Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 13, 2015

German economic growth slows more than expected

German economic growth slowed at the start of 2015, likely a result of weakening exports. PMI data meanwhile signalled a continuation of modest growth moving into the second quarter, but investor sentiment deteriorated in the light of uncertainties linked to the ongoing Greek debt crisis.

Economic growth misses expectations

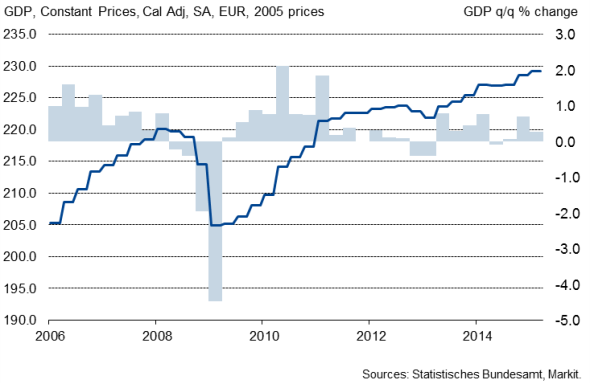

The German economy expanded 0.3% in the opening quarter of 2015, according to a first estimate from the Federal Statistical Office Destatis. Economic growth eased from 0.7% in the final quarter of last year and was below the Thomson Reuters consensus of a 0.5% rise.

Destatis reported that positive contributions came mainly from domestic demand. Household consumption and government expenditure increased between January and March, supported by record employment and rising wages.

Fixed capital formation in both construction and machinery and equipment also continued to rise. The increase in construction fixed capital confirms signals sent by Markit's Construction PMI. The survey data suggested that work on residential building projects rose at a solid rate over the first quarter as a whole. Moreover, construction firms reported a second successive monthly rise in new business in April, which they partly attributed to a low interest rate environment. It is, therefore, likely that output growth in Germany's building sector will be maintained in coming months.

Destatis meanwhile stated that foreign trade had a negative contribution to overall Q1 GDP. While both exports and imports increased on the previous quarter, imports rose at a much stronger rate according to provisional results. The Germany Manufacturing PMI New Export Orders Index has signalled relatively subdued growth in recent months. While a weak euro should have helped making German products more competitive for clients outside the eurozone, uncertain economic and political conditions in some of Germany's main trading partners are likely to have acted as a drag on the country's export performance.

German economic growth

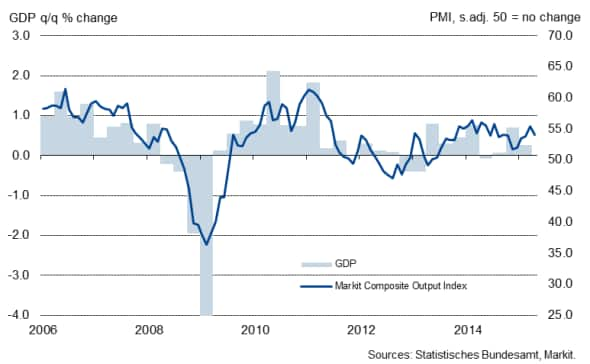

German GDP growth and the PMI

Positive start to second quarter signalled

Survey data available for April meanwhile suggest that economic growth was maintained at the start of the second quarter. Despite falling since the previous month, the all-sector PMI (a weighted average of the output/activity indices for manufacturing, services and construction) is broadly consistent with the German economy expanding at a quarterly rate of around 0.4% in April. Furthermore, the data show that manufacturing production increased at a much stronger rate than seen at the end of last year and activity growth at service providers remained robust.

Investor sentiment deteriorates

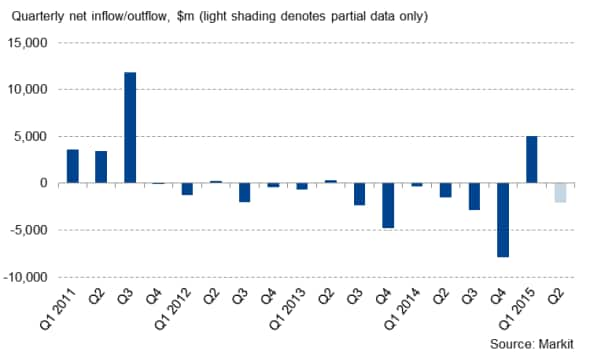

Exchange traded funds exposed to Germany have seen net outflows of $2.1bn in the second quarter so far. These quarterly outflows contrast with net inflows in the first quarter of the year. It is likely that the deterioration in sentiment reflects a number of factors, including the ongoing debt crisis in Greece and the impact of a potential default or 'Grexit' on the eurozone, as well as concerns about economic conditions abroad that could affect German exports.

Germany-exposed ETF flows (monthly)

Exchange traded funds (ETF) provide investors with easy, liquid exposure to various markets. Fund flows consequently provide a valuable and timely insight into how investor appetite towards different markets is changing.

Flash composite PMI data, published on 21st May, will provide the first insight into the economy's performance in the middle of the second quarter.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-German-economic-growth-slows-more-than-expected.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-German-economic-growth-slows-more-than-expected.html&text=German+economic+growth+slows+more+than+expected","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-German-economic-growth-slows-more-than-expected.html","enabled":true},{"name":"email","url":"?subject=German economic growth slows more than expected&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-German-economic-growth-slows-more-than-expected.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+economic+growth+slows+more+than+expected http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13052015-Economics-German-economic-growth-slows-more-than-expected.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}