Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 06, 2016

Weak global PMI for March rounds off worst quarter since 2012

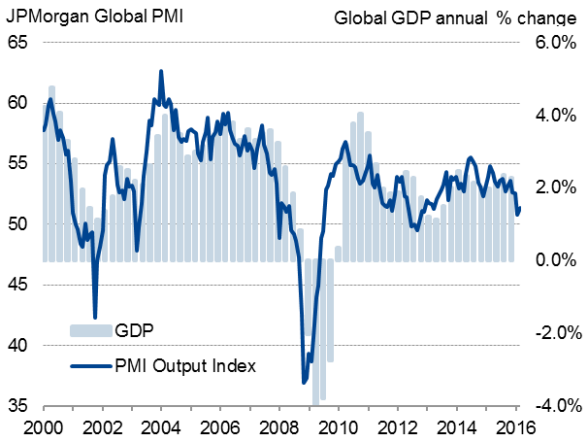

Global economic growth was running at its weakest for over three years in the first quarter, according to PMI data. The JPMorgan Global PMI, compiled by Markit from its worldwide business surveys, rose to 51.3 in March, but the latest reading represented only a minor improvement on February's 40-month low of 50.8. At 51.6, down from 53.1 in the fourth quarter, the average PMI reading for the first three months of the year was the weakest calendar quarter since the end of 2012.

Global economic growth

The PMI is broadly consistent with global GDP rising at a modest annual rate of just over 1% (at market prices) in the first quarter, which is well below the long-run average of 2.3% that has been achieved over the past 18 years.

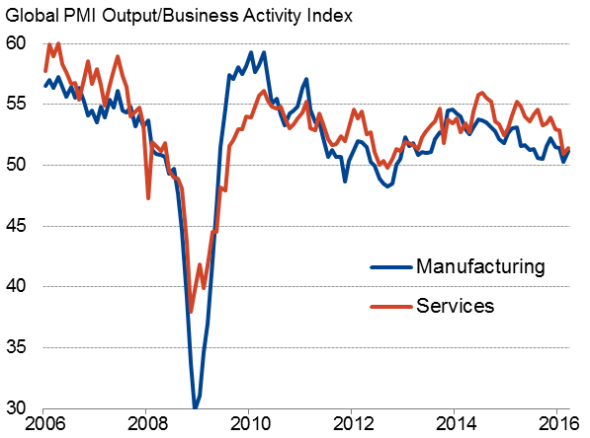

Growth picked up in manufacturing and services, but in both cases the improvement was only marginal compared to the near-stagnation seen in February, highlighting sustained broad-based weakness by sector. The manufacturing data are consistent with worldwide factory output growing at an annual rate of only around 1.5%.

Manufacturing v services

Gloomy outlook

The survey data also suggest growth could deteriorate again in April, as new business rose at the slowest rate since the end of 2012 in March. Employment growth also edged lower to a five-month low, reflecting increased caution among employers to committing to new hires.

Companies' expectations about future business activity in the global services sector also failed to lift higher after slipping to the weakest for over three-and-a-half years in February.

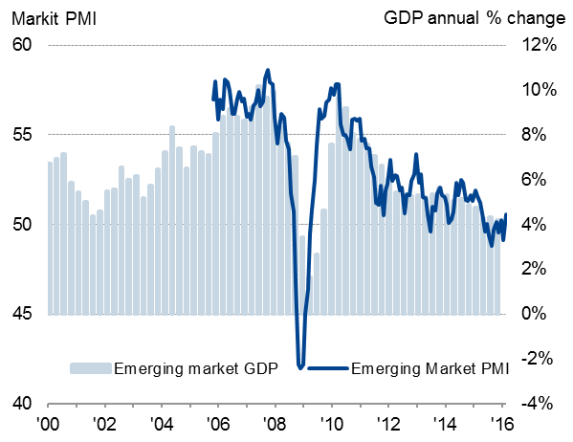

US drags on developed world growth

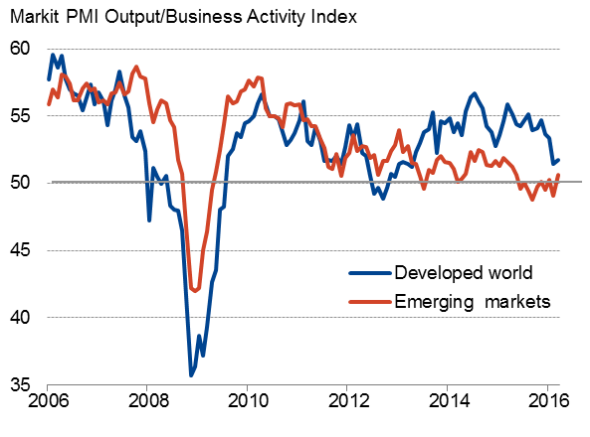

Although composite Emerging Market and Developed World PMIs ticked higher in March, the surveys are consistent with annual GDP growth rates of just less than 1% and 4% respectively in the first quarter.

Developed v emerging markets

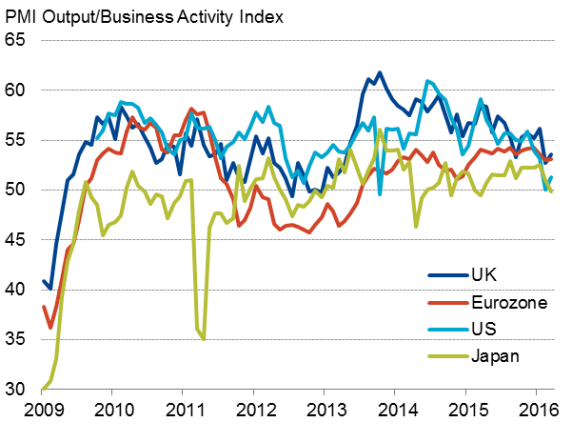

A key development over the past two months has in fact been the extent to which developed world growth has fallen well below rates seen throughout much of the past three years, led by a US slowdown.

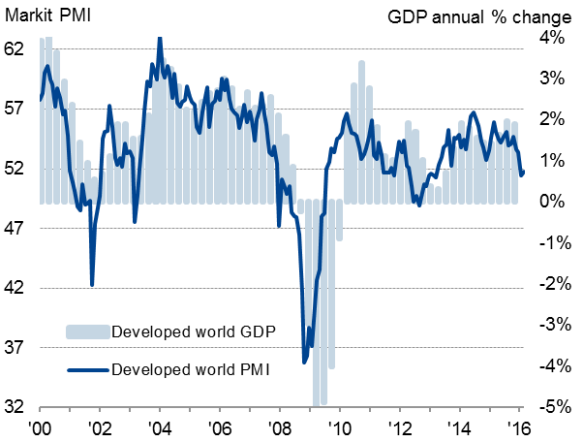

Despite upticks in both the US and UK composite PMIs, in both bases recoveries were only muted, indicating 0.7% and 1.5% annualised growth respectively (or 0.2% and 0.4% quarterly increases). Eurozone growth was meanwhile barely improved on February's 13-month low, suggesting the pace of economic expansion continued to run at 0.3% in the first quarter.

The worst performance among the major developed economies was seen in Japan, however, where the PMIs showed business activity slipping back into decline for the first time in a year. The data clearly indicate a risk of Japan moving back into recession after GDP contracted 0.3% in the fourth quarter.

Developed world

Major developed markets

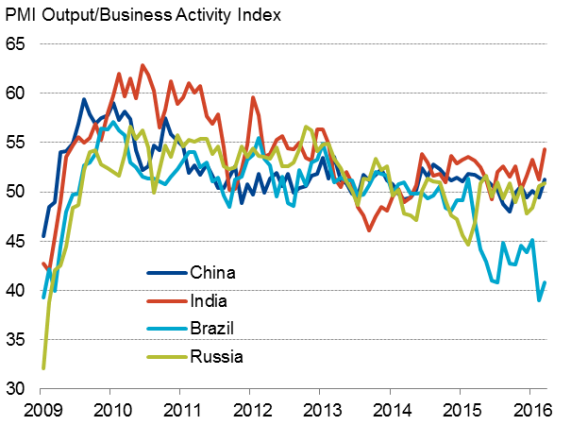

Emerging markets rebound, but weakness highlighted by accelerating job losses

In the largest emerging markets, the March surveys provided tentative signs of malaise lifting, though worries persist, especially in Brazil.

In China, the PMIs signalled the best performance for 11 months. Although only signalling modest growth, the improvement represents a welcome sign of renewed life after the declines seen in five of the past seven months.

Marginal growth (a six-month high) was likewise seen in Russia for a second successive month, suggesting the economy could be stabilising, though falling exports continued to weigh on the economy.

Even Brazil saw an easing in the record pace of decline experienced in February, although the rate of contraction remained one of the most severe ever recorded by the survey.

It was India, however, which saw the best improvement and the strongest rate of growth among the emerging markets, with the manufacturing and services surveys collectively indicating the strongest expansion for over three years.

Uncertain outlook

It's unclear as to the extent to which emerging market growth might continue to recover, however, as staffing levels fell at the steepest rate since March 2009 (contrasting with steady hiring in the developed world), suggesting consumer morale will remain subdued.

The fastest rate of job losses for seven years in China was accompanied by a drop in employment in Brazil which nearly equalled Februarys' record decline. Ongoing job shedding in Russia left India as the only one of the BRIC's to see net job creation, and even here the increase was only marginal.

Emerging markets

Major emerging markets

Sources for all charts: Markit, JPMorgan, Caixin, Nikkei

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-weak-global-pmi-for-march-rounds-off-worst-quarter-since-2012.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-weak-global-pmi-for-march-rounds-off-worst-quarter-since-2012.html&text=Weak+global+PMI+for+March+rounds+off+worst+quarter+since+2012","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-weak-global-pmi-for-march-rounds-off-worst-quarter-since-2012.html","enabled":true},{"name":"email","url":"?subject=Weak global PMI for March rounds off worst quarter since 2012&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-weak-global-pmi-for-march-rounds-off-worst-quarter-since-2012.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weak+global+PMI+for+March+rounds+off+worst+quarter+since+2012 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06042016-economics-weak-global-pmi-for-march-rounds-off-worst-quarter-since-2012.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}