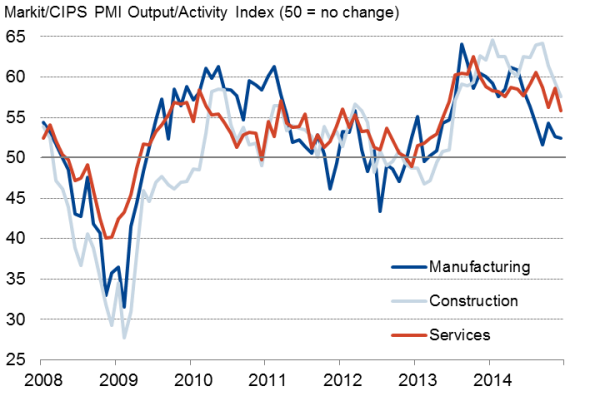

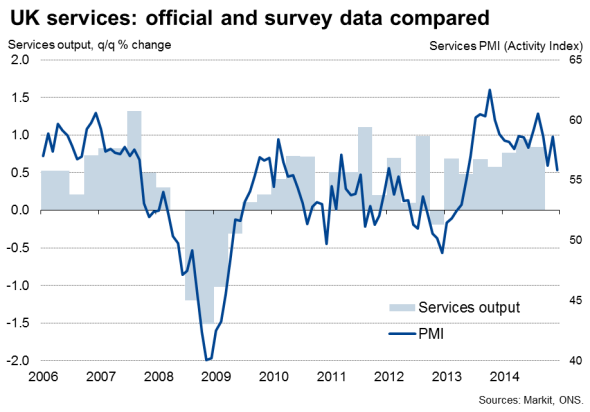

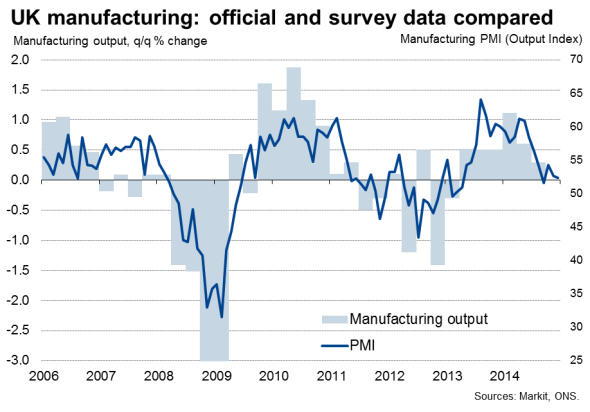

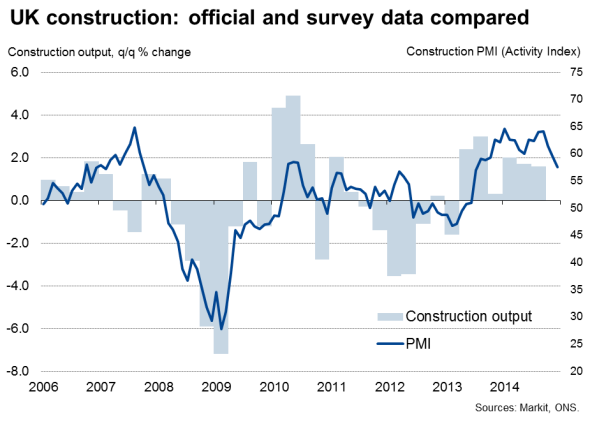

Weaker rates of expansion were seen in services, manufacturing and construction in December, taking the overall pace of economic growth to the weakest for just over a year-and-a-half. The weighted average Output Index from the three Markit/CIPS PMI surveys fell from 57.7 in November to 55.4, its lowest since May 2013.

With the average PMI reading for the latest three months standing at 56.5, the surveys suggest the economy grew by 0.5% in the fourth quarter, down from 0.7% in the third quarter.

The loss of momentum towards the year end will no doubt fuel worries that the upturn is too fragile to withstand higher interest rates. With policymakers clearly remaining extremely cautious in the timing of the first rate rise, the weaker pace of growth signalled by the surveys most likely means any hike in borrowing costs remains firmly off the agenda for the majority of Monetary Policy Committee members.

However, it's too early to get worried about a sharp slowdown; after all, the latest PMI reading is still strong, merely down from unusually high levels earlier in the year and broadly in line with the average seen in the years leading up to the financial crisis.

Furthermore, even a 0.5% expansion of GDP in the final quarter means the economy grew by 2.6% over 2014 as a whole, which would be its best year since 2007 (albeit weaker than previously thought due to recent revisions to the official GDP data in the first half of the year).

Business activity by sector

Improving labour market

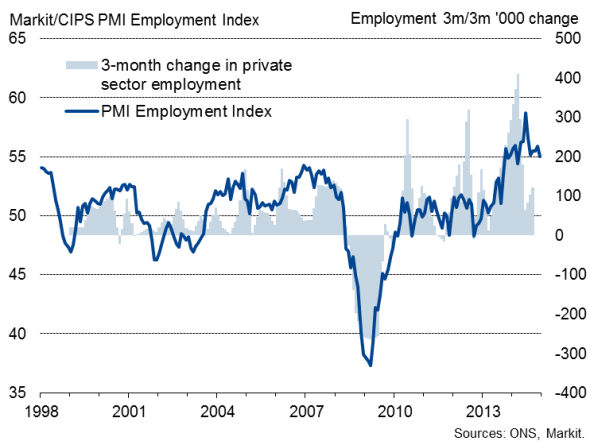

Importantly, the pace of growth also remains robust enough to sustain an impressive rate of job creation, with the surveys also finding welcome evidence of wage growth.

Over 2014 as a whole, the three PMI surveys collectively recorded the strongest employment growth since data were first available in 1998, with only a minor loss of momentum reported in December.

While the surveys do not specifically measure wage growth, service sector firms reported that rising wages were a key element behind an overall increase in their input costs. Similarly, construction companies reported that rates paid to sub-contractors also rose sharply again in December, likewise linked to the need to pay higher wages.

Employment

Cost pressures fall

Fortunately, higher staff costs are being offset by falling fuel and energy prices, linked to the recent slump in the price of oil. Across all three sectors, the PMI measure of input costs showed the slowest rate of inflation since May 2013. The benefits of lower oil and other commodity prices were most clearly evident in manufacturing, where average input prices showed the largest fall for almost two-and-a-half years.

Uncertain outlook

Companies remain upbeat about the outlook, but less so than earlier in 2014. Confidence slipped to the lowest for almost a year-and-a-half in the construction sector in December, and also dipped slightly in services.

Low fuel prices are expected to help boost business profits (outside of the energy sector) and therefore sustain economic growth in 2015, not least because the lower inflationary pressures provide greater leeway for interest rates to remain on hold.

However, global geopolitical tensions remain a major worry for businesses, as does the ongoing crisis in the eurozone, while closer to home the forthcoming General Election is also driving uncertainty.

With the outlook becoming more uncertain and the pace of economic growth fading at the end of 2014, the Bank of England's most recent forecast for the economy to grow by 2.9% in 2015 is already looking too optimistic.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-All-sector-PMI-signals-weakest-growth-for-over-one-and-a-half-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-All-sector-PMI-signals-weakest-growth-for-over-one-and-a-half-years.html&text=%22All-sector%27+PMI+signals+weakest+growth+for+over+one-and-a-half+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-All-sector-PMI-signals-weakest-growth-for-over-one-and-a-half-years.html","enabled":true},{"name":"email","url":"?subject="All-sector' PMI signals weakest growth for over one-and-a-half years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-All-sector-PMI-signals-weakest-growth-for-over-one-and-a-half-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=%22All-sector%27+PMI+signals+weakest+growth+for+over+one-and-a-half+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012015-Economics-All-sector-PMI-signals-weakest-growth-for-over-one-and-a-half-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}