Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 13, 2016

Spectacular start to the year for Germany as GDP surges

It was a better than expected start to the year for the German economy, as its GDP growth rate more than doubled in the opening quarter of 2016. However, it is likely that growth will slow in the second quarter, with business survey data already signalling a slowdown.

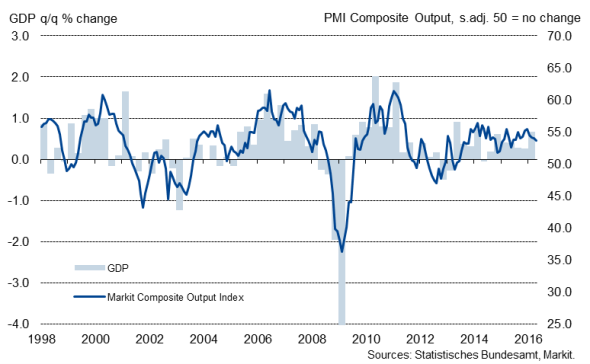

German quarterly GDP growth and the PMI

Gross domestic product (GDP) rose 0.7% over the first quarter of 2016, according to data from Statistisches Bundesamt Destatis, more than doubling the 0.3% growth rate seen in the final quarter of last year and above market expectations of a 0.6% expansion. The quarterly growth rate was the strongest for two years.

However, the official numbers are stronger than recent survey results have signalled and we should therefore anticipate some payback from the unexpectedly strong first quarter GDP numbers. Markit's PMI has been pointing to steady economic growth of around 0.4-0.5% (click here for a guide on how to use PMI survey data to predict official Germany growth rates) over the past year and although the business surveys pointed to weaker first quarter economic growth, the underlying growth trend signalled by the survey data remains broadly in line with the official data.

Moreover, the unexpectedly good first quarter results represent some bounce-back from a weaker-than-expected previous quarter. Despite the low oil price and strong labour market, household consumption rose at a surprisingly slow pace during the final three months of last year and trade acted as a break on growth.

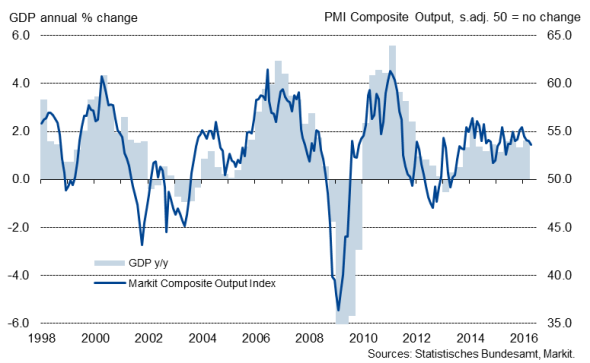

When looking at the annual GDP growth rates (which eliminates some of the volatility in the quarterly data), the official data corroborate the signals sent by the PMI of a steady, although unspectacular recovery.

German annual GDP growth and the PMI

We should also not forget that the PMI measures private sector activity and therefore strips out things like government expenditures. A clearer picture of the growth drivers will emerge when Destatis publish detailed results on 24 May 2016.

Domestic market remains growth driver, trade weighs on stronger growth

Although no details were revealed in its press release, Destatis reported that positive impulses came again mainly from the domestic market, with final consumption expenditure of both households and general government rising. Fixed capital formation in construction and machinery and equipment had a positive effect on economic growth too, according to the press release.

The positive trend in construction has been correctly anticipated by the business survey, with the average Construction PMI over the first quarter as a whole the strongest in five years. Residential building activity was the main pillar of this upturn. With large inflows of refugees and government plans of significant investments to support residential building projects, it is likely that construction activity will continue to expand in coming months.

However, Destatis also pointed out that trade continued to weigh on overall economic growth, with imports rising at a faster pace than exports. Markit's Germany Manufacturing PMI New Export Orders Index signalled a stagnation of export sales in March, with the average over the first quarter as a whole the lowest in a year.

Slow start to second quarter

Latest PMI results meanwhile point to a slowing of economic growth at the start of the second quarter. Although some relief was offered by the German manufacturing PMI in April, it looks as if the sector remains stuck in a low gear. Moreover, growth in Germany's mighty services sector slowed, with levels of work in the pipeline rising only marginally and some businesses having to cut employment in an attempt to optimise costs.

There remain several downside risks to the economic outlook in the year ahead. The effect of the migrant crisis is uncertain, global demand could remain sluggish and it is likely that currency and stock markets will remain volatile.

Bundesbank economists expect German GDP to rise 1.7% in 2016 and 1.9% in 2017, according to its latest semi-annual projection. The bank's president, Jens Weidemann, commented that a "favourable labour market situation and substantial increases in households' real disposable income" are the main drivers of growth. While he also said that "frail" demand from emerging markets hampers foreign trade, "export markets outside the euro area [are] expected to rebound and economic growth within the euro area gaining a little more traction."

Flash composite PMI data, published on 23rd May, will provide further insight into the economy's performance in the second quarter.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Economics-Spectacular-start-to-the-year-for-Germany-as-GDP-surges.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Economics-Spectacular-start-to-the-year-for-Germany-as-GDP-surges.html&text=Spectacular+start+to+the+year+for+Germany+as+GDP+surges","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Economics-Spectacular-start-to-the-year-for-Germany-as-GDP-surges.html","enabled":true},{"name":"email","url":"?subject=Spectacular start to the year for Germany as GDP surges&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Economics-Spectacular-start-to-the-year-for-Germany-as-GDP-surges.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spectacular+start+to+the+year+for+Germany+as+GDP+surges http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052016-Economics-Spectacular-start-to-the-year-for-Germany-as-GDP-surges.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}