Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 14, 2017

Political instability leads optimism among Spanish firms to decline

Spanish companies are less optimistic than they were earlier in the year, according to the latest IHS Markit Business Outlook survey.

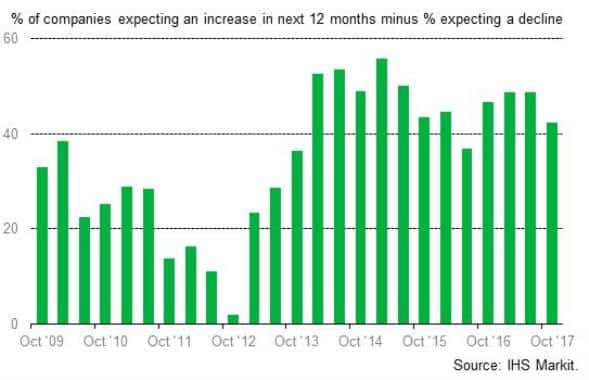

In fact, sentiment is the lowest since mid-2016, with Spain the only eurozone country covered to be less optimistic than in the previous survey. That said, at +42% in October, the net balance of companies predicting a rise in activity over the coming year still signals solid confidence among firms.

Reduced confidence is apparent across the manufacturing and service sectors alike. Service providers are the least optimistic since the June 2016 outlook survey, while manufacturing sentiment is the lowest since February of that year.

Anecdotal evidence suggests that expansion into new markets - both at home and abroad - alongside improving economic conditions, will provide opportunities for growth over the coming year. On the other hand, the political uncertainty surrounding events in Catalonia is the key factor dampening optimism.

Sentiment regarding new business follows a similar trend to that for activity, remaining positive but lower than in June. Confidence among Spanish firms, however, remains above the euro area average.

Employment & Investment Plans

Hiring expectations are little-changed from the position in the summer, with companies expecting to raise employment in line with increased activity. Service providers are more confident regarding future job creation than their manufacturing counterparts. Sentiment regarding staffing levels in Spain is slightly higher than the eurozone average.

Investment spending is also set to rise, with optimism regarding capex broadly in line with that seen in the summer. Meanwhile, manufacturers expect an increase in R&D expenditure. That said, optimism is the lowest since June 2016.

Spain business activity expectations

Inflation Expectations

Price pressures look set to rise, with the net balance for input costs in October above that seen in the previous outlook survey. Both manufacturers and service providers foresee stronger cost inflation.

In contrast, services companies predict that staff costs are less likely to rise than in the summer, with the respective net balance the lowest for a year.

In response to predictions of higher input costs, firms look set to increase their output prices over the coming year. The net balance is unchanged from June's survey, with service providers more likely to raise charges than manufacturers.

Corporate Earnings

Forecasts of higher new business are expected to translate into profits growth over the next 12 months. As is the case with activity and new orders, however, optimism around profitability is the weakest since June 2016.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112017-economics-political-instability-leads-optimism-among-spanish-firms-to-decline.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112017-economics-political-instability-leads-optimism-among-spanish-firms-to-decline.html&text=Political+instability+leads+optimism+among+Spanish+firms+to+decline","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112017-economics-political-instability-leads-optimism-among-spanish-firms-to-decline.html","enabled":true},{"name":"email","url":"?subject=Political instability leads optimism among Spanish firms to decline&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112017-economics-political-instability-leads-optimism-among-spanish-firms-to-decline.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Political+instability+leads+optimism+among+Spanish+firms+to+decline http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14112017-economics-political-instability-leads-optimism-among-spanish-firms-to-decline.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}