Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 10, 2017

Week Ahead Economic Overview

The Federal Open Market Committee will announce its latest monetary policy decision, with markets pricing in another rise in the benchmark lending rate. Meanwhile, US inflation figures and retail sales data are also updated. In the UK, the Bank of England issues minutes from its March meeting. Moreover, the eurozone sees the release of employment and inflation data, while industrial output numbers are also made available for a number of the leading global economies.

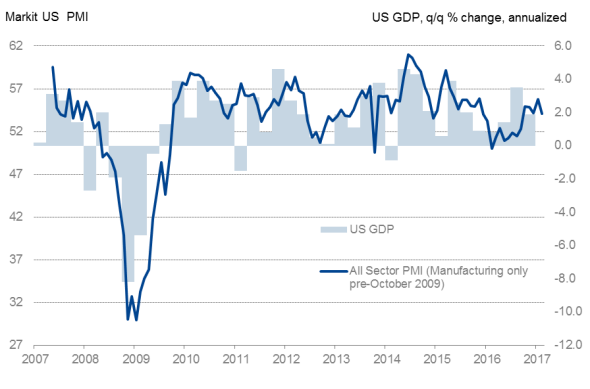

The US Federal Reserve is widely expected to announce a 25bps hike in its benchmark lending rate to 0.75%-1%. These predictions have stemmed from a stronger performance in the US economy of late, including a consensus-beating 235,000 rise in non-farm payrolls and strong survey data, such as the Markit PMI. Inflation is also picking up and quickly closing in on the Fed's 2% target. Prior to the Fed meeting, updated retail sales numbers and inflation figures are also released, offering further clues on the health of the US economy.

Markit Composite PMI and US GDP

Sources: IHS Markit, U.S. Bureau of Economic Analysis.

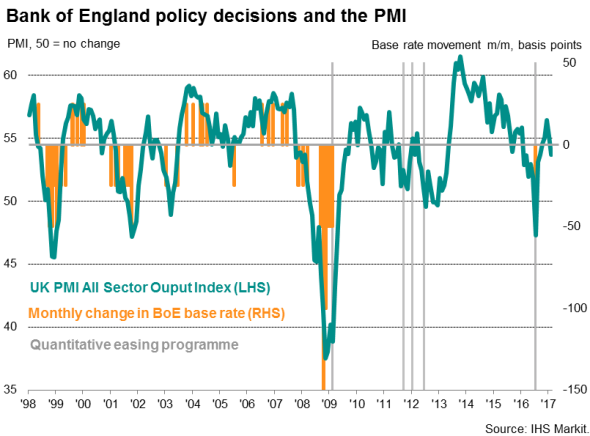

The Bank of England will also set out its latest monetary policy for the UK, yet markets are not holding their breath for any change. Although the economy had showed promise at the end of last year, as GDP rose 0.7% during the fourth quarter, recent PMI data have since signalled a slowdown in growth to 0.4% for Q1 and moved into territory indicative of additional policy stimulus from the Bank. Despite inflation looking likely to now breach 3% by the end of the year, policymakers will continue to reiterate the need for accommodative policy, rather than tightening, in the face of a slowing UK economy.

Eyes will also focus on UK labour market data, and notably earnings figures, for any sign that higher inflation may be feeding through to employee pay reviews, presenting a problem for the Bank of England.

A stream of key economic data are published in the eurozone, including industrial and construction production numbers, employment data, balance of trade figures and the latest euro area inflation rate. The first estimate on the inflation rate provided by Eurostat showed that the rate of price increase was stronger than the ECB's benchmark target for the first time in four years during February, leading the President of the bank, Mario Draghi, to announce that "the risks of deflation have largely disappeared". However, Draghi also warned that the ECB would like to see a "sustained adjustment in the rate of inflation" before contemplating any future interest rate rise from its current level of 0%. The ECB left its 2019 inflation rate forecast at a below-target 1.7%.

Meanwhile, Japan releases its final industrial production figures for January, after the initial estimate showed a solid 3.2% annual increase. Although the consensus is that the figure will remain unchanged from the first reading, industrial production looks set to pick up in coming months after PMI data showed the strongest upturn for nearly three years.

Monday 13 March

The week begins with the release of Chinese foreign direct investment data.

India's latest inflation rate is published.

In Italy, updated industrial production numbers are provided.

Tuesday 14 March

In China, updates on retail sales and industrial production are issued.

Euro area industrial production data are updated.

Germany, Italy and Spain all publish their latest inflation rates.

While Germany also releases the ZEW Economic Sentiment Index.

Latest Italian retail sales figures are issued.

In the US, an update on its producer prices index is provided.

Wednesday 15 March

Japanese industrial production numbers are published, along with latest capacity utilization data.

Singapore publishes its final unemployment rate for the fourth quarter.

Employment figures for the eurozone are announced.

The latest French inflation rate is released.

The Office for National Statistics publishes its latest UK unemployment rate and average earnings data.

US retail sales data and consumer price index are released.

The Federal Reserve announces its latest monetary policy for the US economy.

Thursday 16 March

Australia releases both its unemployment and labour participation rates, alongside figures on full-time employment change.

Russian industrial production data for February are released.

Eurostat issues the latest inflation rate for the euro area.

In the UK, the Bank of England meets to determine its latest course of monetary policy.

Friday 17 March

Latest data on Italy's balance of trade are published.

Eurostat also provides updated numbers on the balance of trade and construction output for the Eurozone.

Samuel Agass | Economist, Markit

Tel: +441491461006

samuel.agass@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032017-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}