Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2015

German "all-sector' PMI signals positive start to New Year

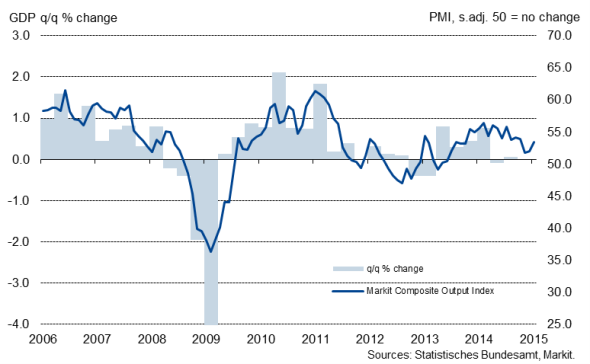

Germany's all-sector PMI (a GDP-weighted average of the three surveys' output measures) rose from December's 51.9 to 53.3 in January, thereby signalling an acceleration in output growth in the country's private sector. The data point to a welcome pick-up in economic growth at the start of 2015, after GDP failed to show any meaningful expansion since the first quarter of last year, according to the latest data.

German economic growth and the PMI

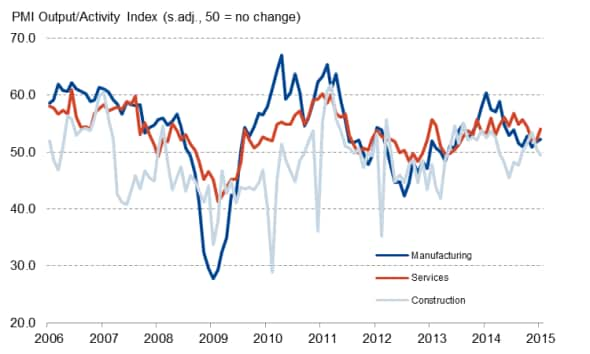

While the PMI reached a three-month high in January, it remained below the average of 54.2 for 2014 as whole. As has been the case since the middle of last year, Germany's service sector led the upturn in January, but manufacturing growth also accelerated from its recent low. However, construction output fell in January for the first time since August of last year.

Business activity by sector

Source: Markit.

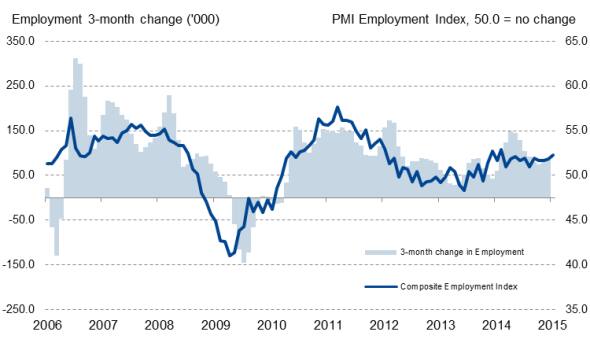

Solid employment growth maintained

Despite the introduction of a national minimum wage at the beginning of the year, German private sector employment rose further in January. The PMI surveys showed that the rate of job creation quickened to the fastest in nearly a year as a renewed upturn in new business for the first time in three months encouraged companies to take on additional workers.

Official data meanwhile showed the jobless rate falling to a record low of 6.5% in December, and looks set to fall further. Employment rose by an average of 34,000 a month last year and survey data suggest that an even stronger gain will be seen in the New Year.

Employment

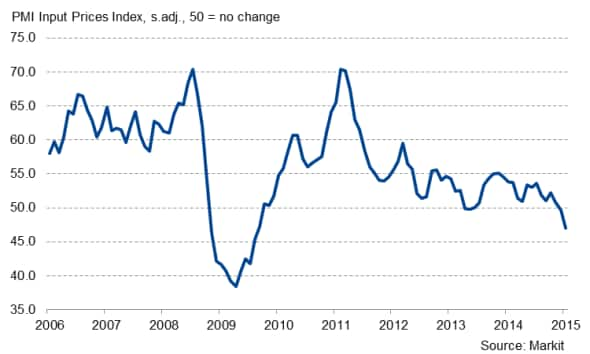

Costs fall at sharpest rate since 2009

Lower oil prices meanwhile led to lower costs for energy, transportation and a number of oil by-products.

The PMI Input Prices Index consequently fell to its lowest level since August 2009 and companies lowered their charges for the third time in the past four months.

PMI Input Prices Index

Lower prices and reduced fuel costs should help boost household spending in the coming months. Markit's Retail PMI, for example, signalled the fourth successive monthly rise in retail sales in January and also found that companies expect sales to exceed plans in February.

However, while a weak euro exchange rate is likely to boost exports, it also increases the price of imported goods and raw materials, offsetting some of the benefits of lower oil prices on domestic demand, especially if the euro continues to depreciate against the dollar.

Service sector drives growth upturn

The upturn in economic growth in January was largely driven by increased activity in the service sector, while output growth in the manufacturing sector remained well below levels seen at the beginning of last year, despite reaching a three-month high.

Manufacturers reported a second consecutive monthly rise in new business in January, following contraction between September and November of last year. However, the rate of growth in new work was subdued, as weak export demand, especially from Russian and Asian markets, acted as a barrier on stronger growth. The following months will show whether the ongoing crisis in Russia and subdued growth in some of Germany's main trading markets will continue to weigh on new export orders or whether a weak euro will help boost foreign demand.

Official data confirm the survey signals of improvement in Germany's manufacturing sector. Today's release of factory orders data for December showed a rebound in demand from November's 2.4% decline. Destatis reported that industrial orders rose 4.2% on the month, which means orders in the fourth quarter as whole were 1.9% higher compared to the third quarter. This represents the largest rise since the final quarter of 2013.

Service sector activity growth meanwhile accelerated and was only marginally below the average for 2014 as a whole. New orders returned to growth and services sector business optimism hit a 45-month high, with companies already feeling the benefit of a strengthening economy.

The fly in the ointment in January's results was the first fall in construction output since August of last year, but this may prove temporary as companies linked the downturn to adverse weather conditions.

Positive outlook for first quarter GDP growth

A picture of a strengthening German economy at the start of the year is also painted by other surveys. The Ifo's Business Climate Index hit a six-month high in January and the ZEW's Economic Sentiment Index reached its highest level since February of last year. Moreover, the Dax recently traded at an all-time high.

Furthermore, the announcement of full-scale quantitative easing by the ECB should also help boost business and consumer confidence.

We therefore expect economic growth to pick up in the first quarter from the subdued pace that we've seen throughout much of last year.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-German-all-sector-PMI-signals-positive-start-to-New-Year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-German-all-sector-PMI-signals-positive-start-to-New-Year.html&text=German+%22all-sector%27+PMI+signals+positive+start+to+New+Year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-German-all-sector-PMI-signals-positive-start-to-New-Year.html","enabled":true},{"name":"email","url":"?subject=German "all-sector' PMI signals positive start to New Year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-German-all-sector-PMI-signals-positive-start-to-New-Year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+%22all-sector%27+PMI+signals+positive+start+to+New+Year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-German-all-sector-PMI-signals-positive-start-to-New-Year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}