Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 08, 2016

Week Ahead Economic Overview

The release of Chinese retail sales, industrial production and GDP figures is likely to move markets during a week that will also be interesting for policy makers in the US, where earnings and inflation data are out. The eurozone also sees the publication of consumer price numbers, while the Bank of England announces its latest monetary policy decision.

The week also sees the IMF update its World Economic Outlook, which is expected to make for gloomy reading. Fund head Christine Lagarde has already gone on record stating how global growth is disappointingly weak and that governments must do more to reinvigorate demand.

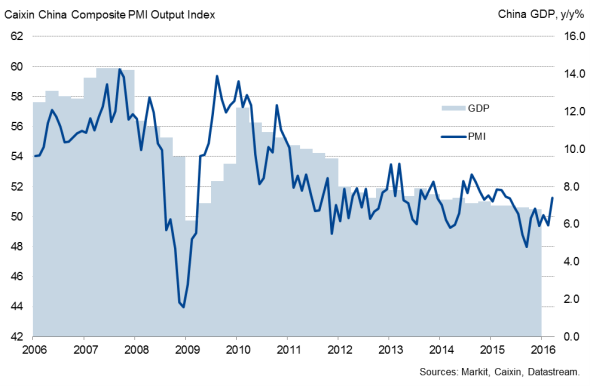

Markets will be on tenterhooks when Chinese GDP figures are released on Friday, a day that is expected to see quarterly growth slow to a near seven-year low. The IMF is predicting Asia's largest economy to expand by 6.3% in 2016 as a whole, down from 6.9% in 2015 and a peak of 14.2% in 2007. Although March's Caixin China PMI signalled the country's best performance for 11 months, the data are consistent with subdued growth during the opening three months of 2016 by Chinese standards. An increased rate of job losses signalled by the survey also raises questions over the durability of the upturn in output.

Chinese economic growth and the PMI

China's GDP update will be accompanied by latest industrial production and retail sales numbers, which should add insight into the extent to which the economy is transitioning towards consumer driven growth. Business survey data are highlighting how Chinese producers are struggling with excess capacity and waning demand, with the Caixin General Manufacturing PMI remaining below the 50.0 no-change mark for a thirteenth month running in March. However, retail sales are expected by economists polled by Thomson Reuters to have risen 10.4% in March, which would be a welcome development from February's eight-month low of +10.1%. Inflation and trade data are also released during the week.

The US Fed will be closely watching the international data flow as well as updates to domestic industrial production and retail sales, although it would require super-strong readings to bring a rate hike in late-April back on the table.

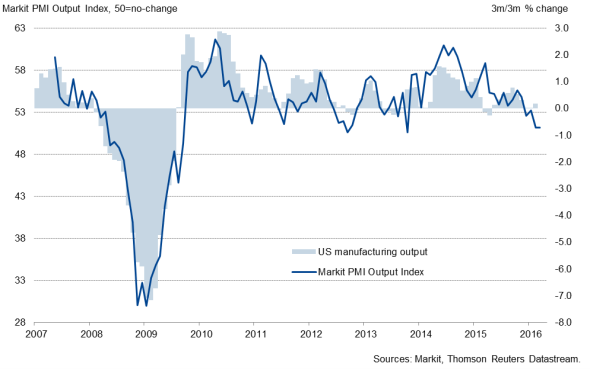

US manufacturing production and the PMI

Latest business survey data have highlighted that the US economy is going through its worst spell of growth for three-and-a-half years. Industrial production fell 0.5% in February, according to official data, as rising factory output was offset by energy sector losses. When combined with the mere 0.2% rise signalled for recent core retail sales data, the industrial malaise adds to suggestions that the pace of economic growth could disappoint in the first quarter. Markets are expecting industrial output and retail sales to have risen marginally in March (+0.1% and +0.4% respectively). Inflation and earnings data will also be closely watched by policy makers and are released on Thursday. Inflation is predicted by markets to have risen 1.2% in the 12 months through to March.

In the UK, the Bank of England announces its latest monetary policy decision on Thursday. It is now widely expected that the bank will hold off on raising interest rates until 2017. PMI data are currently in territory traditionally associated with the Bank choosing to loosen policy, and worries have intensified regarding a possible 'Brexit'. The PMI surveys point to a 0.4% increase in gross domestic product, down from 0.6% in the closing quarter of last year. Construction output and inflation data will provide policy makers with additional information on the state of the UK economy.

Meanwhile, Eurostat releases industrial production numbers for the eurozone, after the official data signalled a 2.1% jump in the measure in January. It is unlikely, however, that the strong trend will continue for the rest of the quarter, as business survey data highlighted that manufacturing growth in the eurozone remained disappointingly modest in March, with particularly poor performances in France and Germany.

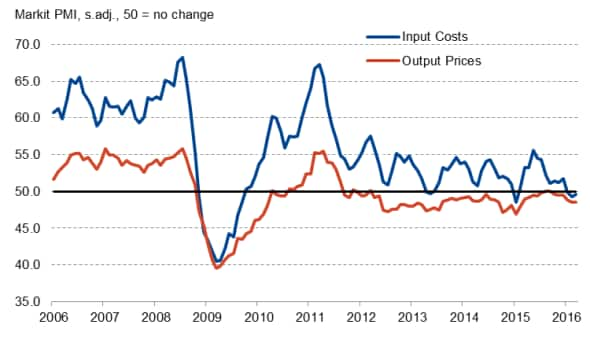

The PMI data also highlighted how price pressures remained on the downside, with both output and input prices falling further during March. Official consumer price data are out on Thursday and it is expected that inflation remained subdued.

Eurozone input and output prices

Monday 11 April

UK regional PMI results and the Ulster Bank Ireland Construction PMI are out.

Mortgage lending data are released in Australia.

China sees the publication of latest inflation numbers.

In Russia, latest trade figures are issued.

ISTAT releases industrial output data in Italy.

Tuesday 12 April

Business confidence numbers are released by the National Australia Bank.

Trade data are issued by the National Bureau of Statistics of China.

India sees the publication of consumer price, industrial production and trade figures.

Final inflation numbers for March are meanwhile published in Germany.

The British Retail Consortium releases retail sales figures in the UK, while the Office for National Statistics publishes inflation data. Moreover, the latest Savills UK Commercial Development Activity Report is issued.

In Brazil, retail sales numbers are out.

The US sees the release of export and import price information and the announcement of its federal budget.

Wednesday 13 April

Consumer sentiment data are updated in Australia.

M3 money supply information are issued in India.

Eurostat released industrial production numbers for the currency union.

Inflation figures are meanwhile update in France and Spain.

Brazil sees the release of service sector growth data.

The Bank of Canada announces its latest monetary policy decision.

In the US, mortgage application, retail sales and producer price numbers are released.

Thursday 14 April

Australia sees the publication of employment figures.

Mining production data are meanwhile released in South Africa.

Inflation numbers are out in the eurozone.

The Bank of England announces its latest monetary policy decision. The latest IPA UK Bellwether Report is published.

Consumer price and earnings data are updated in the US.

Friday 15 April

Industrial production figures are out in Japan and Russia, with the latter also seeing the release of capacity utilisation data.

Industrial production, retail sales and first quarter GDP numbers are out in China.

Trade data are published by Eurostat for the currency bloc.

Construction output figures are updated by the Office for National Statistics in the UK.

Manufacturing sales numbers are updated in Canada, while industrial production and Reuters/Michigan consumer sentiment data are issued in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08042016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}