Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 10, 2017

Improved UK trade picture marred by falling factory and construction output

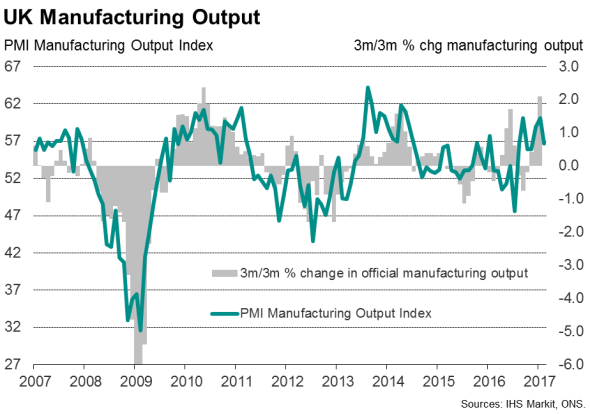

Output of the UK manufacturing and construction industries fell more than expected in January, signalling a disappointing start to the year. Factory output was down 0.9% in the opening month of 2017 against expectations of a 0.4% decline, while construction sector output dropped 0.4% compared to forecasts of a 0.2% fall, according to the Office for National Statistics.

However, the January dip in factory output masks a better underlying trend. Looking over the latest three months, manufacturing production was up 2.1%, its largest rise since May 2010.

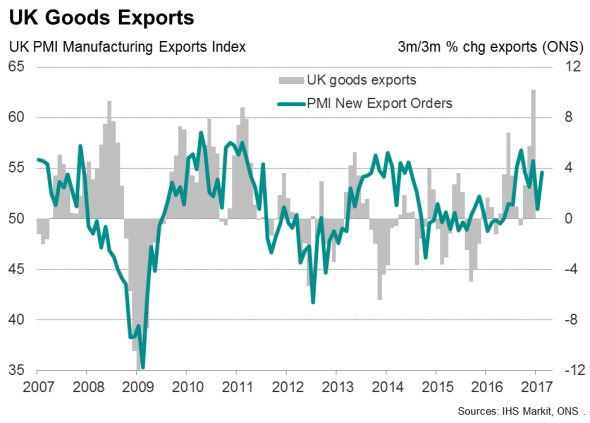

There was also better news from the official trade data, which showed the goods deficit narrowing, buoyed by an 8.7% surge in exports over the three months to January. This was the strongest export growth in over 10 years, and brings the official data more into line with the business surveys. PMI data have for been indicating that UK manufacturers have been benefitting from exports being boosted by the fall in the value of the pound since last summer's Brexit vote.

The concern is that the rising export trend appears to be the only major support to the economy at the moment. The fall in manufacturing output and construction activity in January follows news from the PMI surveys that the economy lost further growth momentum in February. The survey data point to the economy growing by 0.4% in the first quarter, down sharply from the solid 0.7% expansion seen at the end of last year.

The surveys indicate that service sector growth is being weakened by consumers pulling back their spending as rising prices squeeze household budgets. However, the survey data also showed factory production growth slowing to a three-month low in February.

Although the weaker pound was again reported to have been a key driver of stronger export sales in February, growth in domestic demand for factory goods waned. Construction sector output growth also remained disappointingly subdued in February, according to the PMI, companies reported the first decline in commercial construction for four months as well as weaker growth of house building.

As things currently stand, it's looking like the economy could fail to match the 1.8% expansion seen in 2016. The sluggish growth signalled by the surveys and official data at the start of 2017 suggest that the economy is growing at only a modest pace in the first quarter and looks susceptible to further weakening in coming months. Consumers will inevitably continue to rein in their spending amid higher prices, and business uncertainty is likely to intensify as Article 50 is triggered, curbing corporate spending and hiring.

The data suggest the Bank of England will adopt an increasingly dovish view in coming months, with rhetoric highlighting the downside risks to the economy posed by rising inflation and heightened political uncertainty.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-economics-improved-uk-trade-picture-marred-by-falling-factory-and-construction-output.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-economics-improved-uk-trade-picture-marred-by-falling-factory-and-construction-output.html&text=Improved+UK+trade+picture+marred+by+falling+factory+and+construction+output","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-economics-improved-uk-trade-picture-marred-by-falling-factory-and-construction-output.html","enabled":true},{"name":"email","url":"?subject=Improved UK trade picture marred by falling factory and construction output&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-economics-improved-uk-trade-picture-marred-by-falling-factory-and-construction-output.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Improved+UK+trade+picture+marred+by+falling+factory+and+construction+output http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-economics-improved-uk-trade-picture-marred-by-falling-factory-and-construction-output.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}