Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 13, 2016

Global economic growth weakest since late-2012

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

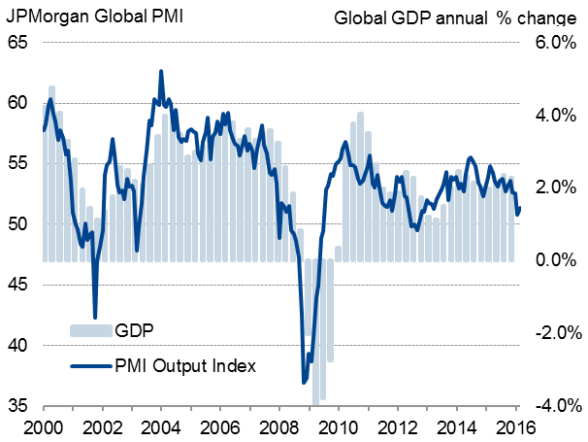

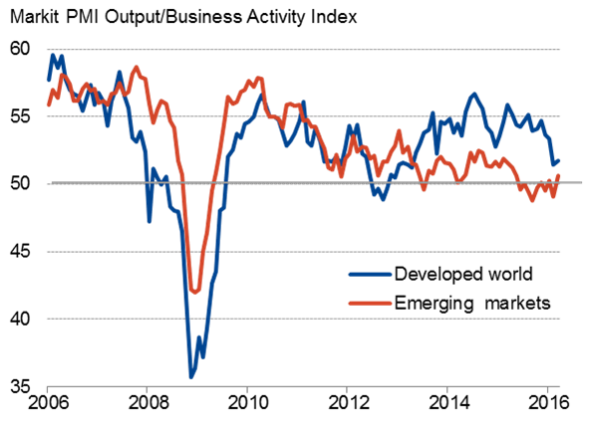

Global economic growth was running at its weakest for over three years in Q1, according to the JPMorgan Global PMI", compiled by Markit. Despite rising slightly in March, the PMI is broadly consistent with global GDP growing at an annual rate of just over 1% (at market prices) compared with a long-run average of 2.3%. Subdued developed world growth was, however, accompanied by tentative signs of renewed life in emerging markets. The weak global PMI data were promptly followed by a downward revision to the IMF's global outlook.

Global economic growth (GDP v PMI)

Developed v emerging markets

Charts show GDP-weighted PMI output indices covering both manufacturing and services

Sources: JPMorgan, Markit, Thomson Reuters Datastream

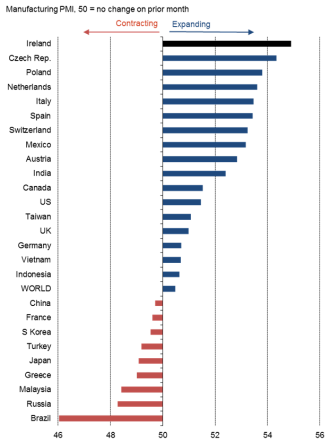

Global manufacturing PMI rankings

A principal area of concern in the global economy has been the weakness of manufacturing and trade. The March PMI signalled just 1.5% annual global manufacturing output growth along with a decline in worldwide trade volumes for a second month.

Nine countries saw manufacturing downturns, six of which were emerging markets, led again by Brazil and followed by Russia. Ireland took over at the head of the growth rankings, followed by six other European nations.

Sources: Markit, CIPS, NEVI, Nikkei, BME, Bank Austria, Investec, RBC, AERCE, ADACI, Caixin, HPI

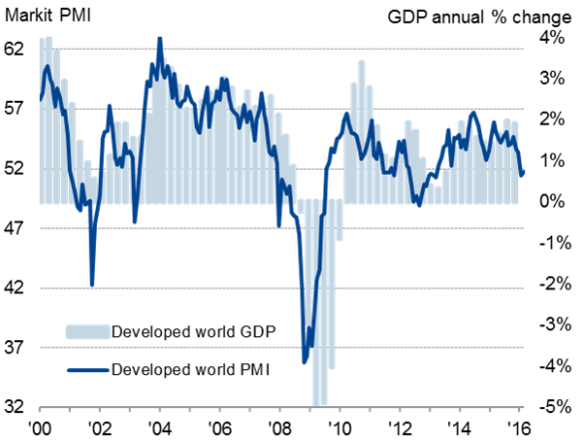

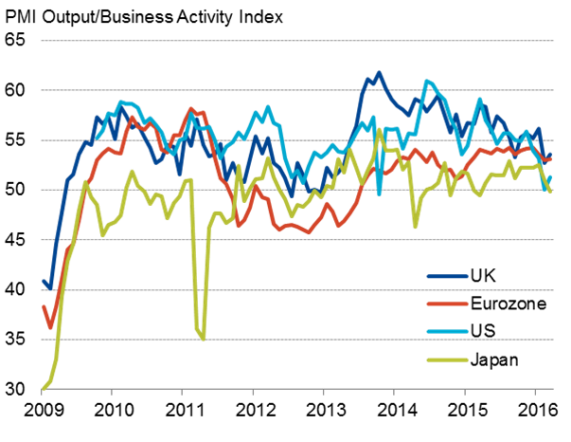

Developed world growth fails to rebound from February's 34-month low

A key development over the past two months has been the extent to which developed-world growth has fallen well below rates seen throughout much of the past three years, acting as an additional drag on global growth. A marked slowdown in the US has been accompanied by signs of similar weakness in the UK as well as a renewed downturn (albeit modest) in Japan. Overall, the PMI surveys are signalling just over 0.5% annual developed world GDP growth in Q1, having failed to show any significant improvement on February's near three-year low.

Developed markets growth (GDP v PMI)

Four largest DM economies

All charts show PMI output indices covering manufacturing and services

Sources: CIPS, Markit, Nikkei, Thomson Reuters Datastream

Use the download link below to access a full overview of the March PMI surveys, including details of all major economies, policy implications and the market impact.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-Economics-Global-economic-growth-weakest-since-late-2012.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-Economics-Global-economic-growth-weakest-since-late-2012.html&text=Global+economic+growth+weakest+since+late-2012","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-Economics-Global-economic-growth-weakest-since-late-2012.html","enabled":true},{"name":"email","url":"?subject=Global economic growth weakest since late-2012&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-Economics-Global-economic-growth-weakest-since-late-2012.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+weakest+since+late-2012 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042016-Economics-Global-economic-growth-weakest-since-late-2012.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}