Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 15, 2017

UK wage growth continues to disappoint as employment falls

The latest batch of labour market data make for disappointing reading, albeit with some welcome signs of improved productivity.

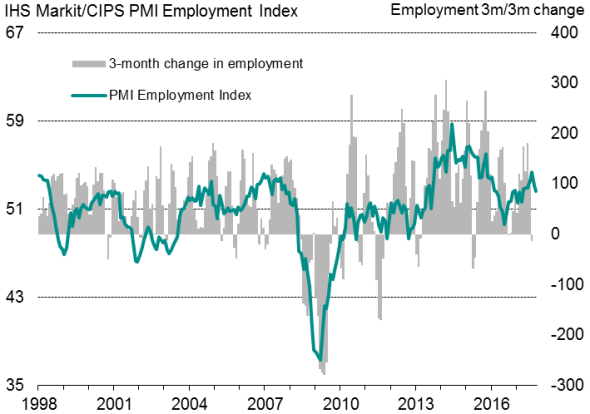

The number of people in employment fell by 14,000 in the third quarter, according to the Office for National Statistics, the largest drop for over two years, and job vacancies fell in the three months to October, corroborating weak survey data.

UK employment shows weakening trend

Sources: ONS, IHS Markit.

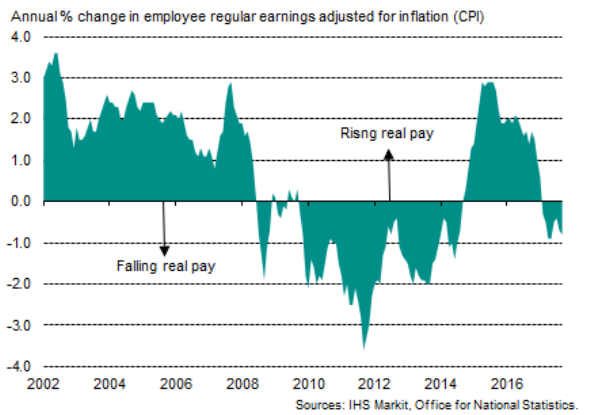

Pay growth meanwhile remained muted, and well below inflation, meaning that real pay continues to fall, squeezing already-stretched household finances.

There was better news on unemployment, with the rate of joblessness holding steady at 4.3%, its lowest since 1975. The number of people registered out of work fell by 59,000 in the three months to September, down to 1.425 million. Output per hour also rose 0.9% in the third quarter, its largest improvement since the second quarter of 2011, to suggest that productivity has picked up.

Lack of pay growth

Average regular pay rose 2.2% in the three months to September, unchanged on the rate seen in the three months to August, according to the Office for National Statistics. For many sectors, pay growth has in fact slowed markedly over the past year, with only financial and business services employees seeing a notable upturn, though even here the rate of increase remains below inflation.

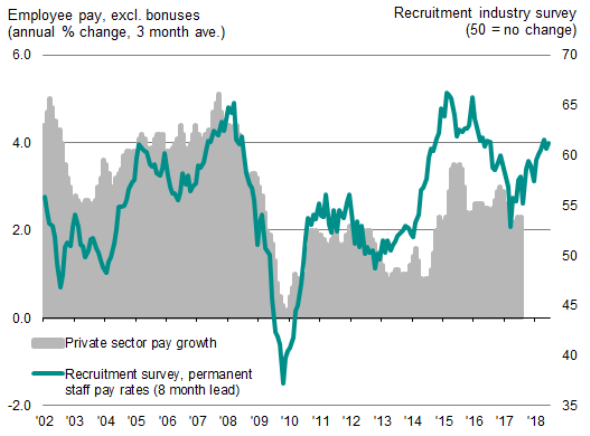

Pay growth remains subdued

Looking at September alone, underlying pay growth was down from 2.3% in August to 2.2%, dropping from 2.5% to 2.3% in the private sector.

By sector, regular pay growth is running at its lowest for three years in the retail, hotels and restaurants sector, down to just 1.4% in the third quarter compared to a rate of 3.6% seen this time last year. Manufacturing workers are also seeing pay growth of just 1.4%, down from 2.5% a year ago. While construction pay has perked up to 2.4% in the third quarter, up from 1.7% in the second quarter, this compares with a rate of 3.6% this time last year.

The only sectors seeing stronger pay growth than a year ago are public sector workers, where pay has merely edged up from 1.5% a year ago to 1.7% in the third quarter, and finance and business services workers. The latter is the only sector showing anything like welcome signs of accelerating pay growth, with the rate of increase in regular pay up from 2.1% a year ago to 2.7% in the three months to September, its highest since the three months to May of last year.

If bonuses are included the overall rate of pay growth fell from an upwardly revised 2.3% to 2.2% in the three months to September, albeit picking up in September alone from 2.4% in August to 2.6%, and accelerating to 2.8% in the private sector. It's unwise, however, to put too much emphasis on the volatile bonus data.

Record labour market tightness

The failure of the drop in unemployment to feed through to higher pay remains the biggest conundrum facing the Bank of England. With just 1.8 unemployed people per job vacancy in the third quarter, the labour market is at its tightest since records began in 2001, which economic theory tells us should be translating into higher pay deals.

Household squeeze

The absence of accelerating pay growth means that, with inflation running at its highest for over five years at 3.0%, real pay continues to fall in all main sectors of the economy, squeezing household finances. Tomorrow's retail sales data are likely to show falling high street spending as a result. A variety of non-official data have indicated that high street sales were under pressures in October, including card spending data from Visa, which showed spending slumping some 5.0% on an annual basis.

Real pay is falling

Signs of weaker hiring in fourth quarter

Employment growth likely remained subdued at the start of the fourth quarter, with PMI survey data showing the rate of job creation waning to its lowest for seven months amid a downturn in business optimism, albeit with signs that hiring may be being restrained by a lack of suitable staff. Similarly, the REC survey of the recruitment industry also showed growth of permanent staff placements edging down to a six-month low in October, but with recruiters clearly struggling with intensifying skill shortages. The latter meant average starting salaries rose at the second-strongest rate for two years, in a tentative sign that average pay growth may pick up in coming months.

Recruitment survey hints at higher future pay growth

Sources: ONS, REC, IHS Markit.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112017-Economics-UK-wage-growth-continues-to-disappoint-as-employment-falls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112017-Economics-UK-wage-growth-continues-to-disappoint-as-employment-falls.html&text=UK+wage+growth+continues+to+disappoint+as+employment+falls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112017-Economics-UK-wage-growth-continues-to-disappoint-as-employment-falls.html","enabled":true},{"name":"email","url":"?subject=UK wage growth continues to disappoint as employment falls&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112017-Economics-UK-wage-growth-continues-to-disappoint-as-employment-falls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+wage+growth+continues+to+disappoint+as+employment+falls http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15112017-Economics-UK-wage-growth-continues-to-disappoint-as-employment-falls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}