Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 07, 2016

US employment growth slows to four-month low in September

A disappointing employment report for September is a setback for those banking on a Fed rate rise later this year, but has by no means shut the door on a December hike.

The economy once again added jobs at a slower than expected pace and the unemployment rate showed a surprise increase from 4.9% to 5.0%. Non-farm payrolls rose by 156,000 in September, coming in below market expectations of a 175,000 increase.

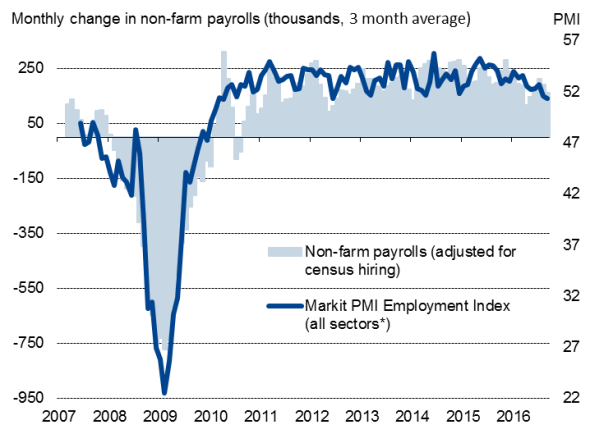

US labour market

The rate of job creation has now slowed for three successive months, albeit from June's peak of 271,000. Even with the slowing, this is still a robust rate of job creation, and more than enough to offset population growth.

Many will therefore brush this off as a natural slowing in the rate of employment growth because the economy is close to full employment. What's more, the increase in unemployment can also be explained away by the positive development of a rise in the number of people joining the labour market.

Reduced appetite to hire

Such an optimistic view may be too complacent: we note that the labour market slowdown has come at a time when business confidence has been rattled by unusually high uncertainty as the presidential election looms, which is holding back investment decisions and hiring, albeit hopefully temporarily.

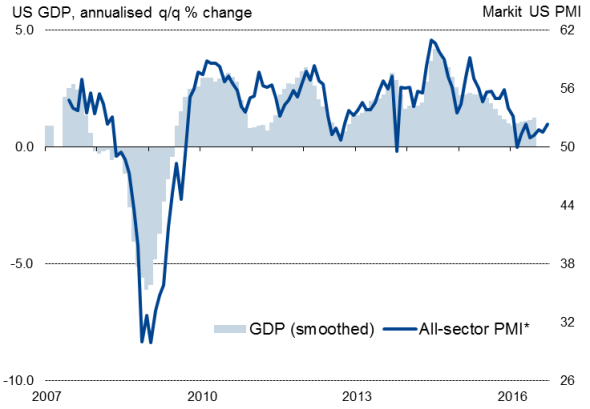

IHS Markit's PMI data - which accurately predicted the subdued rate of economic growth seen in the first half of the year - indicate that the US economy continued to expand at only a modest pace in the third quarter. The September survey also showed the smallest monthly gain in jobs since April 2010 as companies delayed business expansion plans until the political picture clears.

US economic growth indicators

*Manufacturing PMI only pre-October 2009.

Sources: IHS Markit, Bureau of Labor Statistics, Commerce Department.

Manufacturing has been especially hard hit, with political anxiety exacerbated by the dollar's strength and the energy sector downturn. It's therefore not surprising to see further factory job losses in September, the sixth drop in payroll numbers in the past eight months. The slowing is not limited to goods producers though, with service sector companies reporting the second-lowest rate of net job creation seen so far this year in September.

However, today's data are not weak enough to substantially alter the underlying picture of the Fed's next move being one of tightening policy. It likely remains just a case of when, rather than if, rates will rise.

While a November rate hike therefore looks highly unlikely, given the proximity of the election and signs of a current weak-spot in the economy persisting into the third quarter, an election result that is positively received by the markets and business leaders will most likely pave the way for a December Fed rate hike, providing the economic data flow does not deteriorate further in the meantime.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-US-employment-growth-slows-to-four-month-low-in-September.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-US-employment-growth-slows-to-four-month-low-in-September.html&text=US+employment+growth+slows+to+four-month+low+in+September","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-US-employment-growth-slows-to-four-month-low-in-September.html","enabled":true},{"name":"email","url":"?subject=US employment growth slows to four-month low in September&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-US-employment-growth-slows-to-four-month-low-in-September.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+employment+growth+slows+to+four-month+low+in+September http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-US-employment-growth-slows-to-four-month-low-in-September.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}