Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 14, 2015

Hopes of ECB QE rise amid ongoing weakness of industrial production

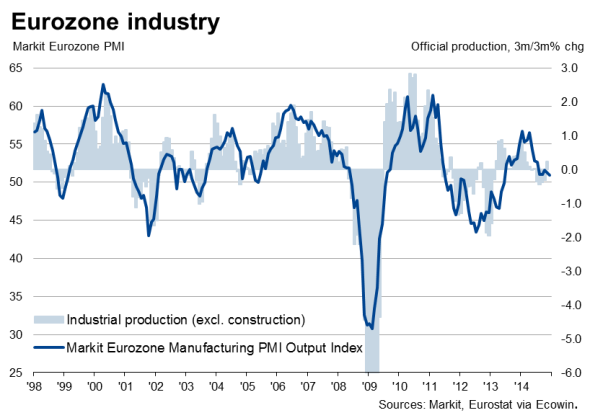

Industrial production in the euro area grew more than expected in November, but the official data confirm the business survey evidence of only modest growth amid widespread malaise across much of the region.

With the industrial sector expanding only modestly in the fourth quarter, and in decline in several countries, while prices are falling on an annual basis for the first time since 2009, there is heightened risk of the region sliding into a deflationary slump, where spending is deferred in the expectation of lower prices in the future, exacerbating already weak demand.

Comments today from ECB President Mario Draghi in German newspaper Die Zeit that the region needs an "expansive monetary policy", alongside a favourable recommendation from a key adviser to the European Court of Justice on the legality of the ECB's OMT bond-buying program, have meanwhile raised expectations that the central bank will announce further stimulus measures at its next Governing Council meeting on 22nd January, including the purchase of government debt.

Modest rise in production

Eurozone industrial production rose 0.2% in November, building on a 0.3% gain in October. Economists had been expecting a flat reading.

This measure includes energy production, which dropped by 0.9%. Output of the region's factories rose 0.3%, led by a 1.9% jump in the production of durable consumer goods, such as TVs, washing machines and other items designed to last several years. But production of capital goods - such as plant machinery - fell by 0.2% after being flat in October, signalling weakening business investment in the fourth quarter.

Inflation

Despite the latest increase, industrial production was 0.4% lower than a year ago in November and is so far on course to rise by just 0.4% in the fourth quarter compared to the third quarter.

The official data from Eurostat follow PMI business surveys which likewise showed a modest gain in output in November, but that also indicated an even weaker rise in December, with the rate of growth having slumped sharply compared to the relative robust pace of expansion seen earlier in the year.

Varied production trends across region

The official data also corroborate the survey evidence that conditions are varied within the region.

Of the bloc's largest economies, only Italy and the Netherlands saw an increase in industrial production in November, enjoying 0.3% and 0.5% gains respectively.

It was Ireland that led the pack, however, with a 4.6% surge in production building on an impressive 9.7% gain in October, pointing towards strong GDP growth in the fourth quarter.

Output was meanwhile flat in Germany and fell by 0.1% and 0.3% in Spain and France respectively. Output also fell 0.3% in Greece.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Hopes-of-ECB-QE-rise-amid-ongoing-weakness-of-industrial-production.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Hopes-of-ECB-QE-rise-amid-ongoing-weakness-of-industrial-production.html&text=Hopes+of+ECB+QE+rise+amid+ongoing+weakness+of+industrial+production","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Hopes-of-ECB-QE-rise-amid-ongoing-weakness-of-industrial-production.html","enabled":true},{"name":"email","url":"?subject=Hopes of ECB QE rise amid ongoing weakness of industrial production&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Hopes-of-ECB-QE-rise-amid-ongoing-weakness-of-industrial-production.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hopes+of+ECB+QE+rise+amid+ongoing+weakness+of+industrial+production http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Hopes-of-ECB-QE-rise-amid-ongoing-weakness-of-industrial-production.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}