Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2014

Japan sees increased investor interest despite sliding back into recession

Foreign investors' appetite for gaining exposure to Japan continues to rise in December, at odds with news of the country sliding back into recession. With the yen continuing to fall, investors appear to be betting on improved performance of Japan's export-oriented manufacturing sector and renewed growth in the fourth quarter and next year, as stimulus slowly feeds through to the economy.

Faith in Abenomics wanes

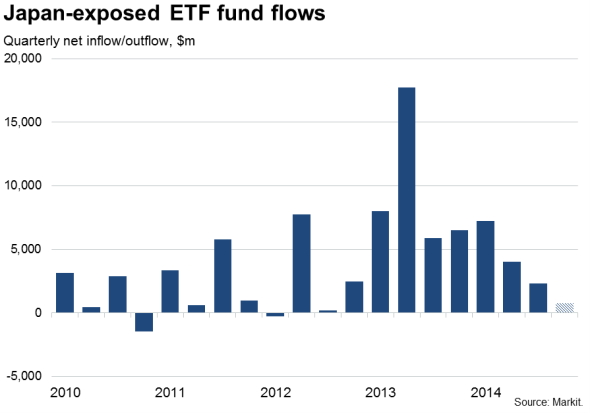

Exchange-traded funds with an exposure to Japan saw strong net inflows in recent years, gaining momentum through 2013 and early-2014 on the back of the promise of renewed and aggressive policy stimulus in the form of 'Abenomics'. Prime Minister Abe's policies included plans to double the balance sheet of the central bank via quantitative easing alongside an infrastructure spending boost and structural reforms.

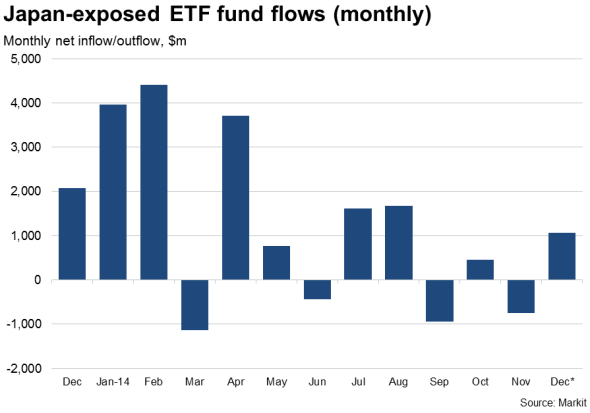

However, recent months have seen investors take a more cautious approach. Inflows into ETFs with an exposure to Japan have eased during 2014, with the fourth quarter so far seeing the smallest net inflow since the third quarter of 2012. Furthermore, in a sign of growing uncertainty among investors, these ETFs even saw net outflows in four months in 2014.

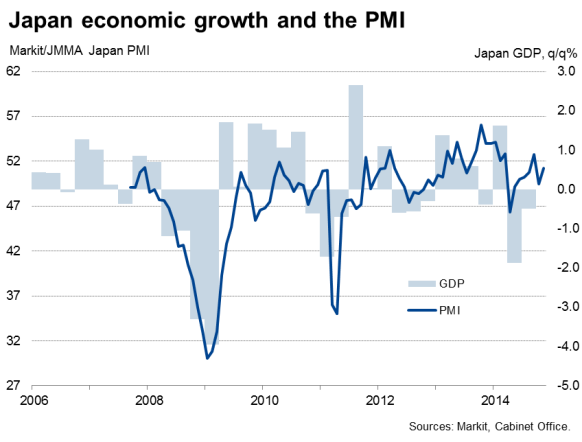

Increased investor nervousness about Japan is not surprising. After a rise in the sales tax from 5% to 8% in April, the country has recorded two consecutive quarters of falling GDP, constituting a recession. A second estimate of GDP in the third quarter was even revised lower, registering a 0.5% decline compared to the initial estimate of a 0.4% downturn and confounding widespread expectations of an upward revision.

Critics of Abenomics point out that the new policies have merely caused a steep depreciation of the yen, which has slumped around 60% against the US dollar since mid-2012 and 13% the past three months alone to reach a seven-year low. This has pushed up the cost of imports which, alongside what appears to be an ill-timed sales tax rise, is driving inflation higher and squeezing household spending, causing the recession.

A resumption of net inflows into ETFs with an exposure to Japan in December, more than offsetting the net outflows seen in November, therefore seem at odds with the news that Japan is mired back in recession.

Export upturn

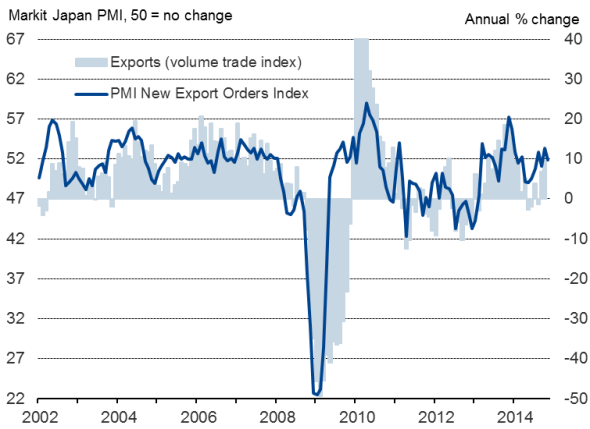

However, the renewed interest in gaining an exposure to Japan can be explained at least in part by the improved prospects for Japanese exporters which have resulted from the weakened yen, something already being confirmed by business surveys, which also suggest that the official data are overstating the current weakness of the Japanese economy.

PMI survey data up to November have shown manufacturing exports rising so far in the fourth quarter at the strongest rate since the final quarter of last year. Similarly, less up-to-date official data showed exports up 9.6% on a year ago in October.

With economic policy set to stay loose for the foreseeable future in Japan, while talk increasingly turns to the timing of the first interest rate hike in the US, the exchange rate is likely to remain favourable for Japanese exporters as we move into 2015, adding to the case for corporate profits growth.

This view of increased investor interest on the back of export-led gain is given weight by the fact that the recent inflows have been led by Yen-hedged products which give investors protection against the falling Yen. This trend has seen three Yen-hedged products make the top 10 inflow list since the start of the quarter indicating that foreign investors like the prospects of Japanese equities, but are sceptical of the value of the Yen.

Japanese exports

GDP data overstating weakness?

Investors may also be gauging the economy to be faring better than the revision-prone official GDP data indicate. PMI survey data, for example, pointed to a modest upturn in the private sector economy in the third quarter after the second quarter downturn, and suggest modest growth has persisted into the fourth quarter.

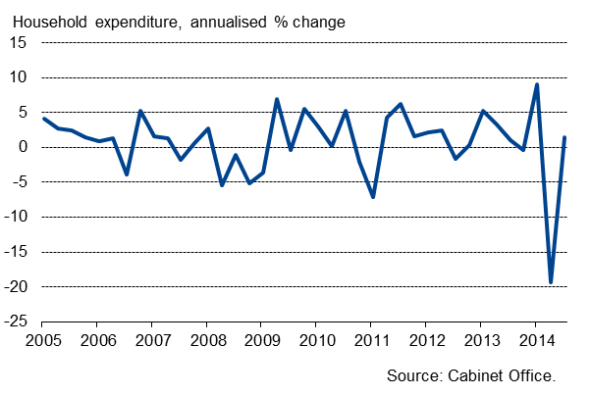

The GDP data themselves also include some encouraging data. Household spending rose at an annualised rate of 1.5% after dropping 19.4% in the second quarter. That's still weak, but the rise is better than a decline and must be viewed in the context of the front-loading of purchases earlier in the year, ahead of the tax rise.

Perhaps most encouraging was the fact that if a steep decline in inventories in the third quarter was excluded, GDP would have risen 0.1%. Such destocking also suggests that companies may restock again in the fourth quarter, boosting GDP.

Finally, investor sentiment will also have naturally been lifted by the news that the government has postponed a further planned hike in the sales tax for next year, which should alleviate a further forecast squeeze on household spending.

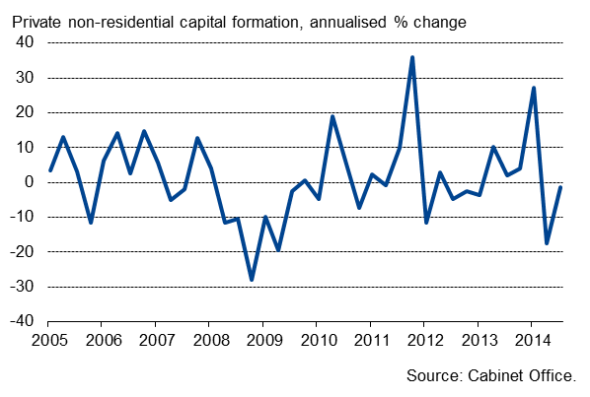

Private investment

Household spending

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-Japan-sees-increased-investor-interest-despite-sliding-back-into-recession.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-Japan-sees-increased-investor-interest-despite-sliding-back-into-recession.html&text=Japan+sees+increased+investor+interest+despite+sliding+back+into+recession","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-Japan-sees-increased-investor-interest-despite-sliding-back-into-recession.html","enabled":true},{"name":"email","url":"?subject=Japan sees increased investor interest despite sliding back into recession&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-Japan-sees-increased-investor-interest-despite-sliding-back-into-recession.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+sees+increased+investor+interest+despite+sliding+back+into+recession http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-Japan-sees-increased-investor-interest-despite-sliding-back-into-recession.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}