Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 10, 2015

Spanish economy sees recovery move up a gear in first quarter

The latest Markit PMI data for Spain signalled that the economy has made a positive start to 2015, with the first quarter of the year seeing growth accelerate. Furthermore, rates of expansion of new orders and employment have each quickened to multi-year highs.

PMI surveys for Spain cover the manufacturing and service sectors, and data for March signalled quickening output growth across both. As a result, the combined rate of expansion was the joint-fastest of the recovery from the global financial crisis so far. The data suggest that GDP will increase at a faster pace than the 0.7% quarterly rate seen in the final three months of 2014, in line with a Bank of Spain estimate of a 0.8% expansion in the first quarter.

Spanish GDP v PMI

Survey respondents have mainly linked recent increases in output to an improving economic situation which has encouraged clients to commit to new projects. Growth of new business quickened in March to the sharpest since prior to the economic crisis, fuelled by the fastest monthly increase in service sector new work since July 2000.

The strength of the recent expansions in new business have exerted capacity pressure on firms, with volumes of outstanding work rising solidly in March. This bodes well for future increases in output and employment, as companies ramp up activity in order to clear backlogs.

Rate of job creation at multi-year high

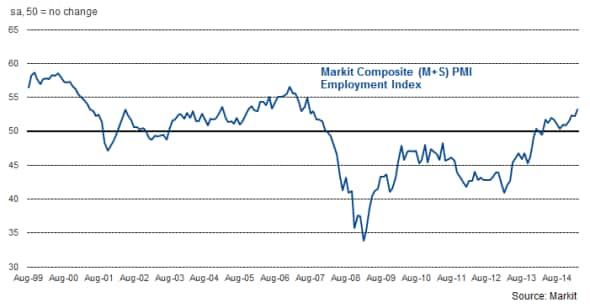

Rising workloads have led companies across both the manufacturing and service sectors to take on extra staff at increased rates. In both sectors, rates of job creation in March were the strongest since prior to the economic crisis, with the composite reading the best since July 2007.

Composite PMI Employment Index

While labour market conditions are clearly improving, there remains a long way to go. The unemployment rate is still well over 20% and close to half of all unemployed people have been so for two years or more. The longer people spend out of work the harder it is for them to return to employment, and so the fact that this figure is so high in Spain is a major worry.

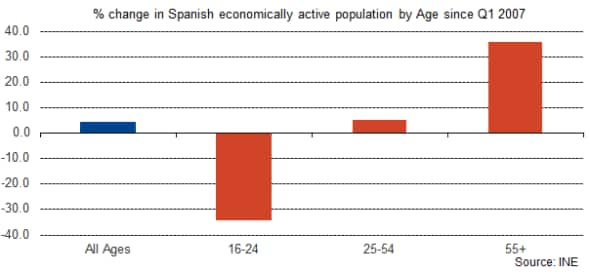

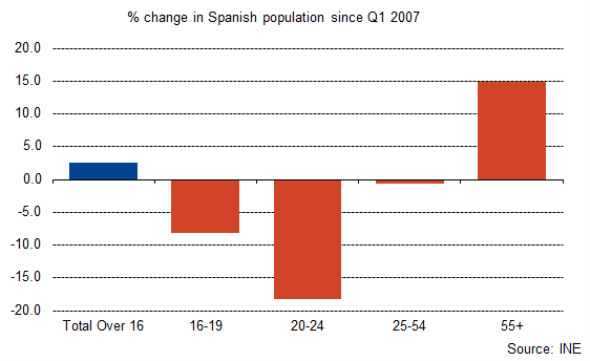

Another issue regarding the labour market is the continuing fall in participation among young people. Data to the end of 2014 shows that since the start of 2007 the number of 16-24 year olds in the labour market has fallen by a third as young people stop looking for work or even take the option of leaving Spain in order to find opportunities elsewhere. Similar trends can be seen in the population data.

Changes in economically active population

Changes in population

Input costs rise on euro weakness

The data also point to some easing of deflationary pressures. Input prices increased for the first time in three months during March, with the same picture recorded across both the manufacturing and service sectors. Manufacturers indicated that the recent depreciation of the euro had been the main factor leading costs to rise, outweighing the effects of lower costs for fuel and raw materials. Although the strongest in eight months, the rate of inflation remained relatively modest.

Despite the pick-up in costs, companies in Spain continued to lower their output prices at the end of Q1 amid efforts to generate new business. That said, the extent of price discounting was the weakest since charges started to fall in September 2008, suggesting that rises in client demand are starting to help generate some pricing power and we may see selling prices rise in coming months.

Outlook bright but political risks remain

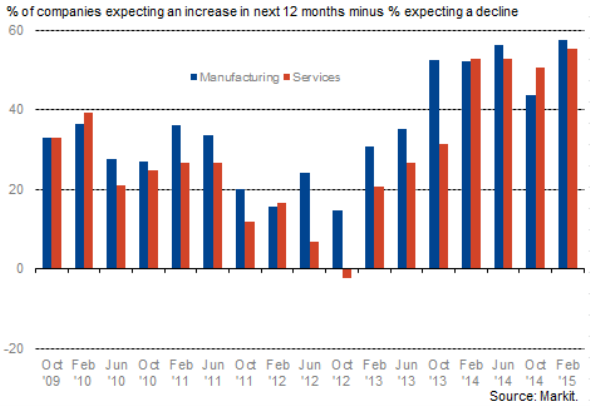

The recent Markit Business Outlook survey showed that Spanish companies are at their most optimistic since the economic crisis, and more positive than their euro area counterparts. Firms generally see the economic recovery continuing over the next 12 months, but political instability in parts of Europe and forthcoming elections in Spain are seen as providing a potential threat to the positive outlook. However, there is so far little sign of the recovery being derailed. In fact, growth seems to have strengthened from the start of the year. Companies will hope to see this continue as 2015 progresses.

Spanish business outlook

The next PMI data for Spain (covering April data) will be released on the 4th of May (manufacturing) and 6th of May (services).

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-Spanish-economy-sees-recovery-move-up-a-gear-in-first-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-Spanish-economy-sees-recovery-move-up-a-gear-in-first-quarter.html&text=Spanish+economy+sees+recovery+move+up+a+gear+in+first+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-Spanish-economy-sees-recovery-move-up-a-gear-in-first-quarter.html","enabled":true},{"name":"email","url":"?subject=Spanish economy sees recovery move up a gear in first quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-Spanish-economy-sees-recovery-move-up-a-gear-in-first-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spanish+economy+sees+recovery+move+up+a+gear+in+first+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-Economics-Spanish-economy-sees-recovery-move-up-a-gear-in-first-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}