Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 12, 2016

New dawn for gold miners in 2016?

Gold's allure may be back among investors after years of being shunned and $50bn of outflows from gold ETFs. Fresh turmoil in markets have seen investors return to gold ETFs as the metal prices rebound along with that of the companies that mine it.

- Investors have rushed to gold ETFs with $778m of inflows so far in 2016

- Gold price surge beats major equity indices and sends shorts covering positions in miners

- Randgold Resources leads the FSTE 100 as miners rise following four years of pain

Shining into 2016

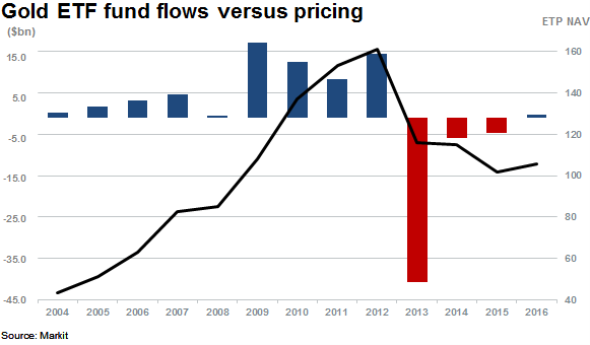

Gold prices more than tripled between 2006 and 2011, peaking at $1889/oz as investors pushed prices higher and hedged against inflation and falling markets in the aftermath of the financial crisis. Inflation turned out to be a bit of a paper tiger however and gold went on to shed almost half its value (in Dollar terms) as investors sold off their gold holdings.

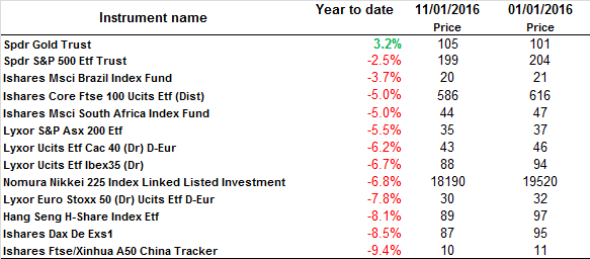

Increased market volatility that unseated equity markets in the opening weeks of 2016 have seen commodities stage a bit of a comeback, evidenced by the recent uptick in gold prices. In fact, gold is currently outperforming most global equity indices off the starting gate.

The underperformance in equities has been widespread with less than 2% (only five individual stocks) of the FTSE 350 managing to outpace gold's performance year to date.

The metal's revival has not gone unnoticed as gold ETFs have managed to attract inflows of $778m. This comes on the heels of three years of sustained out outflows for the prior three years totalling $49.3bn.

Shorts flee as gold bugs return

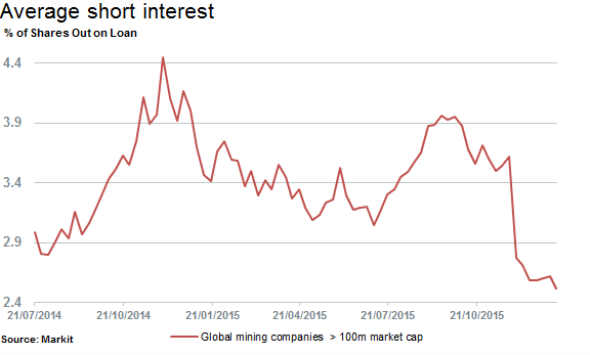

Resurgence in appetite towards gold has also seen sentiment towards its miners improve. Average short interest across global gold miners, with at least $100m in market cap, has fallen sharply recently, down by 21% to 3.6% of shares outstanding since early 2015. This contrasts with the average short interest of the S&P 500 which is at the highest level seen in over three years.

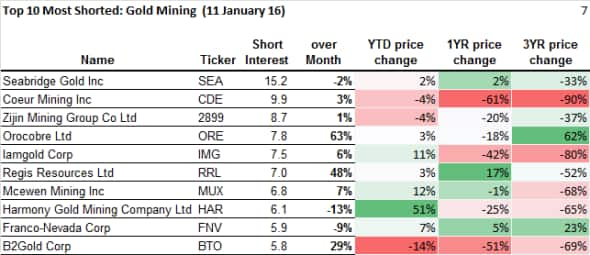

However, some gold miners are still attracting the short sellers, with North American firms attracting the majority of concentrated short trades. This could be as a result of the stronger dollar not benefiting North American operating or exposed firms who are unable to leverage the impact of the stronger dollar in conjunction with higher metal prices.

The most shorted gold miner globally is Seabridge Gold with short interest rising 60% in the last 12 months and shares outstanding on loan reaching 15.2%. Seabridge is an explorer and developer of gold resources, who then sells or enters into joint ventures for mine construction and operation.

Seabridge's share price has rallied by 112% in the last 12 months but is in fact down by two thirds over the past five years.

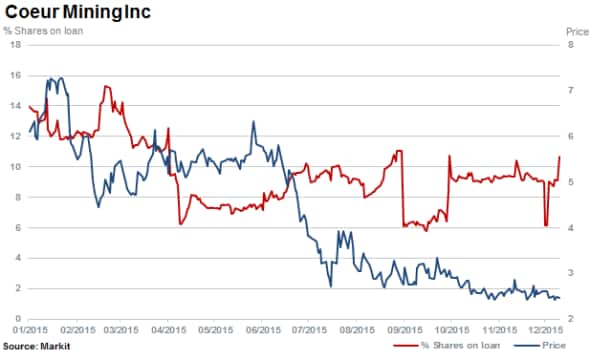

Coeur Mining is the second most shorted gold miner globally and is also the largest US based silver producer. The firm has 10.7% of shares outstanding on loan and operates mines in Mexico, Bolivia, Nevada and South Dakota with other asset interests globally. Shares in the mining company have plummeted 58% in the last 12 months.

While the rise in gold price is positive for the industry, some US based or operating mines will need higher price increases magnitudes to improve their prospects and offset the impact of a stronger local currency. On the flip side of that trend, foreign based firms are benefiting from not only gold's relative resistance to the emerging market and commodities sell off, but from the US dollars surging value.

Emerging market miners shine

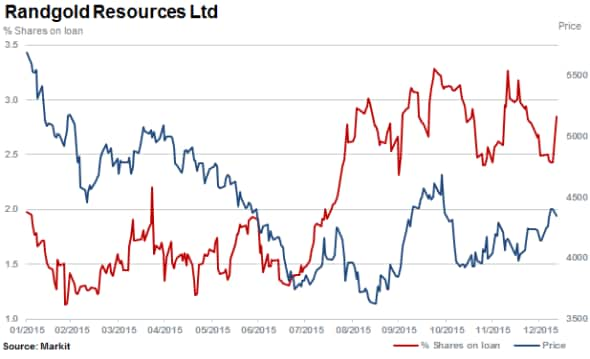

One such company is the best performing FTSE 100 company year to date Randgold Resources, rising 5.9%. The operator of five mines in Africa has seen shorting activity double in the last six months to 2.8% of shares outstanding on loan.

Harmony Gold has seen shares rise by a staggering 141% (in Rand terms) in the last three months with short interest rising to 6.1% of shares outstanding on loan. Benefiting from a stronger dollar during 2015 and plummeting Rand recently, the company is able to fetch a much higher South African Rand price for gold, even before the rise in dollar gold price. The stock has jumped 51% year to date.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-New-dawn-for-gold-miners-in-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-New-dawn-for-gold-miners-in-2016.html&text=New+dawn+for+gold+miners+in+2016%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-New-dawn-for-gold-miners-in-2016.html","enabled":true},{"name":"email","url":"?subject=New dawn for gold miners in 2016?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-New-dawn-for-gold-miners-in-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+dawn+for+gold+miners+in+2016%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-New-dawn-for-gold-miners-in-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}