Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 10, 2016

Irish growth weakens at end of third quarter

The Irish economy has been hit with a double-whammy following the UK’s vote to leave the EU, pushing growth down to a three-year low.

The initial drop in activity in the UK immediately following the June vote hit demand for Irish goods and services, which has since been exacerbated by the sharp depreciation of sterling making it more difficult for Irish exporters to compete in the UK market, in spite of a recovery in activity there.

After last month’s PMI data from Investec, Ulster Bank and IHS Markit suggested that growth had stabilised in August following a slowdown in the aftermath of the referendum in July, the latest data are less reassuring.

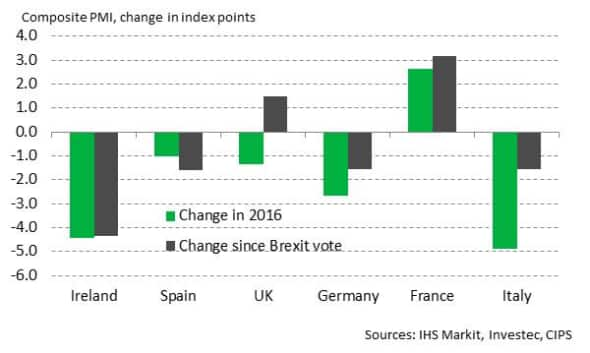

PMI figures show that the Irish private sector has just completed its worst quarter of growth since Q3 2013, with the economy seemingly more affected than other European countries by the UK’s Brexit vote, as had been predicted prior to the referendum as a result of Ireland’s close ties to the UK. Looking at the six EU countries for which composite PMI data are available, Ireland has seen the largest index-point drop since the survey period directly before the referendum in June. Prior to this, the Irish PMI data had shown growth remaining in line with that seen at the end of 2015.

PMI changes in EU countries

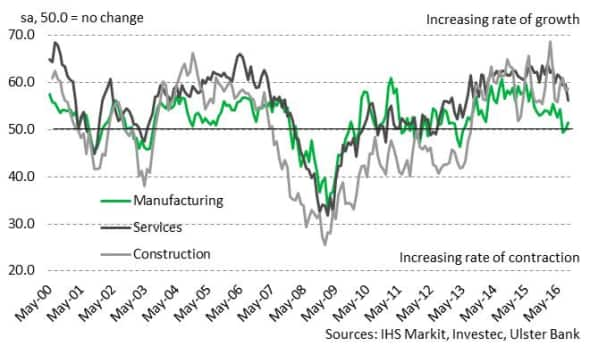

Services growth weakens in September

The biggest concern from the latest month of PMI data comes from the service sector, where activity rose at the weakest pace since June 2013 amid the slowest increase in new business since May of that year. Reduced interest from customers was mentioned by companies, with some linking this directly to the UK’s decision to leave the EU.

Manufacturing production meanwhile increased slightly following a fall in July and stagnation in August. That said, growth remained well below the levels seen in the first half of the year.

The main bright spot from the latest Irish PMI surveys came from the more domestic-focussed construction sector, where the rate of growth in activity actually quickened slightly in September and was the sharpest of the three monitored sectors.

PMI Output Indices

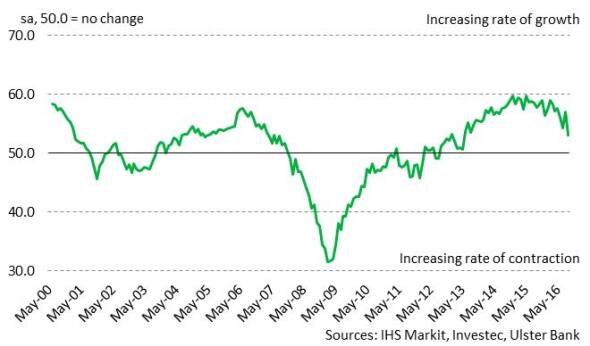

Slower rise in employment

Prior to September, the rate of job creation in the Irish private sector had remained solid, helping the unemployment rate fall to a near-eight year low of 7.9%. However, the latest rise in employment signalled by the PMI data was the slowest since May 2013, suggesting that some firms have enough concerns around the future to hold off on hiring decisions for now. In fact, manufacturers left their staffing levels broadly unchanged in September, ending a 39-month sequence of job creation. Some businesses reported the non-replacement of leavers during the month.

All-Sector PMI Employment Index

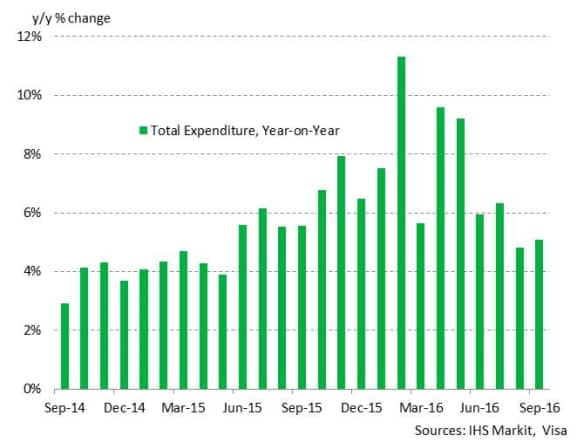

Household spending expands solidly

An area of support to the economy remains consumer spending, helped by low inflation and low interest rates, though even here there are signs of support fading. Growth of spending by households continued to hold up reasonably well in September, according to the latest Visa Irish Consumer Spending Index (CSI). Spending was up +5.1% year-on-year in September, slightly quicker than the +4.8% rise seen in August. That said, the increase was the second-slowest in 16 months, suggesting a weaker growth environment at present.

Visa’s Irish Consumer Spending Index

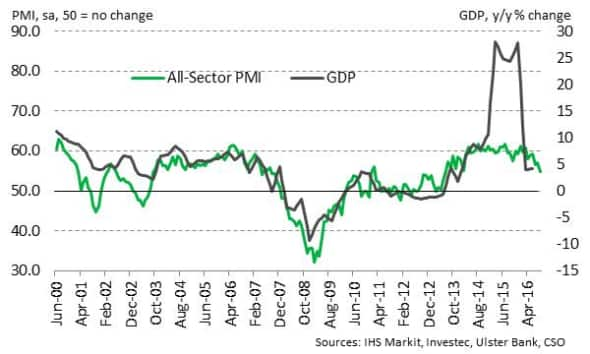

GDP forecasts revised down

Last week, the Irish government revised down its GDP forecasts for both 2016 (4.2% from 4.9%) and 2017 (3.5% from 3.9%) as a result of uncertainty caused by the UK’s decision to leave the EU. John McCarthy, the finance ministry's chief economist said, “We have reduced next year's forecast by around half a percentage point to take into account the uncertainty associated with Brexit.” Meanwhile, IHS Markit forecasts a rise in GDP of just 1.8% next year, well below the strong expansions seen in recent years. With the UK set to trigger Article 50 in Q1 2017, all eyes will be on the progress of the negotiations.

All-Sector PMI v GDP

GDP for 2015 distorted by one-off factors

Andrew Harker | Economics Associate Director, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102016-Economics-Irish-growth-weakens-at-end-of-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102016-Economics-Irish-growth-weakens-at-end-of-third-quarter.html&text=Irish+growth+weakens+at+end+of+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102016-Economics-Irish-growth-weakens-at-end-of-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Irish growth weakens at end of third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102016-Economics-Irish-growth-weakens-at-end-of-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Irish+growth+weakens+at+end+of+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102016-Economics-Irish-growth-weakens-at-end-of-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}