Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2014

German industrial production rises, but underlying trend remains weak

German industrial production data and the PMI survey are signalling a loss of momentum in the goods-producing sector, suggesting that we may see another period of weak GDP growth in the fourth quarter.

Production increases marginally

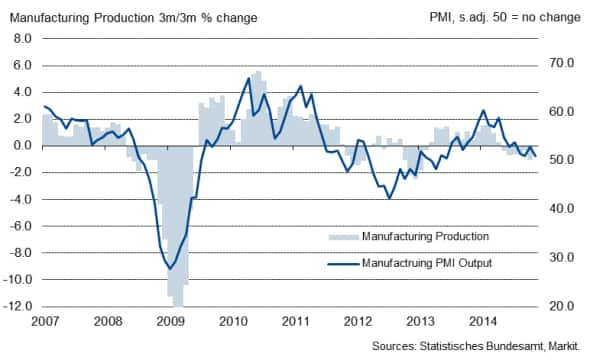

Industrial production rose 0.2% in October, according to the Federal Statistical Office (Destatis). Economists polled by Reuters had expected a slightly stronger, 0.3%, increase. The rise in industrial production follows a revised 1.1% increase in September (previously reported as +1.4%). However, industrial output is down 0.7% in the latest three months, following a 0.3% decline in the third quarter.

With the exclusion of construction and energy, manufacturing output was up 0.2%, following a 1.2% rise in September. In the latest three months, however, manufacturing output is down 1.1%, its weakest performance since January 2013.

Destatis reported that capital goods manufacturers saw a 0.4% decline in output during October. Intermediate goods output meanwhile rose 0.8% and the production of consumer goods increased 0.5%. Energy production was down by 1.1% on the month, but construction was up 1.4%.

Factory orders rise in October

The disappointing production data surprised the markets after official data released last Friday had shown factory orders rising 2.5% in October, following a 1.1% increase (revised up from an initial 0.8% rise) in September. Domestic orders were up 5.3% (a 41-month high), while new export work rose 0.6%.

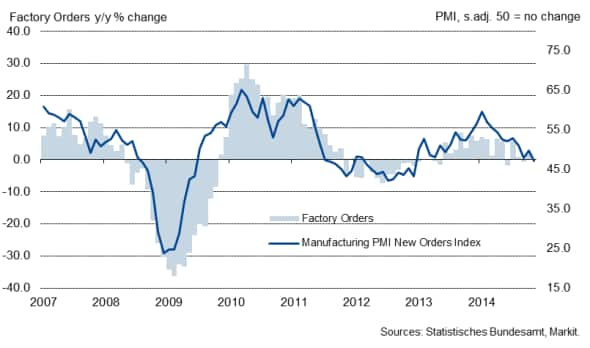

Factory orders rose a mere 0.2% in the third quarter, following an equally modest decline in Q2. PMI data had likewise signalled a weak trend in new orders in recent months and suggest that order intakes may fail to show any meaningful increase moving towards the end of the year.

Factory orders and the PMI

Manufacturing sector continues to struggle

Both the official data and the survey results therefore point to a German industrial sector that continues to struggle and lose momentum in the final quarter of the year. The Markit/BME Germany Manufacturing PMI fell to a 17-month low in November, signaling a renewed deterioration in manufacturers' operating conditions. The PMI is currently running seven points lower compared to the start of the year, indicating a substantial loss of momentum in Germany's goods-producing sector.

Manufacturing production and the PMI

Output growth slowed to only a fractional pace, while new orders declined for a third month running and at the sharpest rate in nearly two years. With backlogs of work and stocks of finished goods falling, the rise in output is based on extremely shaky foundations.

Another worry is the weak export performance, which acted as a main drag on total new orders. The amount of new work from foreign markets fell in November for the first time since July last year, according to PMI respondents, with German manufacturers suffering from poor economic conditions in some of their main export destinations, namely France, China, Austria and Italy.

Other surveys show similar weakness to the PMI. While the Ifo Business Climate Index rose for first time in seven months in November, the latest index reading of 104.7 was still the joint second-lowest in just over one-and-a-half years and compares to a level of 110.6 at the beginning of the year.

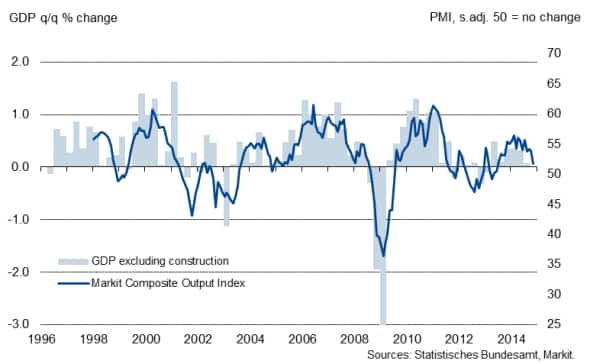

Marginal growth for fourth quarter at best

Both the release of the orders and industrial production data for October confirmed our thinking that Germany's goods-producing sector may struggle to show any meaningful growth in the fourth quarter.

While service sector output remained in expansion territory, its rate of growth slowed dramatically to the weakest in 16 months in November. Consequently, the Markit Germany Composite Output Index, which measures the combined output of the manufacturing and service sectors, signalled only a slight expansion in November. It is therefore possible that the eurozone's largest economy will register only a modest increase in GDP in the fourth quarter.

Last week, the Bundesbank released its final semi-annual projection for economic growth in which it stated that the "German economy remains in good shape". However, the bank cut its growth forecast for 2014 from +1.9% in its June release to +1.4%. For 2015, the bank cut its forecast from an initial +2.0% to just +1.0%.

German GDP (excluding construction) and the PMI

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-German-industrial-production-rises-but-underlying-trend-remains-weak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-German-industrial-production-rises-but-underlying-trend-remains-weak.html&text=German+industrial+production+rises%2c+but+underlying+trend+remains+weak","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-German-industrial-production-rises-but-underlying-trend-remains-weak.html","enabled":true},{"name":"email","url":"?subject=German industrial production rises, but underlying trend remains weak&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-German-industrial-production-rises-but-underlying-trend-remains-weak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+industrial+production+rises%2c+but+underlying+trend+remains+weak http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122014-Economics-German-industrial-production-rises-but-underlying-trend-remains-weak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}