Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 17, 2016

Week Ahead Economic Overview

With policymakers at the world's central banks becoming increasingly concerned about the global economic outlook, flash PMI data for March will be closely watched to see if a US-led faltering of growth persisted at the end of the first quarter. Other important releases include durable goods orders and final fourth quarter GDP data in the US and inflation and retail sales numbers in the UK.

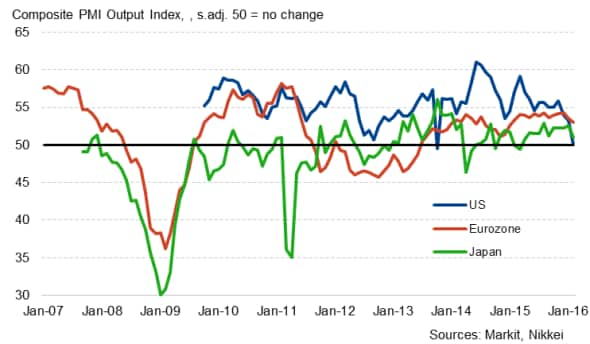

Composite PMI Output Index

The release of Markit's flash US PMI data (published on Tuesday for manufacturing and Thursday for services) will give the first insight into economic conditions in March and will therefore present the first complete picture for the first quarter as a whole, and a key to Fed policy. As widely expected, interest rates were left unchanged at the Fed's March meeting after the recent data flow has disappointed. February's PMI surveys pointed to a danger of the US economy stalling, and have since been followed by lacklustre retail sales and industrial production data.

The US also sees the publication of durable goods orders data. It is expected that durable goods fell in February, after showing a solid 4.7% rise in January. Markit's manufacturing PMI New Orders Index signalled one of the slowest rates of growth over the past three-and-a-half years, led by falling exports.

In the UK, consumer price numbers are released a week after George Osborne announced in his Budget speech that inflation is expected to be 0.7% in 2016, rising to 1.6% in 2017 before returning to the Bank of England's target of 2.0% in 2018. Consumer prices rose 0.3% in the year through to January (a 12-month high) and economists polled by Thomson Reuters expect the rate of inflation to have remained at this level in February. Retail sales are also out during the week. In January, the quantity bought in the retail industry rose 2.3%, according to the Office for National Statistics, so some pay-back is possible in February.

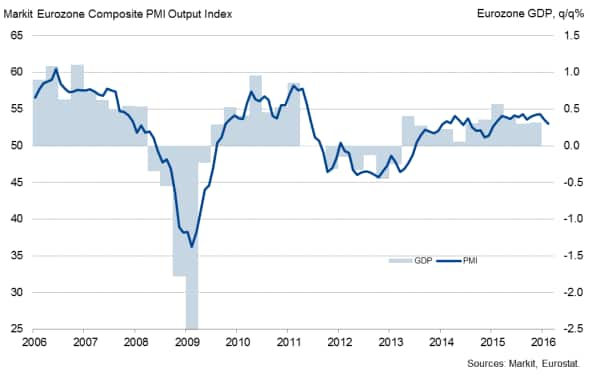

Eurozone PMI data will meanwhile give clues as to whether growth is reviving after having slowed in February. The weak PMI contributed to the perceived need for more stimulus, with an aggressive series of measures introduced by the European Central Bank (ECB) last week.

Eurozone GDP and the PMI

There are other notable data releases in the euro area, including latest Ifo business climate and GfK consumer confidence data in Germany plus industrial orders and retail sales figures in Italy.

Flash PMI results are also published for Japan's manufacturing sector and will give further insight into the country's performance in the first quarter. Goods producers reported a near-stalling of business activity in February with production barely rising and exports falling. The downturn bodes ill for Japan's wider economy in the first quarter, suggesting manufacturing will have acted as a drag and raising the possibility of another slide back into recession.

Monday 21 March

Monthly GDP numbers, retail sales, unemployment and real wage data are published in Russia.

Current account numbers and consumer confidence data are updated by Eurostat in the eurozone.

CBI releases orders figures in the UK.

The CFNA Index is issued by the Federal Reserve Bank of Chicago in the US.

Tuesday 22 March

Markit flash PMI data are released in Japan, France, Germany, the eurozone and the US.

House prices are released in Australia.

The Central Bank of Nigeria announces its latest monetary policy decision.

The Ifo Business Climate and ZEW Economic Sentiment indices are published in Germany.

In Greece, current account numbers are updated.

The Office for National Statistics issues consumer and producer price figures in the UK.

Home price data are meanwhile released in the US.

Wednesday 23 March

South Africa sees the release of consumer price figures.

Wage inflation numbers are meanwhile issued in Italy.

Unemployment and current account data are published in Brazil.

In the US, mortgage application and mortgage rate figures are out.

Thursday 24 March

The European Central Bank issues its latest Economic Bulletin.

Consumer confidence data are published by GfK in Germany.

Meanwhile, France sees the release of business confidence numbers.

Industrial orders, retail sales and trade balance figures are updated in Italy.

Retail sales and BBA mortgage approval data are issued in the UK.

The US sees the publication of building permits, durable goods orders and initial jobless claims numbers. Moreover, Markit's flash US Services PMI is released.

Friday 25 March

Consumer price numbers are issued in Japan.

Preliminary first quarter GDP figures and consumer confidence data are released in France.

The US Bureau of Economic Analysis publishes its final estimate of fourth quarter GDP numbers.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}