Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 12, 2015

UK industrial expansion in March fails to change picture of underlying weakness

UK industrial production showed some encouraging signs of growth in March, which will be widely seen as upping the odds of interest rates rising later this year. But the overall picture in fact remains one of a manufacturing economy that is struggling to expand in the face of the stronger pound and heightened business uncertainty. The near-stagnation of the sector over the first quarter is a reminder of how little progress the UK has made in terms of rebalancing towards manufacturing and will probably do little to persuade the Bank of England that the economy is ready for higher interest rates.

Weak first quarter despite March expansion

Industrial production, which includes manufacturing and energy production, rose 0.5% in March, a marked improvement on the 0.1% increase seen in February and the largest monthly expansion since September, according to data from the Office for National Statistics.

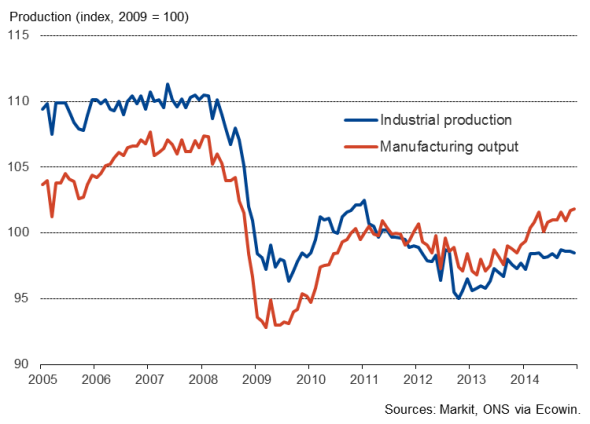

Industrial production and manufacturing output

However, even with the March upturn, industrial production was up only a mere 0.1% over the first quarter as a whole. That's better than the estimate of a 0.1% decline used by the ONS in their first stab at calculating GDP, but is insufficient on its own to cause an upward revision to the disappointingly modest 0.3% growth currently pencilled in.

Manufacturing output rose 0.4% in March while oil and gas production, which tends to be volatile, jumped 4.9%.

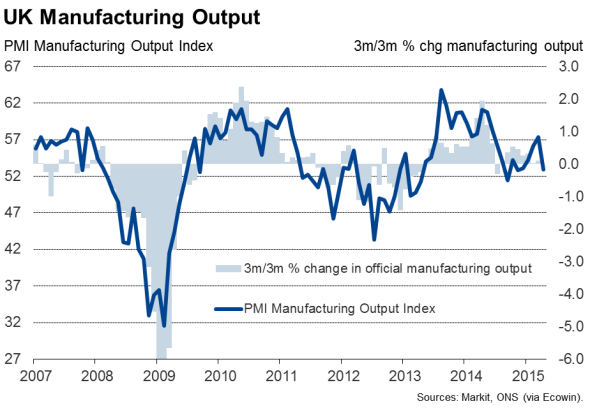

The increase in factory output in March does little to change the overall picture of current weakness in the goods-producing sector. Over the first quarter as a whole, manufacturing output was only 0.1% higher than in the final quarter of last year, and survey data point to a continuation of the malaise into the second quarter.

The Markit/CIPS Manufacturing PMI for April signalled the weakest expansion since last September. The survey showed manufacturers suffering from the largest downturn in export orders since the start of 2013 as companies reported that the stronger pound - notably against the euro - was hitting competitiveness abroad. Any growth was also largely driven by rising demand for consumer goods, with demand for plant and machinery falling.

Twin headwinds

The data are a further reminder of how manufacturers are struggling in the face of the twin headwinds of the stronger pound and weakened business investment spending, which have clearly contributed significantly to the subdued rate of economic growth seen in the first quarter.

Business investment spending is widely expected to pick up again, given the election result which, alongside signs of continued buoyancy of the service sector, should help boost economic growth in the second quarter. In contrast, the strong pound is likely to be something that manufacturers are going to have to get used to, though will at least no doubt also serve to keep interest rate hikes at bay. After all, the strong pound hurts exporters but also reduces the cost of imports, which should keep inflation low.

Unless wage growth picks up substantially though, interest rate hikes look likely to be deferred until next year. We will of course know more tomorrow, after the publication of labour market data and the Bank of England's Inflation Report.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-Economics-UK-industrial-expansion-in-March-fails-to-change-picture-of-underlying-weakness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-Economics-UK-industrial-expansion-in-March-fails-to-change-picture-of-underlying-weakness.html&text=UK+industrial+expansion+in+March+fails+to+change+picture+of+underlying+weakness","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-Economics-UK-industrial-expansion-in-March-fails-to-change-picture-of-underlying-weakness.html","enabled":true},{"name":"email","url":"?subject=UK industrial expansion in March fails to change picture of underlying weakness&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-Economics-UK-industrial-expansion-in-March-fails-to-change-picture-of-underlying-weakness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+industrial+expansion+in+March+fails+to+change+picture+of+underlying+weakness http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-Economics-UK-industrial-expansion-in-March-fails-to-change-picture-of-underlying-weakness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}