Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 15, 2014

UK unemployment falls to six-year low, but wage growth remains stubbornly weak

Stubbornly weak wage data, alongside news that inflation is down to a five-year low and the economy is weakening in the face of more eurozone troubles, effectively kills off any chance of interest rates rising for the foreseeable future.

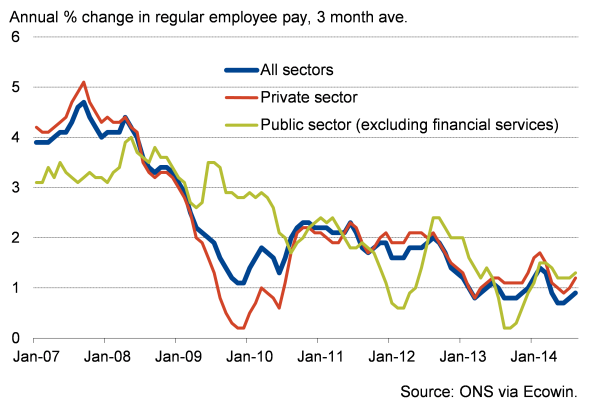

Data from the Office for National Statistics showed wages rising just 0.7% on average in the three months to August. Pay excluding bonuses was up 0.9% on a year ago, up from 0.8% in the three months to July but remaining stuck close to record lows.

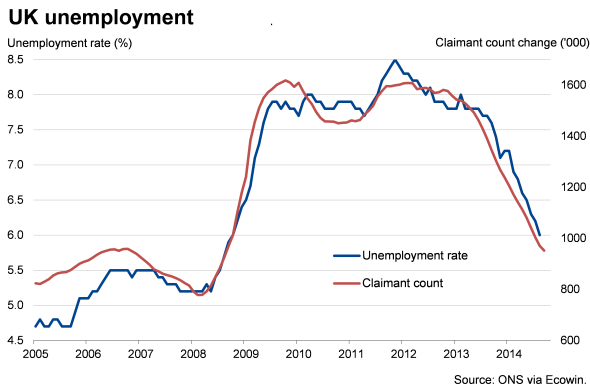

Jobless rate at six-year low

Wages have failed to pick up despite unemployment falling sharply. The jobless rate fell to a six-year low 6.0% in the three months to August, with the total number of unemployed down by 154,000 to 1.972 million, dropping below two million for the first time since November 2008. The 538,000 annual fall in unemployment was in fact the largest since records began over 40 years ago, in 1972.

A further 18,600 fall in the claimant count in September suggests that the unemployment rate will continue to fall, down to 5.9% in the third quarter and dropping further towards the end of the year.

Job creation slows

There are some signs that the labour market upturn is beginning to slow, however. The number of people in work rose by 46,000 in the three months to August, but that was the smallest increase since the spring of last year. This slowing corresponds with survey data showing some easing in employment growth in recent months. The Markit/CIPS PMI employment measure fell on average in the third quarter compared to the second quarter, and recruitment consultancies reported that the number of people placed in permanent jobs rose in September at the slowest rate since November of last year.

However, it's unclear whether the slowdown in employment reflects a weakening of demand, or whether job creation has slowed because of increasingly widespread skill shortages. Some combination of both is likely, given signs of manufacturing growth being hit by slower exports and survey evidence of record difficulties in finding suitable staff in the third quarter.

Employment

Pay puzzle continues

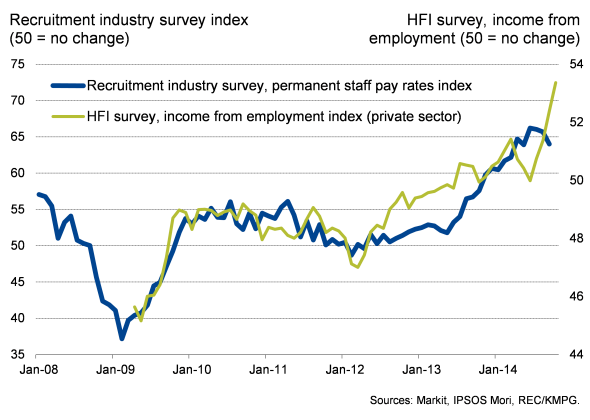

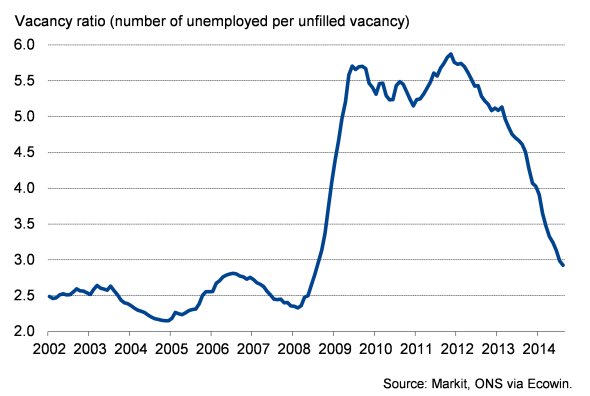

The puzzle remains as to why the tightening of the labour market has failed to feed through into higher wages (the number of people unemployed for every existing job vacancy is now down to 2.9, its lowest for six years). The normal laws of supply and demand do not appear to be applying to the current labour market, at least according to the official data. Survey data are more positive on the wages front. Recruitment survey data point to steep rises in both salaries awarded to new starters as well as temporary and contract staff pay rates. Today's Markit Household Finance Index likewise shows incomes from employment rising at the steepest rate since the financial crisis in September.

Some of this brighter picture from the survey is starting to shine through in the official wage data. Private sector regular wages, for example, rose 1.4% in the year to August (based on the single month figures), which was the fastest rate of increase since February. However, the overall rate of pay growth remains disappointingly muted, and below inflation, which is currently running at 1.2%. Until wage growth picks up significantly, and at least outstrips inflation, there is little chance of the Bank of England raising interest rates.

Regular pay growth (excluding bonuses)

Survey-based pay measures

Unemployed per existing job vacancy

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-unemployment-falls-to-six-year-low-but-wage-growth-remains-stubbornly-weak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-unemployment-falls-to-six-year-low-but-wage-growth-remains-stubbornly-weak.html&text=UK+unemployment+falls+to+six-year+low%2c+but+wage+growth+remains+stubbornly+weak","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-unemployment-falls-to-six-year-low-but-wage-growth-remains-stubbornly-weak.html","enabled":true},{"name":"email","url":"?subject=UK unemployment falls to six-year low, but wage growth remains stubbornly weak&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-unemployment-falls-to-six-year-low-but-wage-growth-remains-stubbornly-weak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+unemployment+falls+to+six-year+low%2c+but+wage+growth+remains+stubbornly+weak http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-UK-unemployment-falls-to-six-year-low-but-wage-growth-remains-stubbornly-weak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}