Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2015

Ireland sees solid start to 2015 and record low borrowing costs

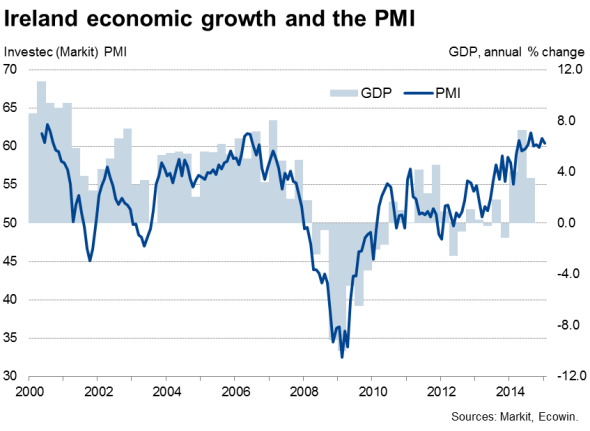

Ireland's economic growth rate hit a nine-year high in 2014, according to the central bank, and PMI data paint a buoyant picture at the outset of 2015, boding well for another year of economic recovery.

Ireland's central bank estimates that gross domestic product rose 5.1% in 2014, and also expects a 3.7% rise in 2015. The 2015 expansion should return the Irish economy to its pre-crisis peak. As of the third quarter of last year, GDP was still 3.8% below the high recorded in the final quarter of 2007, having reclaimed around two-thirds of the 10.7% drop in GDP seen during the financial crisis.

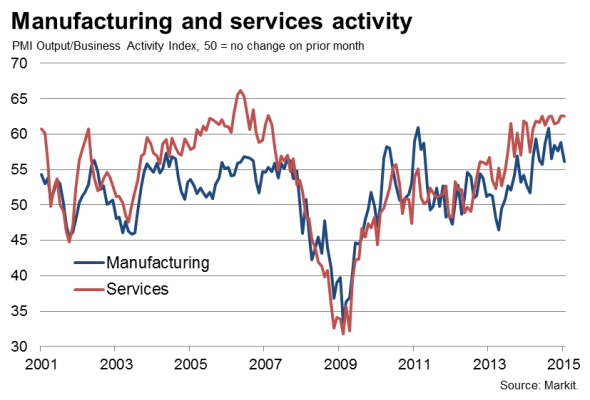

The central bank's optimism for 2015 is supported by the first batch of survey data for 2015. The Investec PMI, produced by Markit, showed the output of the combined manufacturing and service sectors growing at one the strongest rates seen since the financial crisis, building on the growth surge recorded by the survey data throughout much of 2014. The service sector was once again the main driver of growth but was supported by a solid expansion of the manufacturing sector. Although growth of factory output waned in January, the sector continued to expand at a strong pace, buoyed by yet another month of encouragingly upbeat export order inflows.

Growth in the service sector has been driven to a large extent by rising consumer spending at home as the labour market improved in 2014. This trend looks set to continue, as the January PMI surveys showed a further month of strong job creation, which held close to the survey highs seen late last year.

Consumer spending should also be boosted by falling oil and fuel costs, and lower inflation. Companies reported a marginal fall in prices charged for goods and services in January, linked to the smallest rise in firms' costs for a year and a half.

Record low borrowing costs

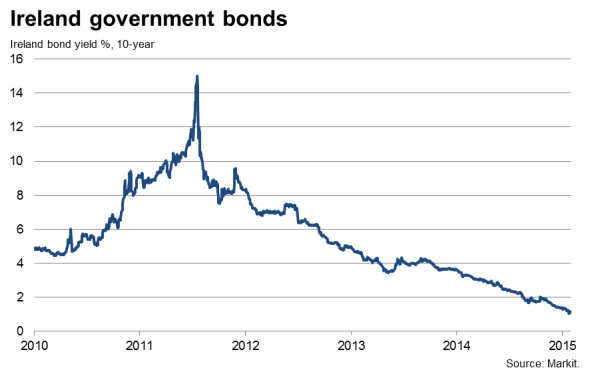

Prospects for 2015 have also improved following the announcement of full-scale quantitative easing by the ECB, to commence in March to the tune of €60bn per month.

The controversial move by the ECB (as the QE will also include government debt purchases) helped push equity prices higher and government borrowing costs lower. The combination of QE and Ireland's improved economic prospects have driven the yield on Ireland's 10-year bonds, which move inversely to prices, to record lows in recent sessions. Ireland can now borrow at just over 1.1% over 10 years, according to Markit data. That compares favourably with 1.5% for Spain, 2.4% for Portugal and 1.6% for Italy.

Ireland has taken advantage of the drop in borrowing costs, embarking on its first ever sale of 30-year bonds in early February. Ireland sold €4bn of debt due in 2045 at a yield of just over 2%.

The drop in yields contrasts sharply with the height of the region's debt crises in 2011 when, amid fears of the collapse of the currency union, the yield on 10-year Irish debt hit 15%.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-Ireland-sees-solid-start-to-2015-and-record-low-borrowing-costs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-Ireland-sees-solid-start-to-2015-and-record-low-borrowing-costs.html&text=Ireland+sees+solid+start+to+2015+and+record+low+borrowing+costs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-Ireland-sees-solid-start-to-2015-and-record-low-borrowing-costs.html","enabled":true},{"name":"email","url":"?subject=Ireland sees solid start to 2015 and record low borrowing costs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-Ireland-sees-solid-start-to-2015-and-record-low-borrowing-costs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ireland+sees+solid+start+to+2015+and+record+low+borrowing+costs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05022015-Economics-Ireland-sees-solid-start-to-2015-and-record-low-borrowing-costs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}