Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 14, 2015

Retail sales downturn adds to US growth worries

Retail sales fell sharply in December, catching analysts by surprise but adding to survey evidence which points to a potentially marked slowdown in the US economy towards the end of last year.

The data have led to a rethink by many analysts on the strength of the US economy in the fourth quarter and the trajectory for coming months, calling into question the ability of the US to 'decouple' from slower global economic growth. Expectations of the timing of the first rate hike, pencilled in by many for the second quarter, are therefore also likely to be pushed back in response to the downbeat dataflow.

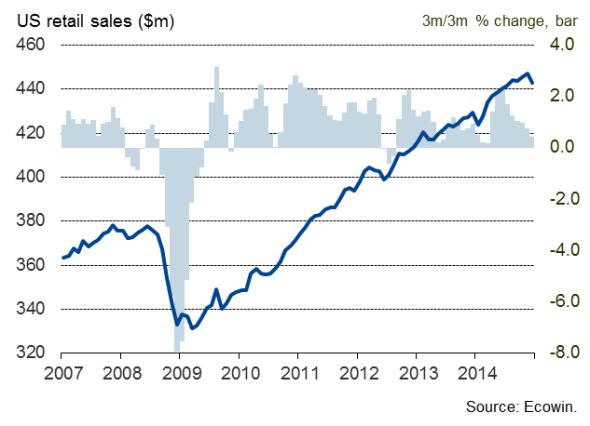

Poor end to the year for retailers

Sales fell 0.9% in the closing month of the year against a consensus expectation of a mere 0.1% decline, showing the sharpest contraction for 11 months. Sales excluding volatile autos and gas also fell, dropping 0.3% and confounding expectations of a 0.5% rise. November's figures were also revised down.

The decline leaves total sales just 0.4% higher in the fourth quarter, representing an annualised rate of growth of just 1.6%. That compares with a 1.1% (4.4% annualised) increase in the third quarter.

Retail sales

The retail sales data are especially important as they form a major component of US GDP data, the first estimate of which is calculated on an expenditure basis. The weaker-than-expected number has therefore been followed by downward revisions to fourth quarter GDP estimates from many analysts, many of whom had been expecting growth to have persisted at a pace not too far off the blistering 5.0% annualised rate seen in the third quarter.

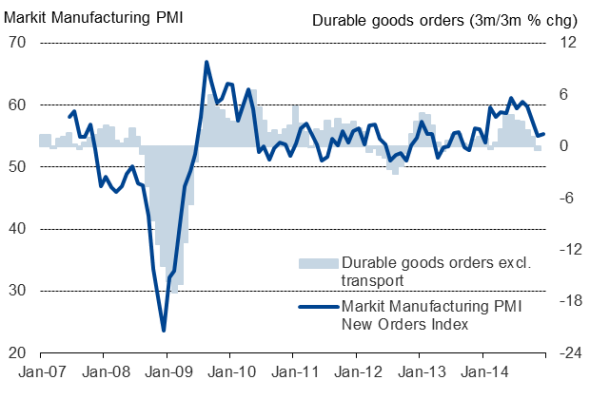

Durable goods orders

Survey weakness

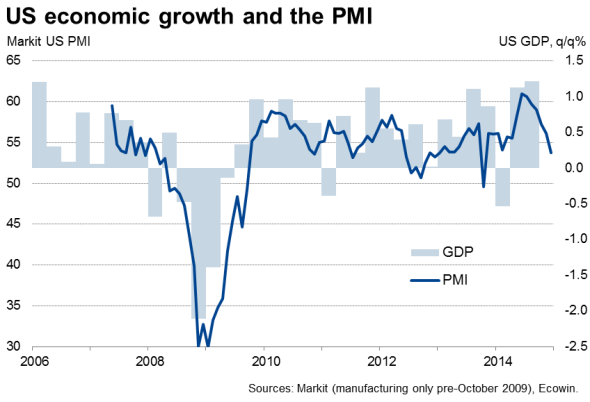

The weak retail sales number is the first major release except factory orders data to corroborate Markit's PMI survey evidence, which indicated a marked slowing in the economy towards the end of last year.

Excluding the drop in activity caused by the October 2013 government shutdown, the December PMI surveys signalled the weakest expansion since 2012, with growth having slowed for a sixth consecutive month in December. The survey data suggest that the pace of US economic growth will have slowed in the fourth quarter compared to the 1.2% quarterly (5.0% annualised) expansion seen in the third quarter, down to around 0.6% (2.5% annualised) or perhaps even less.

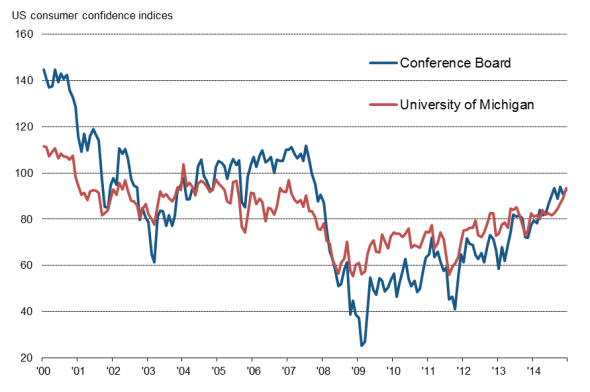

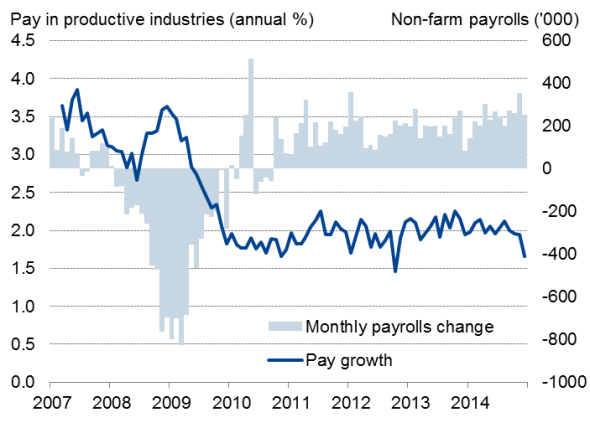

Sales may pick up again in 2015, buoyed in particular by falling gasoline prices, as the recent oil price rout feeds through to forecourt pumps and frees up income to be spent on other goods and services. Employment growth and consumer confidence also remain strong, suggesting sales growth can be supported in coming months. However, the latest labour market data also showed employee pay growth moderating to just 1.7%, which will act as a dampener on demand.

Consumer confidence

Labour market

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Retail-sales-downturn-adds-to-US-growth-worries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Retail-sales-downturn-adds-to-US-growth-worries.html&text=Retail+sales+downturn+adds+to+US+growth+worries","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Retail-sales-downturn-adds-to-US-growth-worries.html","enabled":true},{"name":"email","url":"?subject=Retail sales downturn adds to US growth worries&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Retail-sales-downturn-adds-to-US-growth-worries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Retail+sales+downturn+adds+to+US+growth+worries http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012015-Economics-Retail-sales-downturn-adds-to-US-growth-worries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}