Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 06, 2017

China's economy downshifts in Q1 but slowdown unlikely to persist

The upturn in the Chinese economy lost some momentum at the end of the first quarter, but forward-looking indicators suggest that the slowdown is likely to be temporary. March PMI data showed that order book growth remained solid, while business optimism continued to be buoyant. Price pressures meanwhile stayed elevated.

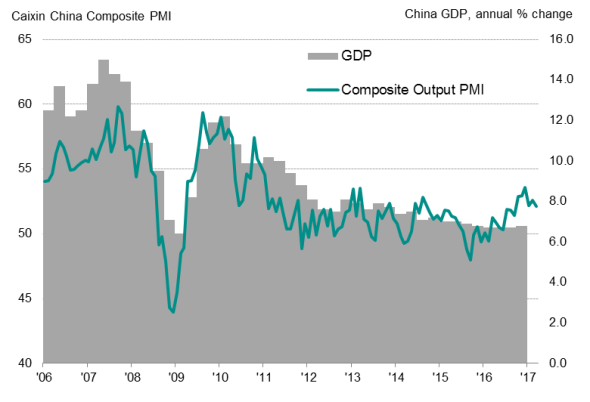

Growth slows but remains strong

The headline Caixin China Composite Output Index, compiled by Markit, fell to a six-month low of 52.1 in March from 52.6 in February. Slower output growth was linked to a deceleration in activity across both manufacturing and service sectors. However, the rate of expansion in both sectors remained robust.

Moreover, the March upturn took the average index reading for the first quarter to 52.3, which is the second-best quarter in four years and reflects improving market conditions.

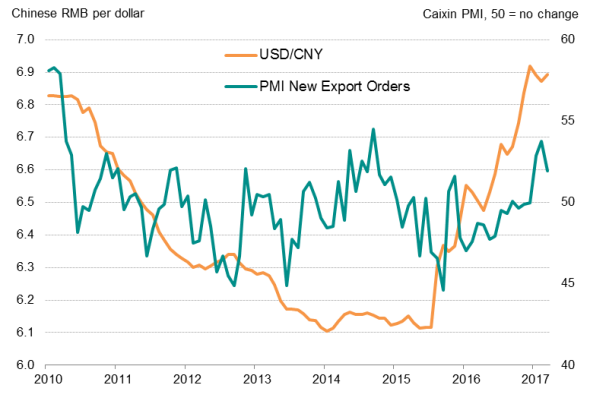

In a further sign that the slowdown in March is likely to be temporary, new order growth for the first quarter rose to a four-year high, with manufacturing export sales returning to growth after more than two years of largely declining, supported by the depreciation in the yuan and strengthening demand in key markets.

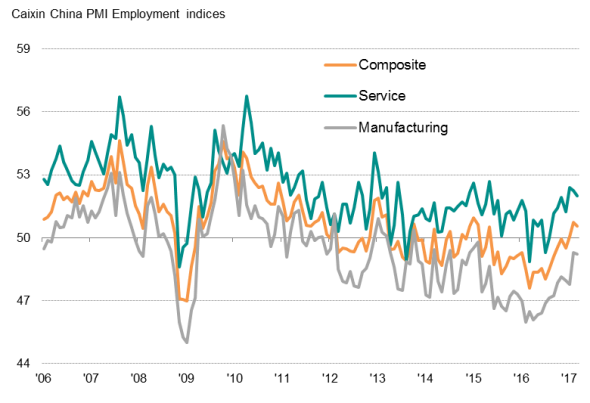

Rising employment and confidence

A strengthening job market underscores the recent health of the economy. Overall employment rose for the second month in a row during March, albeit only slightly, contrasting with job losses seen through much of the past few years. Although job shedding continued to be seen in the manufacturing sector, the rate of decline in factory jobs for the first quarter was the slowest in two years.

China GDP v PMI

Yuan vs export growth

Employment

Furthermore, Chinese manufacturers have become optimistic about future hiring for the first time since June 2015, according to the Markit China Business Outlook survey, suggesting that manufacturing employment may head into growth territory in the months ahead.

Firms' expectations of their output levels in the year ahead also remained upbeat. March PMI data showed the Future Output Index readings for both manufacturing and services remaining above the 2016 average as a whole. Optimism was supported by improving market demand and expansionary government policies.

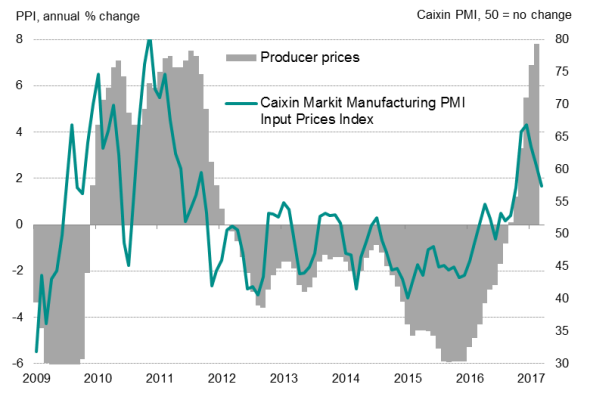

Price pressures remain strong

While there were recent signs of easing inflationary pressures, cost increases nonetheless remained elevated. The rise in input costs slowed for the third successive month during March, but the average PMI input prices index for the first quarter was nevertheless still the second-highest in nearly six years.

Especially strong cost inflation continued to be reported across China's manufacturing industry, with higher costs linked to increased prices for raw materials such as oil and metals.

Meanwhile, prices charged for Chinese products and services rose in tandem with increased costs, reflecting companies' efforts to protect their margins. However, the rate of increase in firms' own selling prices remained below the rise in input costs, suggesting that companies were absorbing part of the higher cost burdens.

Price pressures

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Economics-China-s-economy-downshifts-in-Q1-but-slowdown-unlikely-to-persist.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Economics-China-s-economy-downshifts-in-Q1-but-slowdown-unlikely-to-persist.html&text=China%27s+economy+downshifts+in+Q1+but+slowdown+unlikely+to+persist","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Economics-China-s-economy-downshifts-in-Q1-but-slowdown-unlikely-to-persist.html","enabled":true},{"name":"email","url":"?subject=China's economy downshifts in Q1 but slowdown unlikely to persist&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Economics-China-s-economy-downshifts-in-Q1-but-slowdown-unlikely-to-persist.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%27s+economy+downshifts+in+Q1+but+slowdown+unlikely+to+persist http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042017-Economics-China-s-economy-downshifts-in-Q1-but-slowdown-unlikely-to-persist.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}