Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 11, 2017

UK industry shows signs of stronger growth, but construction declines

More mixed news on the economy: a strong rebound in manufacturing output in November and a further rise in exports has been accompanied by a dip in construction output.

Despite the better than expected industrial production numbers for November, the official data suggest that both industry and construction could have slipped into technical recessions in late 2016, with much depending on December's data. Overall economic growth could therefore be largely dependent on services (and most likely, consumers) to drive growth.

Signs are appearing, however, that the weaker pound is benefitting the economy, especially in terms of rising goods exports. Encouragingly, more up-to-date business surveys also indicate that the economy enjoyed a strong December, which suggests that the UK is pulling out of a post-Brexit vote lull.

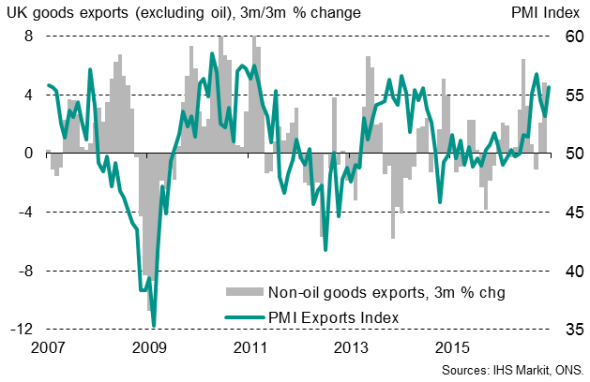

Rising exports

Goods exports rose 2.8% in November, according to the Office for National Statistics, building on a 6.7% rise in October. Over the latest three months, exports of goods are 4.6% higher than in the previous three months, suggesting the UK is seeing some benefit of the weakening of sterling. Imports are meanwhile just 3.2% higher over the same period. With imports of services down 0.1% over the same period while exports of services rose 0.8%, the trade deficit in the latest three months was the lowest since August, albeit still historically high at nearly "12bn.

UK non-oil exports: official and survey data compared

The conclusion from the trade picture is there we are now seeing some tentative evidence of the economy benefitting from the improved international competitiveness resulting from the weaker pound, but the official data are still not as upbeat as business surveys such as the PMI, which depict a considerably more buoyant picture of export performance.

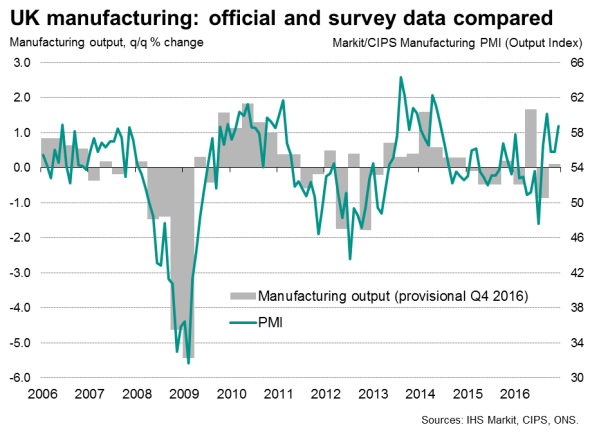

Manufacturing rebound

Stronger exports do at least seem to be helping drive manufacturing output higher. Manufacturing output was up 1.3% in November, more than recovering from a 1.0% drop in October. The improvement means that factory output rose 0.2% in the three months to November, pulling out of the downturn seen in the previous three months. The data suggest that manufacturing output is edging 0.1% higher in the fourth quarter, contrasting with the 0.8% decline seen in the third quarter.

However, although the wider measure of industrial production rebounded by 2.1% in November after a 1.1% slump the prior month, production in the fourth quarter is running 0.5% below the third quarter, which would be a second consecutive quarterly decline.

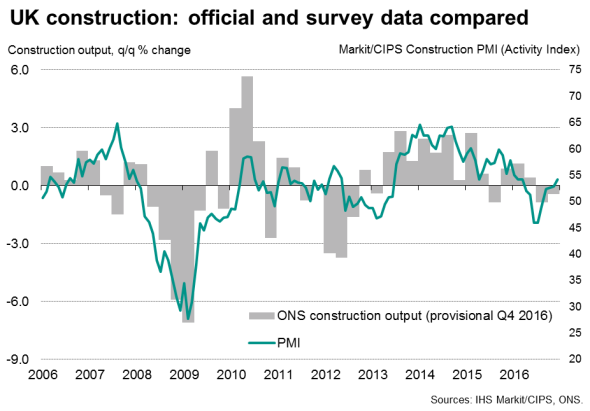

Building gloom set to lift?

Adding to the gloom, construction output fell 0.2% in November after a 0.6% decline in October, meaning output from the sector is on course to drop 0.5% in the fourth quarter after a 0.8% decline in the third quarter.

Looking at the latest official data, there is a clear risk that industry and construction could both have fallen into technical recessions in the final half of 2016 unless there's a strong performance in December. We expect the official data will improve, as survey data have signalled a strengthening in the pace of economic growth towards the end of the year, with the PMI surveys indicating the strongest increase in business activity for nearly one-and-a-half years in December. The surveys also indicate that hiring has gathered pace, suggesting that firms expect growth to be sustained in coming months.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-economics-uk-industry-shows-signs-of-stronger-growth-but-construction-declines.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-economics-uk-industry-shows-signs-of-stronger-growth-but-construction-declines.html&text=UK+industry+shows+signs+of+stronger+growth%2c+but+construction+declines","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-economics-uk-industry-shows-signs-of-stronger-growth-but-construction-declines.html","enabled":true},{"name":"email","url":"?subject=UK industry shows signs of stronger growth, but construction declines&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-economics-uk-industry-shows-signs-of-stronger-growth-but-construction-declines.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+industry+shows+signs+of+stronger+growth%2c+but+construction+declines http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-economics-uk-industry-shows-signs-of-stronger-growth-but-construction-declines.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}