Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 07, 2015

US, eurozone and UK upturns help drive global growth to six-month high

Global economic growth accelerated for a third successive month in March, reaching a six-month high according to business survey data.

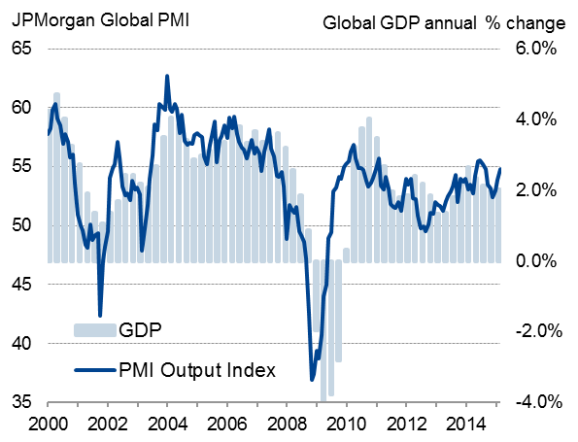

Global economic growth

The JPMorgan Global PMI, compiled by Markit from its national survey data, rose from 53.9 in February to 54.8 in March. The latest reading is broadly consistent with worldwide GDP expanding at an annual rate of 2.5%, up from 2.0% at the end of last year but still weak by pre-crisis standards.

There were welcome signs of growth reviving in the US, eurozone and the UK. However, Japan slipped back into contraction, and the emerging markets remained in the doldrums, led by the steepest downturns since 2009 in Russia and Brazil in the opening quarter.

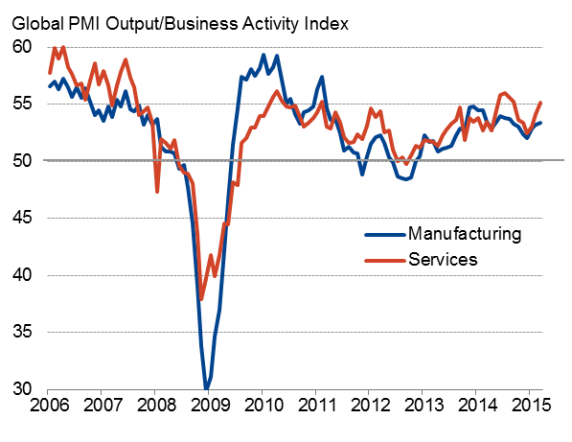

Services leads growth, as global goods trade remains weak

Growth accelerated in both manufacturing and services, with the latter outperforming the goods-producing sector for an eleventh successive month. The divergence highlights how global manufacturing, and trade in particular, continues to act as a dampener on economic growth in the world's major economies. The manufacturing PMI export orders index - a reliable bellwether of global trade - edged lower in March to register a near-stagnation of trade flows.

Global manufacturing and services

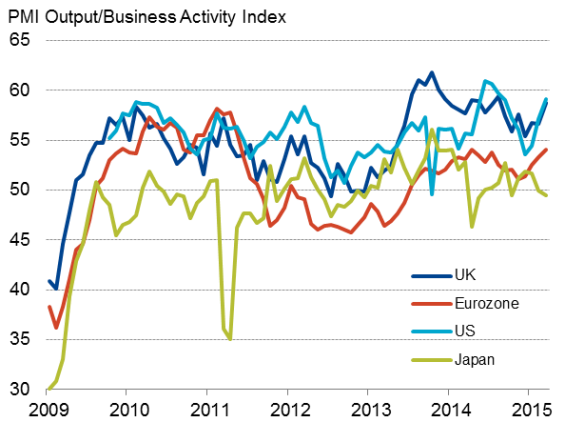

Signs of US reviving after slowdown

A key development in March was a further acceleration of economic growth in the US, according to Markit's PMI surveys. The surveys, like many other data series, pointed to the US having hit a soft patch in the first quarter, but buck the trend by showing the economy gaining momentum again to bode well for stronger second quarter GDP growth.

Another welcome development in March was an upturn in the eurozone PMI, which rose to its highest level in almost a year. While signalling a modest 0.3% expansion of the region's GDP in the first quarter, like the US the eurozone survey data are pointing to a gaining of momentum heading into the second quarter. Particularly encouraging is the fact that all four of the largest euro nations are now expanding, with France having returned to growth in February.

The upturn in the Eurozone was a contributory factor to growth also accelerating to a seven-month high in the neighbouring UK. The PMI surveys point to GDP growth accelerating to 0.7% in the first quarter, making it the strongest growing developed economy at the start of 2015.

Japan meanwhile looks to have suffered the worst performance of the major developed economies so far this year. Its PMI fell to a ten-month low, signalling the first contraction of business activity since October. Although manufacturing output rose, the rate of expansion weakened in part due to sluggish domestic demand. The service sector meanwhile contracted for a second successive month, fuelling worries about yet another slide back into recession.

Emerging markets lag developed world

The weakness of the global economy, and manufacturing in particular, was in part a reflection of ongoing malaise in the emerging markets. The survey data suggest the emerging markets collectively saw economic growth remain in the doldrums in the first quarter. GDP looks set to have risen at an annual rate of around 5%, half the pace of expansion seen prior to the global financial crisis.

The emerging markets are now underperforming relative to the developed world to the greatest extent since last July, and to one of the greatest extents in recent years.

Developed world

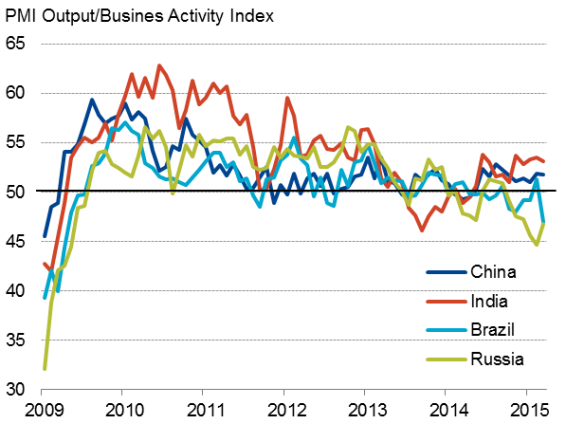

Mixed bag of BRICs

Looking in more detail at the emerging markets, there was a mixed bag of data across the 'BRIC' economies. India has taken over as leader of the quartet, followed by China, although rates of expansion remain disappointingly subdued in both cases. However, even these historically modest rates of growth are welcome contrasts to the downturns currently being signalled in Brazil and Russia.

The surveys indicate that India's growth rate is likely to have picked up from the 7.5% annual pace seen late last year, helped by a stronger expansion in the service sector. China's growth rate, on the other hand, looks set to have weakened further from the 7.3% annual pace seen at the end of last year due to weak growth in both goods-producing and service sectors.

One of the most worrying developments in March, however, was the deterioration in business conditions in Brazil, where the PMI surveys registered the steepest rate of decline since April 2009, adding to fears that the country is sliding back into recession.

The rate of decline moderated in Russia but remains severe, suggesting the country is likewise undergoing a downturn of a severity not seen since 2009.

Emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-US-eurozone-and-UK-upturns-help-drive-global-growth-to-six-month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-US-eurozone-and-UK-upturns-help-drive-global-growth-to-six-month-high.html&text=US%2c+eurozone+and+UK+upturns+help+drive+global+growth+to+six-month+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-US-eurozone-and-UK-upturns-help-drive-global-growth-to-six-month-high.html","enabled":true},{"name":"email","url":"?subject=US, eurozone and UK upturns help drive global growth to six-month high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-US-eurozone-and-UK-upturns-help-drive-global-growth-to-six-month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US%2c+eurozone+and+UK+upturns+help+drive+global+growth+to+six-month+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-US-eurozone-and-UK-upturns-help-drive-global-growth-to-six-month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}