Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 15, 2014

US retail sales fall in September, blurring policy picture

Retail sales fell for the first time in eight months in September. Total third quarter retail sales were nevertheless higher than in the second quarter, but the decline raises questions about whether domestic demand is cooling as the reality of tighter monetary policy starts to take hold.

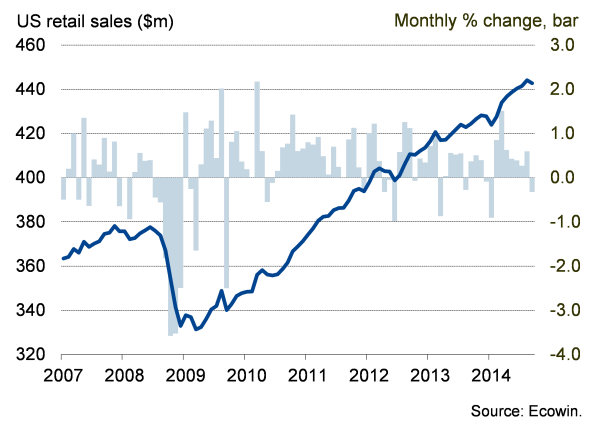

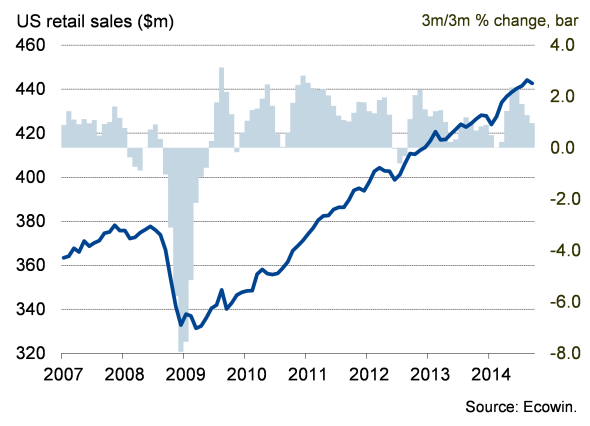

A 0.3% drop in retail sales in September contrasted with a 0.6% increase in August and 0.3% rise in July, leaving retail sales 1.0% higher in the third quarter as a whole compared to the three months to June.

The 1.0% rise in sales points to the consumer having helped boost the economy again in the third quarter. This would corroborate Markit's PMI surveys, which collectively point to an annualised GDP growth rate of at least 3% in the third quarter.

This quarterly rate of increase represents a weakening compared to the 2.3% rise seen in the second quarter, when levels rebounded from a weather-torn first quarter during which retail sales barely rose. The worry is therefore not that growth slowed between the second and third quarters, but whether the September decline represents the start of a renewed downturn in consumer spending, which might be linked to the Fed halting its asset purchases in October and mulling the timing of an initial interest rate hike.

Even core sales, which exclude autos, gasoline, building materials and food, fell 0.2% in September.

Fears of a downturn look overplayed at the moment. It is always inadvisable to put too much emphasis on just one month's number, especially when the change is not supported by other data. Markit's domestically-focused service sector PMI in fact showed an upturn in growth of new business in September, buoyed by rising demand for consumer services as well as strong corporate demand.

Retail sales monthly % change

Retail sales quarterly % change

Optimistic consumers

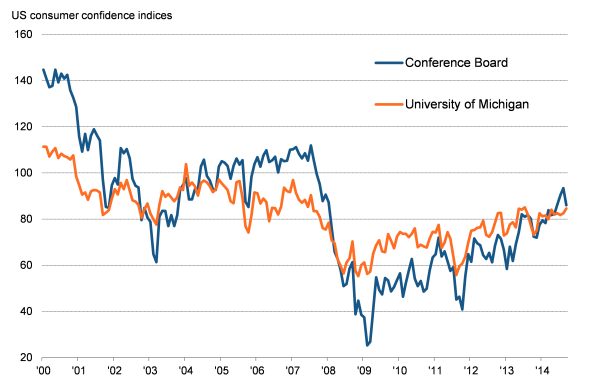

The University of Michigan's consumer confidence measure also ticked high in September, signalling the most upbeat mood among consumers since July of last year, and one of the best readings since mid-2007. The Conference Board's measure of consumer confidence did fall in September, but the decline needs to be looked at in the context of August's reading being the highest since October 2007.

Clearly consumers remain in one of the best moods seen since the financial crisis, suggesting the September drop in retail sales is merely a blip. The data will, however, spur further caution among policymakers about the potential impact of higher interest rates.

Consumer confidence

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-US-retail-sales-fall-in-September-blurring-policy-picture.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-US-retail-sales-fall-in-September-blurring-policy-picture.html&text=US+retail+sales+fall+in+September%2c+blurring+policy+picture","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-US-retail-sales-fall-in-September-blurring-policy-picture.html","enabled":true},{"name":"email","url":"?subject=US retail sales fall in September, blurring policy picture&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-US-retail-sales-fall-in-September-blurring-policy-picture.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+retail+sales+fall+in+September%2c+blurring+policy+picture http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-Economics-US-retail-sales-fall-in-September-blurring-policy-picture.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}