Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 07, 2015

UK 'all-sector' PMI hits seven-month high in March

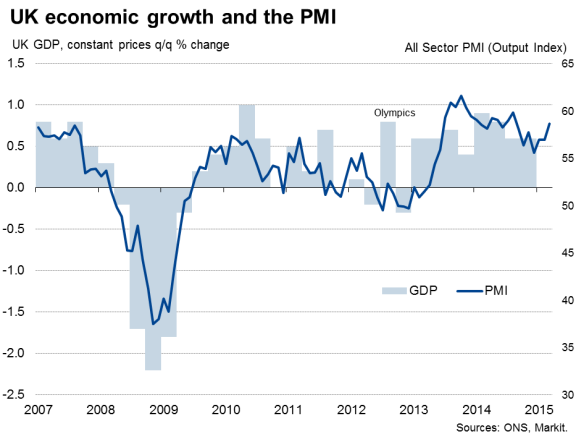

The UK economy moved up a gear in March, recording the strongest pace of growth since last August. The three PMI surveys collectively indicate that the economy grew by 0.7% in the first quarter, reviving from the slowdown seen late last year. Revised official data showed the economy to have grown 0.6% in the final three months of last year, down from 0.9% at the start of the year.

A GDP-weighted average of the three PMI surveys' output indexes rose from 57.0 in February to 58.7 in March.

Faster growth of new business and improved expectations of prospects for the year ahead also bode well for the upturn to retain strong momentum as we move through the spring. The 'all-sector' New Orders Index jumped to its highest level since last July, while future expectations among services firms were the most buoyant seen since last May.

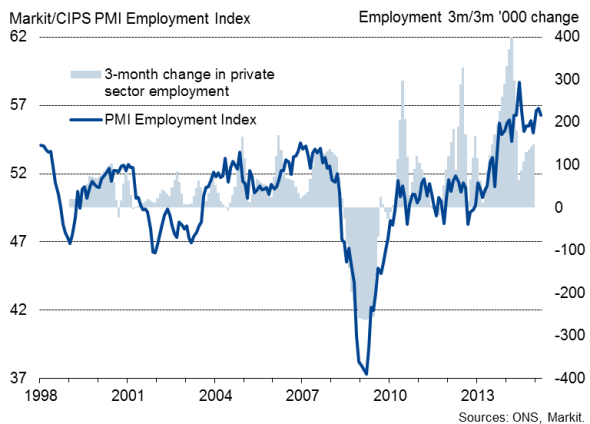

The survey data also show employment growth remaining close to record highs and few signs of inflation picking up from its record low. Average prices charged for goods and services were unchanged during the month, contrasting with modest rises in prior months.

Employment

The combination of fuller employment and low inflation should support economic growth by providing an important catalyst to higher consumer spending, on which the upturn appears to have become increasingly dependent in recent months.

While the data support the view that the next move in interest rates will be upward, the lack of inflationary pressures suggests the first hike remains some way off, and probably not this year unless we see some significant upturn in wage growth.

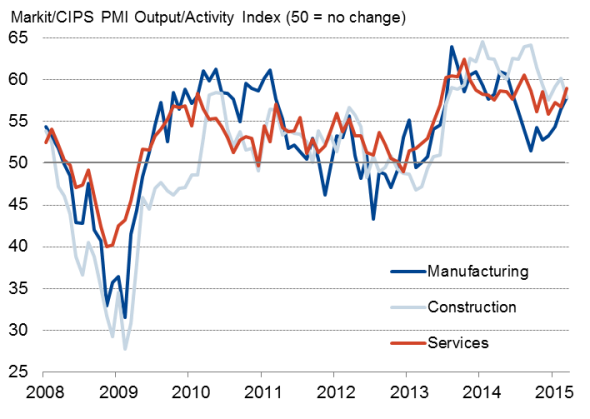

Business activity by sector

Source: Markit.

Service sector-led upturn

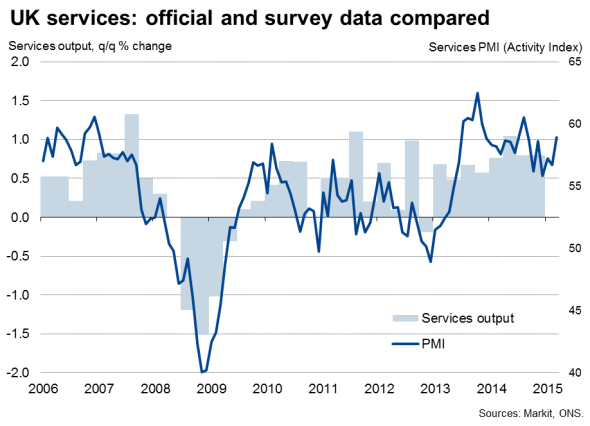

The upturn continued to be broad-based across all main sectors of the economy, led by the vast services economy, where growth accelerated to the fastest since last August. The survey's activity measure points to service sector GDP growing 0.7-0.8% in the first quarter, similar to the 0.8% growth rate seen in the final two quarters of last year. Moreover, the upturn in March (alongside stronger growth of new business inflows) bodes well for faster services growth in the second quarter.

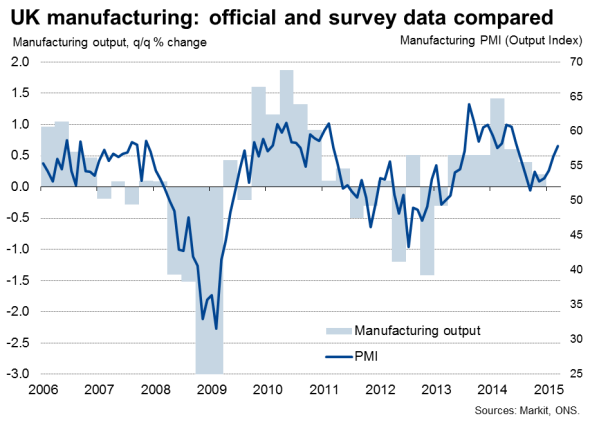

Manufacturing output growth meanwhile accelerated to an eight-month high, showing further signs of reviving from the slowdown seen late last year. Manufacturing output rose just 0.2% in the fourth quarter of last year (its smallest gain since the first quarter of 2013) but the survey data are pointing to a 0.5% rise in the first quarter. With growth of new orders also hitting an eight-month high, manufacturers look set to continue to expand production at a robust pace heading into the second quarter.

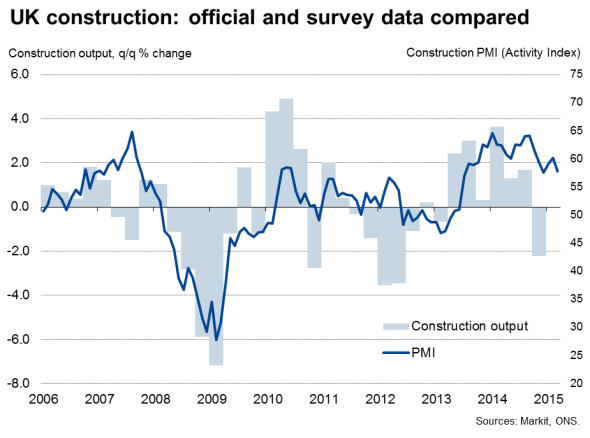

The construction sector also continued to enjoy robust growth in March, albeit with the pace of expansion sliding to a three-month low. The sector nevertheless looks to have notched up the strongest expansion of all three sectors in the first quarter, with growth exceeding 1%. The resilient PMI readings for construction contrast markedly with the official data, which indicated that the sector suffered a steep 2.2% contraction of activity in the fourth quarter in a surprise turnaround from strong growth earlier in the year. The PMI therefore suggests the official data may be under-recording recent construction activity.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-UK-all-sector-PMI-hits-seven-month-high-in-March.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-UK-all-sector-PMI-hits-seven-month-high-in-March.html&text=UK+%27all-sector%27+PMI+hits+seven-month+high+in+March","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-UK-all-sector-PMI-hits-seven-month-high-in-March.html","enabled":true},{"name":"email","url":"?subject=UK 'all-sector' PMI hits seven-month high in March&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-UK-all-sector-PMI-hits-seven-month-high-in-March.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+%27all-sector%27+PMI+hits+seven-month+high+in+March http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07042015-Economics-UK-all-sector-PMI-hits-seven-month-high-in-March.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}