Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 04, 2015

UK "all-sector' PMI shows economy picking up speed again at start of the year

PMI" survey data signalled a reassuringly robust start to the year for the UK economy, leaving open the possibility of interest rates starting to rise in late 2015.

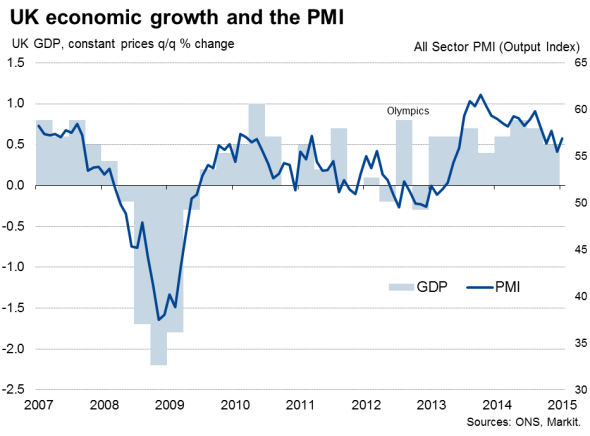

The three PMI surveys collectively indicated an acceleration of output growth from December's 19-month low. The headline index (a GDP-weighted average of the three surveys' output measures) rose from 55.5 to 56.9. The latest reading was slightly higher than the average of 56.5 recorded over the fourth quarter as a whole, and is consistent with GDP growing at a quarterly rate of just over 0.5% at the start of the year.

Business activity by sector

The upturn in the PMI, and its elevated level by historical standards (the long-run average is 54.1), gives reassurance that the UK economy is not slowing sharply but has merely seen its growth rate cool during the winter months from an unusually strong rate earlier last year to a more sustainable pace. The current rate of growth is close to the economy's long-term annual trend rate of roughly 2.5%.

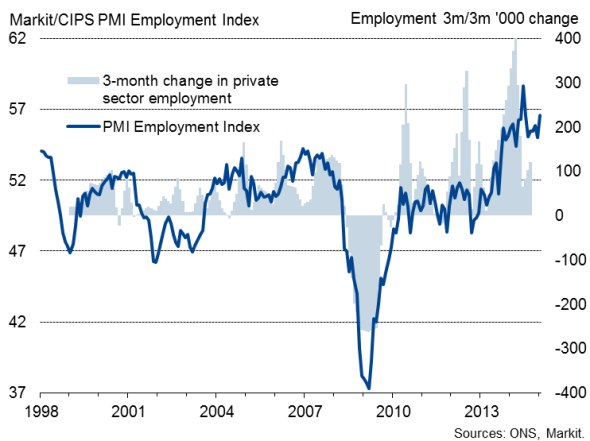

Job creation near record high as costs fall

Even more encouraging is the upturn in employment growth seen in January. The three surveys collectively signalled the strongest rate of job creation seen since comparable data were first available back in 1998 with the sole exception of the jump in hiring seen last June. The surveys are currently signalling a net rate of job creation of approximately 70,000 per month.

Input costs meanwhile rose at the slowest rate since the height of the financial crisis in July 2009. Manufacturing costs dropped sharply, linked mainly to lower oil and other commodity prices, while rates of input cost inflation in construction and services both slowed markedly, again commonly linked to lower oil, fuel and transport prices.

Employment

2015 rate hike still on the table

Policymakers will be reassured by the signs of the economy having enjoyed a robust start to the year, but with inflation falling to 0.5% in January there seems little likelihood of the Monetary Policy Committee voting to hike interest rates any time soon. If wage growth picks up further, some members may begin to worry about the medium-term inflation outlook, but it will take some months for any such wage pressures to appear in the official data, and even then the hawkish policymakers are likely to remain in the minority for some time, leaving early-2016 as still the most likely time for the first rate hike. That said, January's PMI data mean the possibility of a hike in November 2015 very much remains on the table.

Service sector dependence

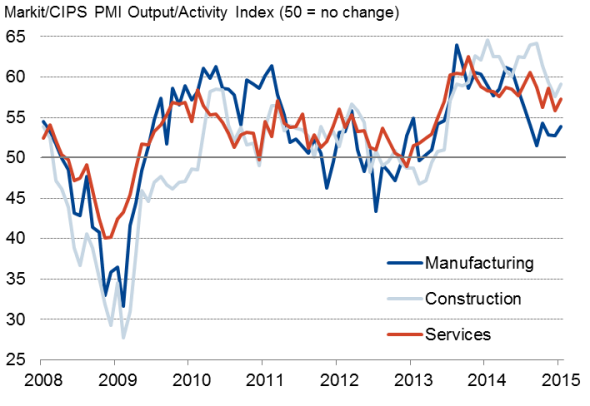

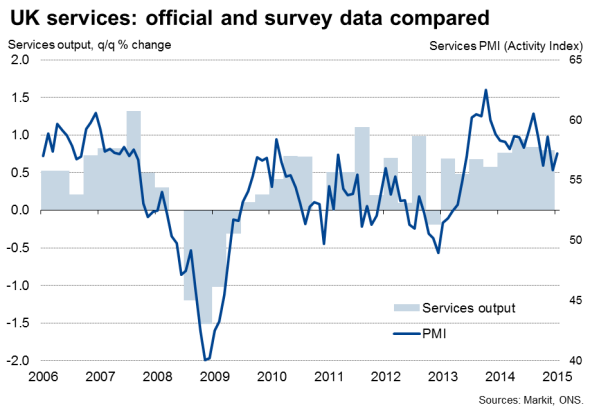

In the detail, growth picked up in services, manufacturing and construction in January, but it's clear from the surveys that the economy remains dependent on the vast service sector to sustain even the more subdued growth rate seen in recent months.

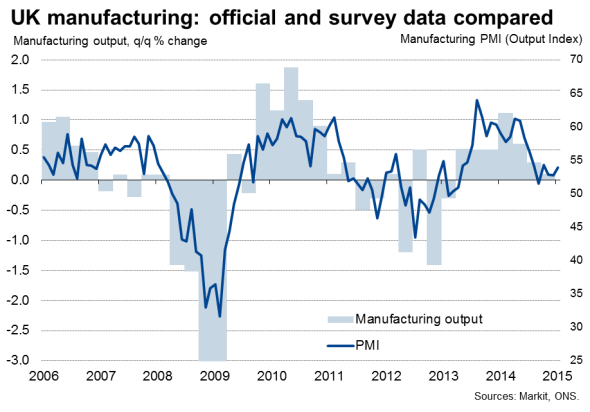

Manufacturing output grew only modestly, suggesting the first quarter may only see a slight improvement in the 0.1% pace of expansion in the final quarter of last year unless the sector picks up steam in coming months. Both the survey and official data presented a consistent picture of the manufacturing economy slowing sharply over the course of last year, subdued in part by weakened trade to the struggling euro area.

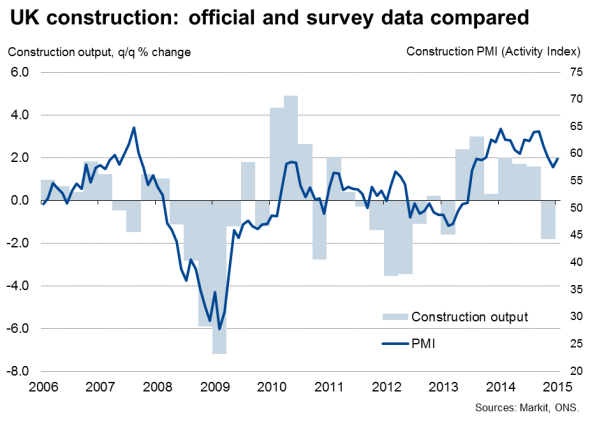

Construction companies participating in the PMI survey reported that they continued to fare well in January, contrasting with the downbeat picture painted by the official data, which showed output of the sector falling 1.8% in the fourth quarter. However, the official data have been volatile lately, and subject to substantial revision. We therefore expect the official data to be revised higher, and on course to show an expansion of 1-2% in both Q4 2014 and first quarter of 2015. However, with construction only accounting for 6% of the economy, this performance will do little to power a wider economic upturn.

The main driver of the economy therefore remains the service sector, which accounts for around three-quarters of GDP and which expanded by 0.8% in the fourth quarter. The PMI data so far point to only a modest slowing in the first quarter to 0.7%. Service sector companies are being buoyed by rising consumer demand, linked to rising wages and lower inflation (household optimism about future finances hit a post-crisis high in January).

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-UK-all-sector-PMI-shows-economy-picking-up-speed-again-at-start-of-the-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-UK-all-sector-PMI-shows-economy-picking-up-speed-again-at-start-of-the-year.html&text=UK+%22all-sector%27+PMI+shows+economy+picking+up+speed+again+at+start+of+the+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-UK-all-sector-PMI-shows-economy-picking-up-speed-again-at-start-of-the-year.html","enabled":true},{"name":"email","url":"?subject=UK "all-sector' PMI shows economy picking up speed again at start of the year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-UK-all-sector-PMI-shows-economy-picking-up-speed-again-at-start-of-the-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+%22all-sector%27+PMI+shows+economy+picking+up+speed+again+at+start+of+the+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022015-Economics-UK-all-sector-PMI-shows-economy-picking-up-speed-again-at-start-of-the-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}