Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jan 14, 2016

Investors flee high yield bonds as risk escalates

Despite remaining relatively calm amid the equity price volatility in the first few days of 2016, US high yield bond risk has now started to escalate, with investors heading for the doors.

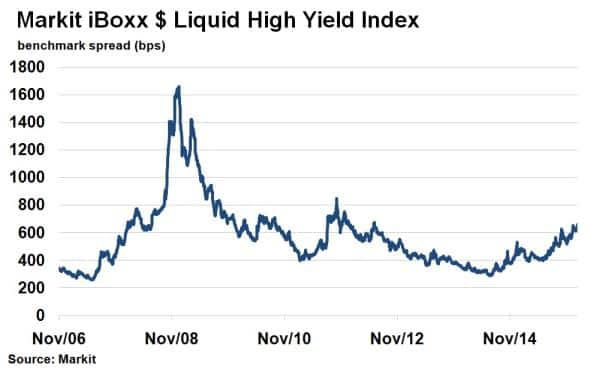

- Markit iBoxx $ Liquid High Yield index has seen its spread widen to mid-2012 highs.

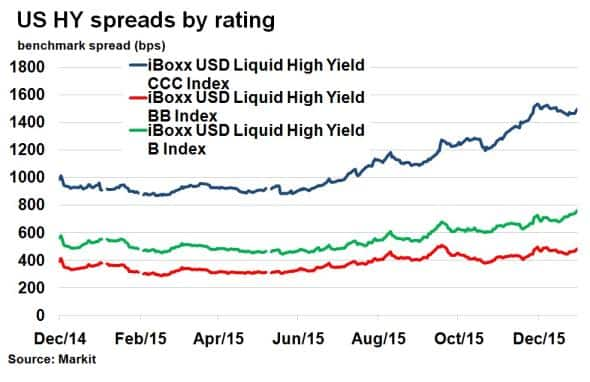

- Higher quality B rated bonds have led the recent spread widening as opposed to CCC rated bonds last December.

- US HY bond ETFs have seen outflows accelerate with $1.87bn of outflows so far in 2016.

Last December was a particularly bad month for US high yield bonds. The Markit iBoxx $ Liquid High Yield Index shed over 2% on a total return basis as panic spread among investors, forcing the biggest mutual fund failure since the financial crisis. The annual benchmark spread for the Markit iBoxx $ Liquid High Yield Index peaked at 652bps in December before ending the year at 615bps.

Volatility in global equity markets stemming from China threatened to derail the mini HY bond rally, as investors shunned risky assets, but spreads held up relatively well during the first week of 2016. This period of calm wasn't to last as further weakness in energy and commodity prices have sent spreads to 660bps as of yesterdays close, a new recent high and the widest level since mid-2012.

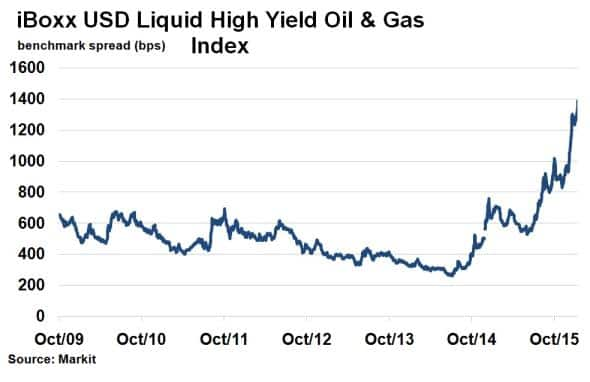

The effect of ever weaker energy prices is evident by singling out the Oil & Gas sector among US high yield bonds. WTI crude prices dropped below $30 per barrel for the first time in 11 years and this sent the annual benchmark spread on the iBoxx USD Liquid High Yield Oil & Gas Index to 1385bps over US treasuries, equivalent to a 15.6% yield. This spread has widened over 400bps since the start of December and has had a significant effect on the broader US HY market, especially considering the sector makes up around 9% of the Markit iBoxx $ Liquid High Yield Index by weight.

HY contagion

Another noticeable trend has been the shift in risk from CCC bonds, to higher quality B rated bonds over the course of the past month. As you may recall it was the CCC rated cohort among US HY that was driving much of Decembers spread widening in the broader HY market. Spreads reached 1532bps on December 14th; they are now 40bps tighter as of yesterdays close. Conversely, the iBoxx USD Liquid High Yield B Index has widened 36bps over the same period, and this compression suggests that the HY bond risk is starting to spread to higher rated names.

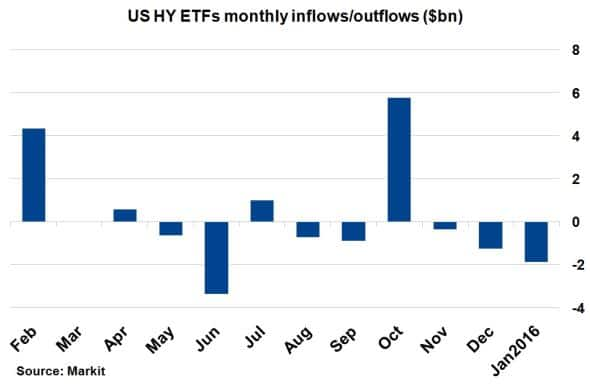

ETF outflows accelerate

The worry around the US HY market has seen investors dump the asset class in an accelerated manner so far in 2016. ETFs tracking US HY bonds have seen around $1.87bn of outflows so far this year, over $1bn of which has been over the last two days, far outstripping the outflows seen over the course of last month.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Credit-Investors-flee-high-yield-bonds-as-risk-escalates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Credit-Investors-flee-high-yield-bonds-as-risk-escalates.html&text=Investors+flee+high+yield+bonds+as+risk+escalates","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Credit-Investors-flee-high-yield-bonds-as-risk-escalates.html","enabled":true},{"name":"email","url":"?subject=Investors flee high yield bonds as risk escalates&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Credit-Investors-flee-high-yield-bonds-as-risk-escalates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+flee+high+yield+bonds+as+risk+escalates http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14012016-Credit-Investors-flee-high-yield-bonds-as-risk-escalates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}