Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 05, 2017

UK builders hit by housing and commercial construction slowdowns

UK construction growth slowed in March, according to survey data, following a similar waning of growth in the manufacturing sector. The survey data therefore add to evidence that the economy suffered a weak start to what looks likely to be a challenging year.

Forward-looking indicators are mixed, suggesting firms believe the sluggish start to 2017 will be short-lived: weak near-term signals contrast with improved optimism about the year ahead.

Construction soft spell

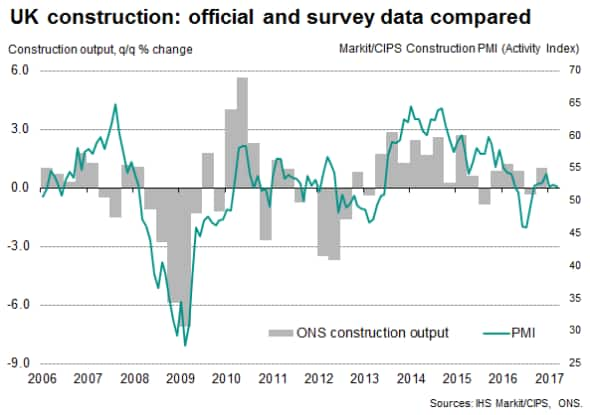

The headline Markit/CIPS UK Construction PMI fell from 52.5 in February to 52.2 in March, its joint-lowest in seven months. At 52.3, the first quarter average is down from 53.2 in the fourth quarter and suggests that the sector will have made a smaller contribution to economic growth than the 1.0% expansion seen at the end of last year.

With the exception of the downturn seen last summer, the recent construction PMI numbers have been the weakest since the second quarter of 2013, underscoring the extent of the current soft patch.

Historical comparisons in fact suggest that the March reading pushes the survey down to level consistent with a near-stagnation of comparable official construction sector output data.

Civil engineering activity was the fastest growing sub-sector again in March, enjoying its second-best month in a year. Commercial activity saw the worst performance, with activity barely rising, though that was an improvement on the decline seen in February.

The broad-stagnation of commercial activity that has been recorded over the first quarter suggests that demand has weakened for fixed-asset investments such as offices, industrial capacity and retail space.

Slowing housing market

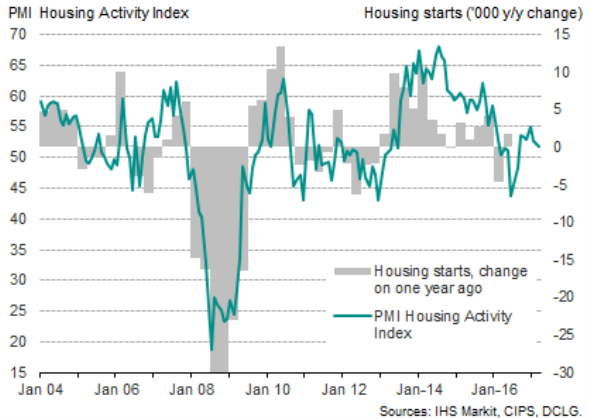

However, perhaps the most marked development has been a significant slowing in housebuilding activity since a peak seen in December.

Historical comparisons of the PMI data against official numbers of new housing starts (the latter being available only with a considerable delay) indicate that the survey data are in fact signalling a stagnation in housing starts when measured on a year-on-year basis.

Cloudy outlook

There's a mixed picture on the outlook from the survey's sub-indices. On the one hand, with the amount of materials bought by construction firms falling slightly, inflows of new work continuing to grow at a sluggish pace and the use of subcontractors back in decline, building activity looks set to remain subdued in the near-term.

On the other hand, builders' expectations about their activity levels in a year's time rose to the second-highest in 15 months, indicating that firms are generally optimistic that the current soft spell will prove short-lived.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-builders-hit-by-housing-and-commercial-construction-slowdowns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-builders-hit-by-housing-and-commercial-construction-slowdowns.html&text=UK+builders+hit+by+housing+and+commercial+construction+slowdowns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-builders-hit-by-housing-and-commercial-construction-slowdowns.html","enabled":true},{"name":"email","url":"?subject=UK builders hit by housing and commercial construction slowdowns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-builders-hit-by-housing-and-commercial-construction-slowdowns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+builders+hit+by+housing+and+commercial+construction+slowdowns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05042017-Economics-UK-builders-hit-by-housing-and-commercial-construction-slowdowns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}