Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 04, 2015

US economy's strength highlighted as unemployment rate hits 7" year low

A mixed report on the health of the US labour market gives frustratingly little new insight into whether the Fed will start to hike rates. The report has been one of the most eagerly awaited so far this year, as it provides a last-minute steer to policymakers mulling over whether to hike interest rates at the FOMC's 16-17 September meeting.

A bumper payrolls number would have sealed the case for higher interest rates in many people's minds, while a low number would have dealt a blow to any chances of tightening of policy at the next meeting. Instead, we had something in the middle. Dig deeper and the labour market report should in fact add to rate rise odds, but recent financial market volatility and growth jitters in China mean it would be seen by many to be a risky move to start hiking rates any time soon.

Job creation and unemployment

Payrolls miss expectations

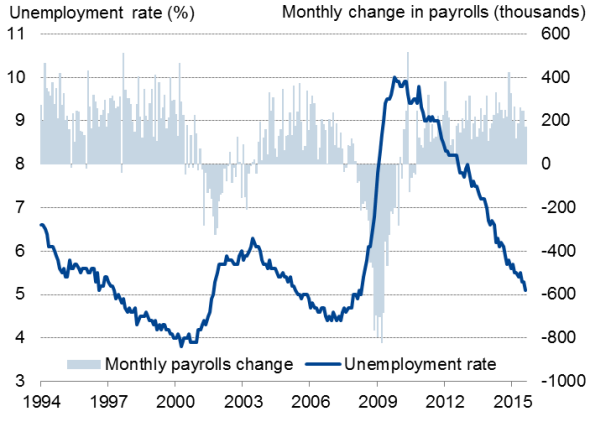

The 173,000 rise in non-farm payrolls fell short of expectations of a 218,000 rise, but should be seen as a solid enough number to reassure that the labour market remains in good health. With PMI data pointing to a 225,000 increase, we also have some confidence that the number will be revised higher in future releases (the August figure is especially revision-prone, initially coming in weaker than the final numbers). Note also that July's figure was revised higher to show a 245,000 gain. The message should be that the rate of job creation remains strong, at around the 200,000 per month level, which is double the rate required to keep up with population growth.

The revision-prone payroll count is therefore certainly not weak enough on its own to justify not hiking rates, especially given other positive data included in the report.

Unemployment drop

The clincher for a September hike may be the drop in the unemployment rate to a near seven-and-a-half year low of 5.1%, down from 5.3% in July and below the consensus of a drop to 5.2%. By most people's measures, including the Fed's, this represents full-employment. The broader measures of joblessness, which includes people who would like to work more than they are currently doing, likewise fell, down from 10.4% to 10.3% and its lowest since mid-2008.

Subdued wage growth

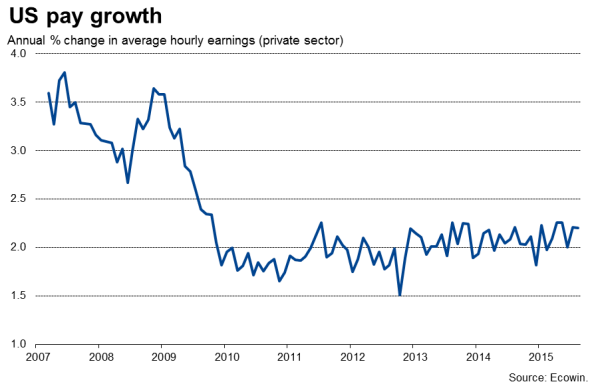

With the labour market at, or approaching full employment and the economy continuing to show robust job-creating growth, it seems only a matter of time before wages respond to the tightening labour market. Hence the growing nervousness among policymakers that "a stitch in time saves nine', and that it's better to start nudging interest rates up gradually as soon as possible rather than risk a steeper, more aggressive, pace of tightening later.

An upwardly revised 3.7% annual rate of growth of GDP in the second quarter is likely to be followed by a 2.5% expansion in the third quarter, according to survey data.

The number that the doves will focus on, however, is the still disappointing wage growth, which showed pay rising at a meagre annual rate of 2.2%. This raises questions as to whether 5% really does still reflect full employment, or whether the economy mas more capacity to use up before inflation ignites. Even excluding any potential uplift in wage growth, inflation is likely to remain benign due to low commodity prices (especially oil) and the strong dollar.

Volatility blurs the picture

Matters are of course also blurred by the current volatility in the financial markets and the deteriorating picture in China, where the latest PMI survey data show the economy contracting at the steepest rate for six-and-a-half years.

Irrespective of whether or not the US economy is in a healthy enough state to withstand higher interest rates, the policymaking decision may well therefore be dominated by worries about the potential impact of any imminent hike in rates on the wider global economy and the financial markets. A September policy decision could still very much go either way in terms of hiking or holding rates, but the most likely scenario is one where the Fed waits a little longer in the light of recent economic and financial market instability, instead merely testing financial market reactions with rhetoric that a rate rise is increasingly imminent.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-US-economy-s-strength-highlighted-as-unemployment-rate-hits-7-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-US-economy-s-strength-highlighted-as-unemployment-rate-hits-7-year-low.html&text=US+economy%27s+strength+highlighted+as+unemployment+rate+hits+7%22+year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-US-economy-s-strength-highlighted-as-unemployment-rate-hits-7-year-low.html","enabled":true},{"name":"email","url":"?subject=US economy's strength highlighted as unemployment rate hits 7" year low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-US-economy-s-strength-highlighted-as-unemployment-rate-hits-7-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy%27s+strength+highlighted+as+unemployment+rate+hits+7%22+year+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-US-economy-s-strength-highlighted-as-unemployment-rate-hits-7-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}