Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 13, 2016

US retail sales buoy hopes of second quarter economic rebound

Hopes were raised for a second quarter rebound in the US economy as retail sales smashed expectations in April. Faster than expected sales growth and the prospect of an overall pick-up in the second quarter will further raise expectations of the Fed hiking interest rates again in coming months. However, with signs of the upturn remaining fragile, the chance of a June hike still looks low.

US retail sales

Source: US Census Bureau

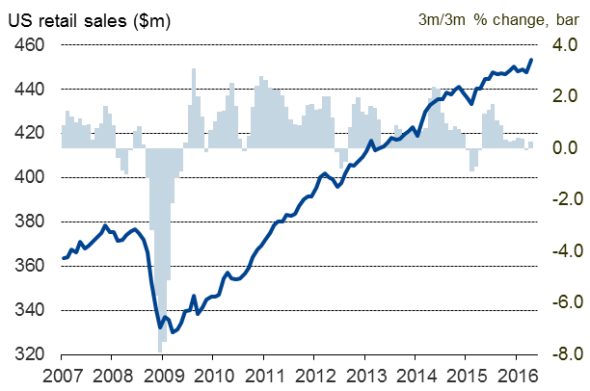

Official data showed US retail sales surging 1.3% in April, rebounding from a 0.3% decline in March. Core sales were up 0.8%. Economists polled by Reuters were anticipating a 0.8% sales upturn, with a 0.5% rise in core sales.

After economic growth slowed to an annualised rate of just 0.5% in the first quarter, analysts have been looking for signs that the slowdown will prove temporary. But gloom has descended after non-farm payrolls rose much less than anticipated in April, a 160,000 rise contrasting with the consensus of a 202,000 increase.

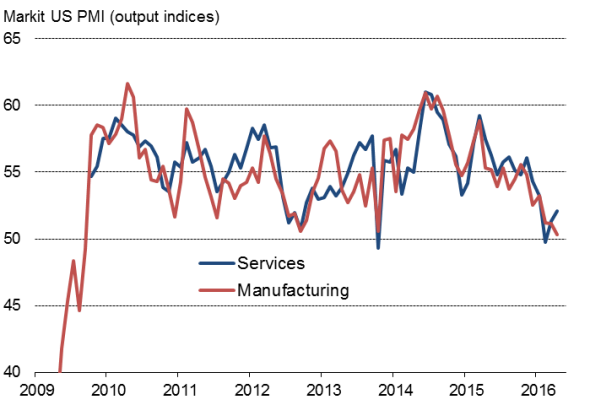

However, the retail sales data add to the signal from Markit's PMI surveys that the economy has picked up pace again, albeit with big question marks hanging over the robustness of growth.

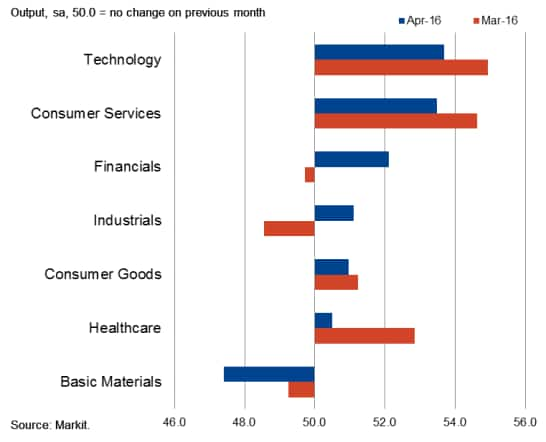

The PMIs had accurately foretold the slowing in both the GDP and non-farm payrolls reports, but have also shown signs of growth picking up at the start of the second quarter, linked to better service sector numbers. In particular, the surveys show the domestic consumer remaining an important growth driver in April, indicating demand for consumer services rising sharply alongside the upturn signalled by the official retail sales data.

Financial services firms also saw growth recover in April after a torrid start to the year.

Markit PMI surveys

However, the PMI surveys point to an annualised pace of economic growth of just 1.0% in April, a far cry from the 2.2% second quarter growth expectations recorded by the latest Reuters poll. The faster pace of service sector expansion was in part countered by a near-stagnation in manufacturing and deteriorating export demand. Manufacturing reported its worst month since the height of the financial crisis.

The latest upturn in sales growth also needs to be treated with caution. The monthly data are often volatile, and the timing of Easter may have complicated monthly trends further. In the latest three months, sales were up just 0.3% compared to the prior three months (though core sales were 1.1% higher).

While the upturn in the retail sales trend is therefore good news in terms of the pace of economic growth lifting off its first quarter low, worries about the robustness of growth and an over reliance on the consumer persist.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-us-retail-sales-buoy-hopes-of-second-quarter-economic-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-us-retail-sales-buoy-hopes-of-second-quarter-economic-rebound.html&text=US+retail+sales+buoy+hopes+of+second+quarter+economic+rebound","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-us-retail-sales-buoy-hopes-of-second-quarter-economic-rebound.html","enabled":true},{"name":"email","url":"?subject=US retail sales buoy hopes of second quarter economic rebound&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-us-retail-sales-buoy-hopes-of-second-quarter-economic-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+retail+sales+buoy+hopes+of+second+quarter+economic+rebound http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-economics-us-retail-sales-buoy-hopes-of-second-quarter-economic-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}