Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 07, 2016

Week Ahead Economic Overview

More information on the health of the US economy is provided by latest retail sales and consumer sentiment data. The week also sees updates on inflation figures across some of the largest eurozone countries and China, while construction output numbers are issued in the UK.

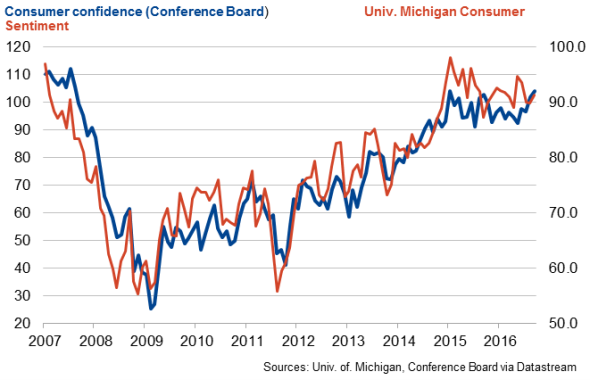

The data-dependent Fed will continue to monitor the data flow in the coming weeks for signs that the US economy is ready for a further tightening of monetary policy, which many are pencilling-in for December. The release of retail sales numbers and consumer sentiment data could be encouraging for policy makers : the University of Michigan Consumer Sentiment Index increased in September, with expectations about the outlook improving and thereby indicating that consumer spending is likely to pick up. Meanwhile, the Conference Board measure for consumer confidence rose to its highest level since 2007 in September, also boding well for the short-term outlook. Although retail sales fell in August, IHS Markit expects spending to return to growth in September, with the outlook for holiday retail sales looking significantly brighter this year than last year.

US consumer sentiment

The European Central Bank will await consumer price data across the eurozone's largest member states for more information on price trends. Although inflation reached a two-year high in September, it remained well below the ECB's target of just under 2%. Moreover, with core inflation flat at only 0.8%, job creation in the region stalling and PMI results pointing to a growth slowdown, expectations are growing that the central bank will extend its bond buying programme beyond its scheduled expiration in March 2017. IHS Markit predicts inflation in the currency union to pick up slightly in October and start to slowly move closer towards the bank's target.

Eurozone inflation

Inflation figures are also released in China and will add to the policy debate at the People's Bank. In August, the CPI measure indicated the slowest rise in consumer prices in nearly a year. Inflation stood at just 1.4%, down from 1.8% in July and well below the bank's target of 3%.

The Office for National Statistics publishes construction output data on Friday which, although declassified as an official statistic due to quality issues, will provide analysts with further insight into the health of the UK economy in the third quarter. Latest PMI data signalled that building activity returned to growth in September, following a steep Brexit-vote related downturn in July. The upturn was driven by resilient housing market conditions and a renewed upturn in civil engineering activity. The ONS data will be scoured for signs that the UK economy avoided a recession in the second half of the year, thereby casting doubt on the need for further stimulus from the Bank of England in coming months.

Monday 10 October

India sees the release of latest industrial production and trade data.

M2 money supply numbers are updated in China.

The latest Eurozone Sentix Index is out.

Destatis publishes trade figures for Germany.

Industrial output numbers are released in Italy.

UK regional PMI results are published.

Tuesday 11 October

Business confidence and mortgage lending data are released in Australia.

In Japan, current account figures are issued.

South Africa sees the publication of manufacturing production numbers.

Economic sentiment data are meanwhile released by ZEW in Germany.

The British Retail Consortium issues retail sales figures.

Housing starts numbers are updated in Canada.

In the US, the latest NFIB Business Optimism Index is published.

Wednesday 12 October

Australia sees the publication of consumer sentiment numbers.

Machinery orders figures are out in Japan.

In Russia, trade data are updated.

Eurostat releases industrial production numbers for the currency union.

Inflation figures are meanwhile published in France.

The UK sees the release of the Commercial Development Activity and Bellwether reports.

Thursday 13 October

Consumer price figures are issued in India, while China sees the release of trade data.

Meanwhile, mining production numbers are updated in South Africa.

Inflation figures are out in Germany.

Latest results from the RICS Housing Survey are issued in the UK.

In Canada, house price data are published.

Initial jobless claims and export price figures are released in the US.

Friday 14 October

In India, wholesale price numbers are updated.

Meanwhile, consumer price data are issued in China, Italy and Spain.

Eurostat releases trade figures for the eurozone.

The Office for National Statistics publishes construction output data for the UK.

Retail sales, business inventory and producer price numbers are out in the US. Moreover, latest Reuters/Michigan consumer sentiment data issued.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}