Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 10, 2015

UK industrial production and construction show disappointing starts to the year

Weaker than expected construction and industrial production numbers point to the UK economy having slowed at the start of the year. The data provide further evidence to support the case of interest rates to remain on hold, and will add to chatter that policy may even need to be loosened further.

However, more up-to-date survey data suggest the economy is reviving again, which suggests that the next move in interest rates will be a rise, but that there's little likelihood of rates being hiked this year.

Poor start to the year

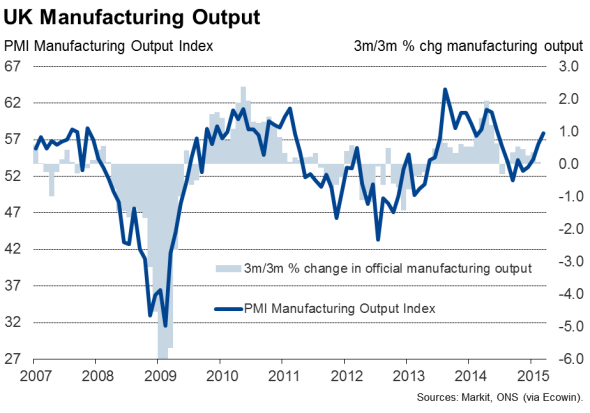

UK factory output rebounded in February, rising 0.4% after dropping 0.6% in January (revised from a previous estimate of a 0.5% decline), according to data from the Office for National Statistics. The wider measure of industrial production, which includes energy, rose a more modest 0.1%, merely reversing a 0.1% drop in January.

Despite the upturn in February, factory output in the first quarter is running 0.2% below the fourth quarter of last year, while industrial production is down 0.1%.

Even worse news came from the construction sector, where official data pointed to a 0.9% fall in output in February. All types of new building work declined, with the exception of certain areas of public sector construction, pointing to weaker private sector investment in housing as well as industrial and commercial construction.

The industrial production and construction data follow official numbers showing a 0.2% deterioration in service sector output in January.

Clearly this all bodes ill for economic growth in the opening quarter of the year. It's now looking like the economy slowed, and possibly quite markedly, compared to the 0.6% expansion seen in the closing quarter of 2014.

Brighter outlook

The trend should improve in March, however, according to survey data. Manufacturing PMI data showed growth having accelerated to an eight-month high in March, with growth of new orders also hitting an eight-month high to suggest that goods producers look set to continue to expand production at a robust pace in coming months. The output of the service sector also accelerated in March, and likewise showed an upturn in growth of new business inflows.

We also suspect the official data understate the true health of the building sector, as PMI data show construction activity continuing to grow at a robust pace in recent months, albeit with the pace of expansion sliding to a three-month low in March. (Note that the accuracy of the official data have been called into question to the extent that they are no longer deemed National Statistics, meaning the data need to be taken with a pinch of salt.)

Ammunition for the doves

Our suspicion is therefore that the initial estimate of first quarter GDP could well surprise on the downside to register only modest growth, but that this initial reading will subsequently be revised higher to indicate reasonably robust growth, at least in line with that seen late last year. However, the weakness of the initial reading will give the doves at the Bank of England additional ammunition for holding off with interest rate hikes, the first of which we believe will not take place until next year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-UK-industrial-production-and-construction-show-disappointing-starts-to-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-UK-industrial-production-and-construction-show-disappointing-starts-to-the-year.html&text=UK+industrial+production+and+construction+show+disappointing+starts+to+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-UK-industrial-production-and-construction-show-disappointing-starts-to-the-year.html","enabled":true},{"name":"email","url":"?subject=UK industrial production and construction show disappointing starts to the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-UK-industrial-production-and-construction-show-disappointing-starts-to-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+industrial+production+and+construction+show+disappointing+starts+to+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-UK-industrial-production-and-construction-show-disappointing-starts-to-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}