Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 11, 2017

Global economy ends 2016 on 13-month high

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

"The global economy ended 2016 on a solid footing, according to PMI survey data, enjoying the fastest growth for over a year. The JPMorgan Global PMI", compiled by Markit from its various national surveys, edged higher from 53.3 in November to reach a 13-month of 53.4 in December. The latest reading rounded off the strongest quarter since the third quarter of 2015 and represents a marked improvement from the weak growth signalled earlier in the year. The PMI data are consistent with global GDP rising at an annual rate of just under 2.5% in Q4.

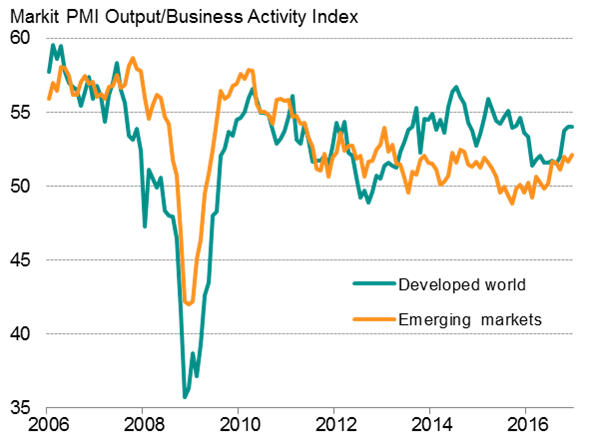

"The pace of emerging market expansion perked up to a 27-month high, though remained weaker than seen in the developed world, where business activity growth was maintained at November's 12-month high.

Global PMI & economic growth

Sources: IHS Markit, JPMorgan, Thomson Reuters Datastream

Developed & emerging market output

Source: IHS Markit

Global hiring picks up, but so do prices

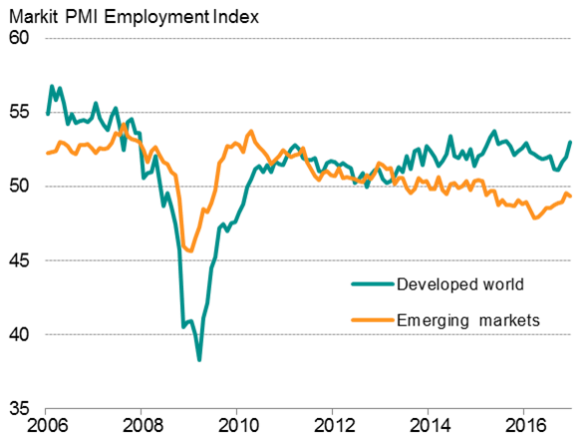

"Other PMI sub-indices suggest global economic growth is likely to continue to accelerate in early 2017. Inflows of new business rose globally at the fastest rate since July 2015 and firms added to their payrolls to the greatest extent seen since May 2015. The upturn in employment was driven by the developed world, however, with emerging markets continuing to see a net reduction in payroll numbers, albeit only modest compared to earlier in the year.

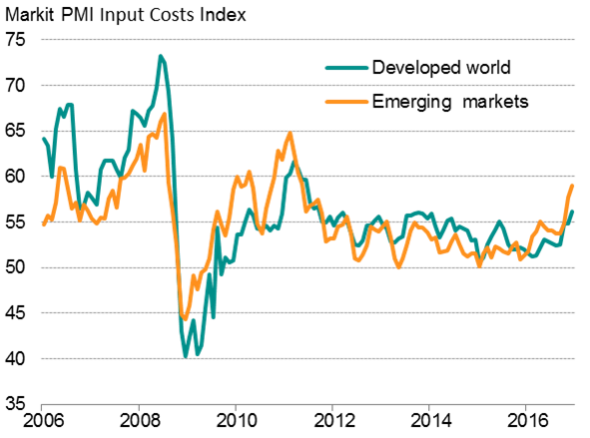

"However, the upturn in staffing levels is being accompanied by the largest rise in firms' costs for over five years, hitting emerging markets especially hard (where the strengthening of the US dollar was also reported to have led to higher prices for dollar denominated imports).

Employment

Sources: IHS Markit

Input costs

Source: IHS Markit

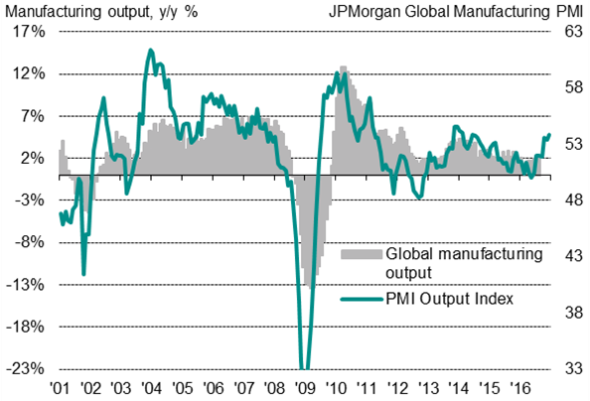

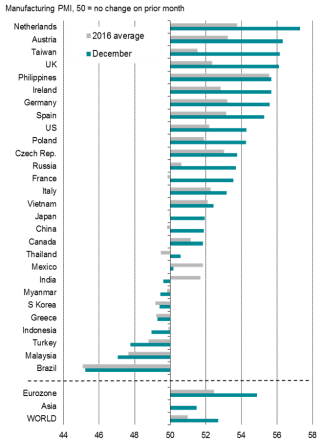

Manufacturing PMI near 3-year high

"Global manufacturing business conditions improved at the fastest rate for nearly three years at the end of 2016, as the recovery from the stagnation seen earlier in the year continued to gather momentum.

The JPMorgan Global Manufacturing PMI, compiled by Markit from its surveys in 28 countries, rose in December to its highest since February 2014. Expansions were recorded in 20 countries with only eight reporting deteriorations. The strongest improvement was seen in the Netherlands, followed by Austria, while Brazil recorded the steepest decline, followed by Malaysia.

Sources: IHS Markit, JPMorgan, ISO, CIPS, NEVI, Nikkei, BME, Bank Austria, Investec, AERCE, Caixin, HPI, Thomson Reuters Datastream.

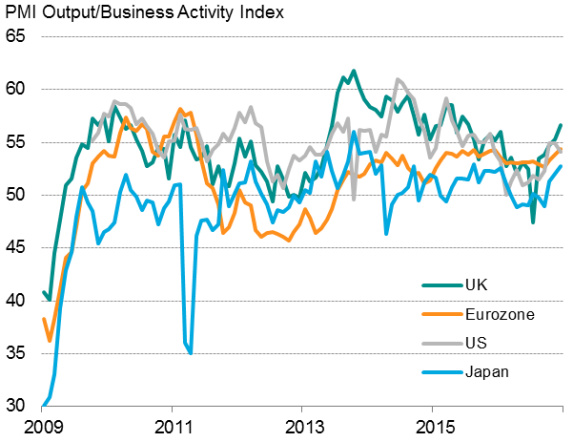

Broad-based developed world upturn in fourth quarter

"Growth of developed world business activity held steady at November's 12-month high, broadly consistent with annual GDP growth of just under 2% in the fourth quarter. While still subdued by historical standards, the Q4 upturn marks a welcome contrast to the lacklustre pace seen earlier in the year.

"Developed world growth has also become increasingly broad-based, though exchange rates appeared to play a role in diverging growth trends. US growth slowed, linked in part to the stronger dollar, but remained one of the strongest rates of expansion seen over 2016. In contrast, faster rates of growth were seen in the UK, eurozoneand Japan, aided by weaker currencies.

Developed world PMI* & economic growth

Source: IHS Markit.

Main developed markets*

Sources: IHS Markit, CIPS, Nikkei.

* PMI shown above is a GDP weighted average of the survey output indices.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Economics-Global-economy-ends-2016-on-13-month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Economics-Global-economy-ends-2016-on-13-month-high.html&text=Global+economy+ends+2016+on+13-month+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Economics-Global-economy-ends-2016-on-13-month-high.html","enabled":true},{"name":"email","url":"?subject=Global economy ends 2016 on 13-month high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Economics-Global-economy-ends-2016-on-13-month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+ends+2016+on+13-month+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11012017-Economics-Global-economy-ends-2016-on-13-month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}