Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 18, 2016

Bank of Russia maintains current interest rate but looks set to endure a testing few months

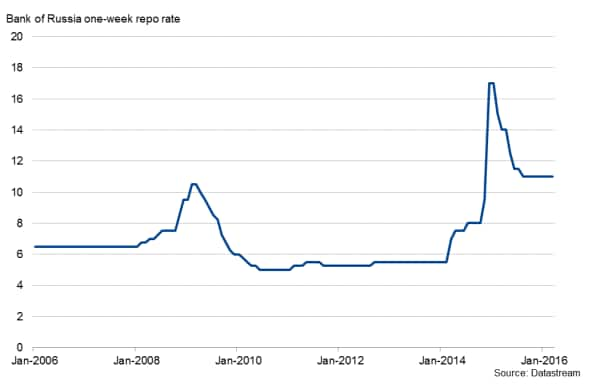

The Bank of Russia's decision to keep its benchmark one-week repo rate at 11.0% today was unsurprising to global analysts. However, with a number of economic headwinds on the horizon, the consensus that a rate cut is nearing has been gathering momentum.

Bank of Russia one-week repo rate

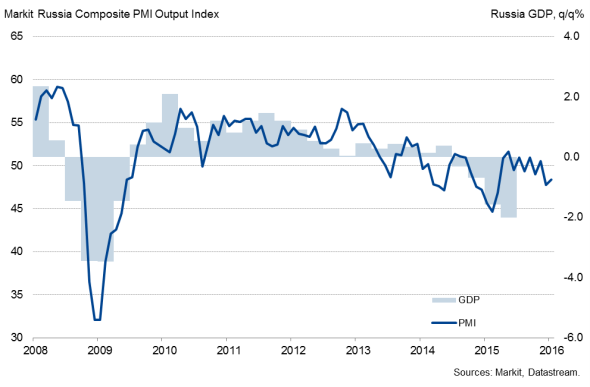

Russia's economy has been enduring its longest recession in the last 20 years. Gross domestic product contracted 3.7% year-on-year in 2015 as a whole, with forecasters expecting the economy to shrink further in 2016. Policymakers have been searching for methods to resuscitate one of the world's largest emerging markets, but with little success.

Russian GDP vs PMI

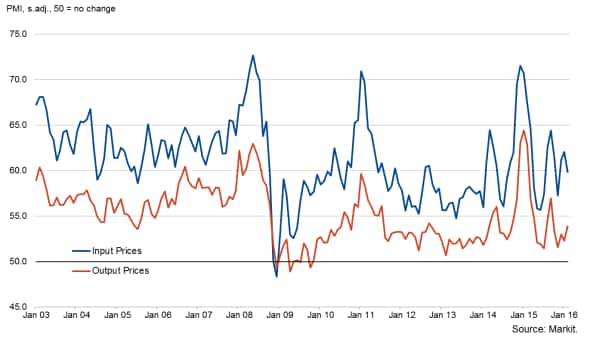

Despite the downturn, standing in the way of a BoR rate cut are strong inflationary pressures, stemming from the sharp decline in global oil prices and a depreciation of the rouble. Official data signalled a 8.1% annual increase in Russian consumer prices during February, and although easing to the weakest in two years, the rate of increase was still far higher than the central bank's target of 4%.

Studying Russia's PMI numbers strengthens the case for economic stimulus from the bank. The survey data from Markit have been lacklustre since the start of 2014, with the average headline figure coming in below the all-important 50.0 threshold during this period. Survey data have highlighted a lack of new business into the economy and a trend of job cuts that stretches back to July 2013.

Analysing the survey data at a sector level highlights an equally bleak economic environment across both the manufacturing and service sectors. Operating conditions at goods producers have deteriorated in each of the past three months, while service providers registered only marginal growth in business activity during February, the first time an expansion has occurred since September last year. Not only are both sectors experiencing worryingly sluggish conditions, but manufacturers and service providers continue to report mounting price pressures, adding to the dilemma faced by the central bank.

Output Prices vs Input Prices

However, some economists believe that Russia's recession is 'bottoming out'. Industrial production data published yesterday showed a 1.0% annual increase at Russian factories in February, the first expansion registered in over a year. Furthermore, oil prices appear to be on the rebound, rising to just over $41 per barrel, from the lows of roughly $29 per barrel at the start of 2016. However, the improvements made have been slight and there is still a long journey to take until an economic recovery can be achieved.

The Bank of Russia will make their next interest rate decision on the 29th April. By then, policymakers will be wanting to see indications of slowing inflation before a verdict to cut their lending rates can be made. Next week sees a number of key economic data releases that will also help guide the bank on its future monetary policy including monthly GDP figures, updated retail sales numbers, real wages data and latest unemployment figures. Moreover, manufacturing and services PMI data for March, compiled by Markit, published on the 1st and 5th April respectively, will give an early steer for first quarter 2016 GDP figures and provide an assessment of the health of Russia's economy.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-economics-bank-of-russia-maintains-current-interest-rate-but-looks-set-to-endure-a-testing-few-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-economics-bank-of-russia-maintains-current-interest-rate-but-looks-set-to-endure-a-testing-few-months.html&text=Bank+of+Russia+maintains+current+interest+rate+but+looks+set+to+endure+a+testing+few+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-economics-bank-of-russia-maintains-current-interest-rate-but-looks-set-to-endure-a-testing-few-months.html","enabled":true},{"name":"email","url":"?subject=Bank of Russia maintains current interest rate but looks set to endure a testing few months&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-economics-bank-of-russia-maintains-current-interest-rate-but-looks-set-to-endure-a-testing-few-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+Russia+maintains+current+interest+rate+but+looks+set+to+endure+a+testing+few+months http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f18032016-economics-bank-of-russia-maintains-current-interest-rate-but-looks-set-to-endure-a-testing-few-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}