Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 13, 2016

GILTS surge to top of global return table

Lukewarm economic data has seen forecasters push back expectations of a rate rise from the Bank of England which has in turn seen pound denominated bonds surge to the top of the global pack.

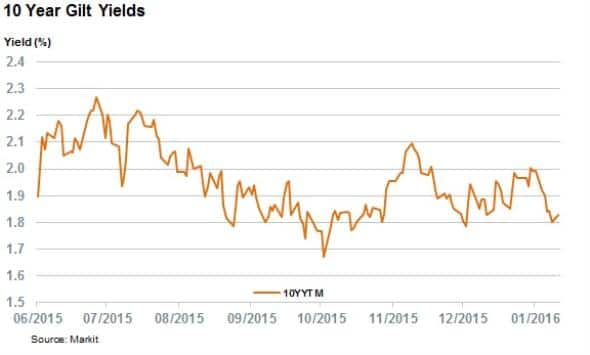

- The 10 year GILT yields now at 1.8%, down from 2.2% in July

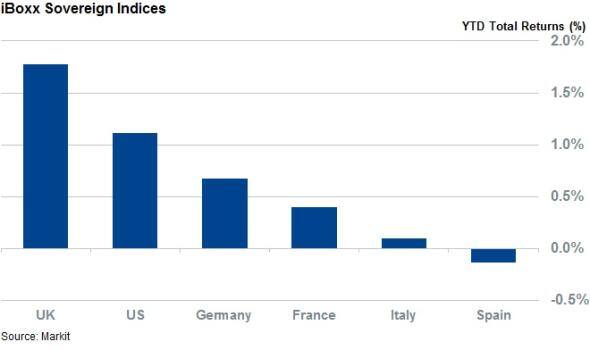

- Gilts are the best performing sovereign asset class according to the iBoxx " Gilts index

- Inflation linked bonds have returned more than 3% year to date as pound fell significantly

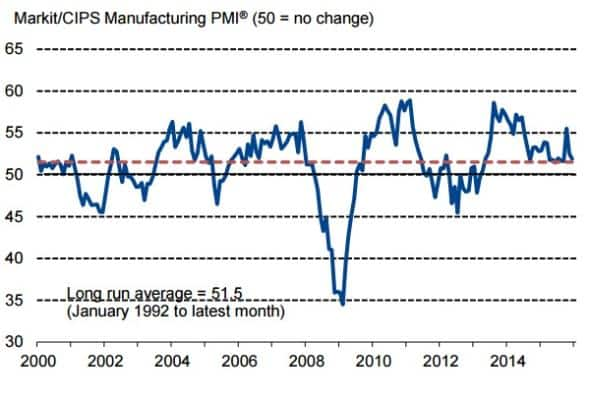

Tuesday's sobering UK industrial production numbers saw output fall for the second month running in November as the gauge of economic activity fell 0.7%, the largest fall since early 2013. This trend is unlikely to reverse in the closing month of the year given that the December Markit/CIPS UK Manufacturing PMI fell to 51.9 from 52.5. This disappointing economic news has in turn seen market forecasters push back their expectations for a UK rate rise further out into 2016 with JP Morgan now predicting expecting the move to come in November.

While the news is a setback for UK policy makers, it does bring some positive news for GILT investors given that the 10 year gilt rates have fallen by over 16bps since the start of the year. Yields in the UK's benchmark rates are now over 40bps off the recent highs seen in July last year.

GILTs surge ahead

These falling yields have enshrined GILTs at the top of the global sovereign bond league table after the Markit iBoxx " Gilts index returned 1.8% in the first 12 days of the year.

This strong performance far outweighs the 1.1% total returns delivered by the US Treasuries and the 0.7% year to date total return of the Markit iBoxx " Germany which tracks the performance of the Bund market.

Much like in the US, pound denominated corporate bonds have also benefited from this underlying trend as the iBoxx " Corporates which tracks pound denominated investment grade corporate bonds has delivered 1.2% year to date. This is twice the 60bps year to date returns delivered by their dollar denominated peers and a massive 130bps more than Euro denominated bonds which have delivered negative 10bps of total returns year to date.

Inflation linked surge ahead

The pound has also taken a hit on the back of the disappointing news with UK currency falling by 0.7% against the US dollar. This fall in the country's currency looks to have spurred on UK inflation expectations as UK inflation linked bonds have advanced by over 3% since the start of the year. This is nearly twice the advance seen by conventional bonds and indicates that the market is expecting higher inflation going forward.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-credit-gilts-surge-to-top-of-global-return-table.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-credit-gilts-surge-to-top-of-global-return-table.html&text=GILTS+surge+to+top+of+global+return+table","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-credit-gilts-surge-to-top-of-global-return-table.html","enabled":true},{"name":"email","url":"?subject=GILTS surge to top of global return table&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-credit-gilts-surge-to-top-of-global-return-table.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=GILTS+surge+to+top+of+global+return+table http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13012016-credit-gilts-surge-to-top-of-global-return-table.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}