Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 04, 2015

German PMI rises to five-month high and signals further GDP growth in Q3

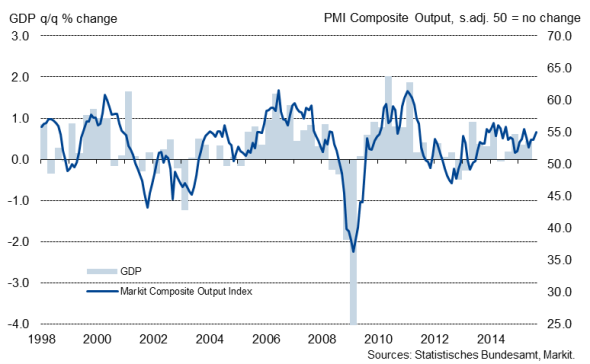

Germany’s ‘all-sector’ PMI (a GDP-weighted average of the three surveys’ output measures) rose from July’s 53.6 to 54.7 in August, thereby signalling an acceleration in output growth in Germany’s private sector. The data point to further solid economic growth of 0.5% in the third quarter, after GDP rose 0.4% in the second quarter.

While the PMI reached a five-month high in August, with manufacturing and services expanding at healthy rates, Germany’s construction sector remained stuck in a low gear. However, the outlook for Q3 is bright, with both survey and exchange-traded funds data sending positive signals.

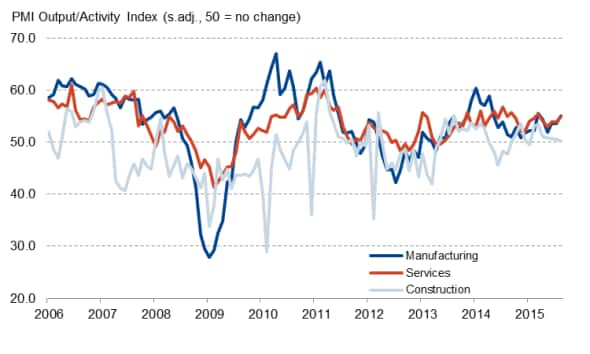

PMI Output/ Activity Index

Manufacturing growth accelerates, service sector remains strong

German manufacturing struggled in the second quarter of the year, with official data showing that industrial production rose a mere 0.1% in the three months to June, following a 0.5% increase in Q1.

Encouragingly, Germany’s goods-producing sector showed some signs of renewed life in August, with the headline manufacturing PMI rising to a 16-month high. Companies enjoyed a combination of rising new business from both the domestic and foreign markets, partly driven by increased demand from the Middle East and the US. The business survey had previously signalled only marginal growth in the sector in the second quarter.

The data furthermore suggest that growth should be maintained, at least in the short term. Manufacturers reported the strongest inflow of new orders for nearly one-and-a-half years and accumulated backlogs of uncompleted work at the fastest pace since February 2014. Moreover, goods producers were encouraged to further add to their payrolls, with the rate of job creation in the sector hitting a 43-month high.

Meanwhile, Germany’s mighty services sector, which accounts for roughly two-thirds of GDP, remained in good shape in August. Markit’s PMI highlighted a particularly strong performance among hotels and restaurants, likely a result of good weather and above-average temperatures.

Moreover, consumers kept their purse strings open in August, as highlighted by a further rise in retail sales. Despite dropping from July’s recent high, the headline Retail PMI index still pointed to a robust rise in German retail sales, with consumers benefitting from discount sales. Data from German Statistics body Destatis showed that retail sales rose 1.4% in July, supporting signals sent by the PMI that consumers are in spending mode.

Construction edges closer to stagnation

While manufacturers, service providers and retailers enjoyed solid summer growth, Germany’s construction sector remains stuck in a low gear, with the headline PMI holding only fractionally above the neutral 50.0 threshold in August, at 50.3. This was the lowest reading since January and indicative of a near-stagnation in construction output. Growth looks less and less sustainable, as building firms reported a further sharp drop in civil engineering activity and a lack of incoming new work.

Official data from the Destatis showed that gross fixed capital formation in construction fell 1.2% in Q2, acting as a drag on stronger GDP growth. Survey data available for the third quarter so far suggest that the sector is unlikely to have a positive effect on economic growth.

Positive outlook for third quarter GDP

Despite the weak performance of the construction sector, the German economy looks set to expand further in Q3, with the information available so far pointing a quarterly GDP rise of 0.5%. A picture of a strengthening German economy is also painted by other surveys. The Ifo’s Business Climate Index reached a three-month high in August and the ZEW’s Current Conditions Index rose to its highest level since April.

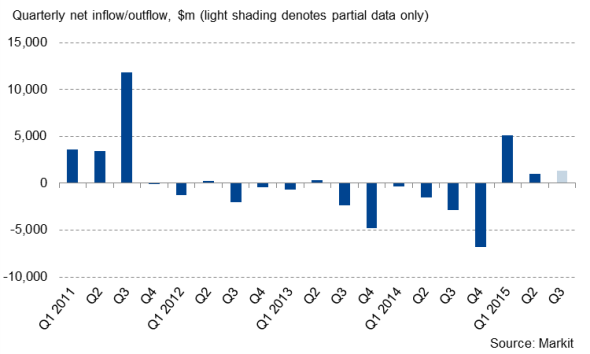

Moreover, investor sentiment continues to improve, as highlighted by our exchange-traded funds (ETF) data. ETFs exposed to Germany have seen net inflows of $1.4 billion in the third quarter so far, following increases in each of the previous two quarters.

Exchange-traded funds provide investors with easy, liquid exposure to various markets. Fund flows consequently provide a valuable and timely insight into how investor appetite towards different markets is changing.

Germany-exposed ETF flows (quarterly)

Based on the information available for the third quarter so far, we should expect a further rise in gross domestic product. It looks like positive contributions will come mainly from consumers and the goods-producing and service sectors. Germany’s building sector is unlikely to contribute to economic growth, however.

German GDP growth and the PMI

Oliver Kolodseike | Economist, IHS Markit

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-German-PMI-rises-to-five-month-high-and-signals-further-GDP-growth-in-Q3.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-German-PMI-rises-to-five-month-high-and-signals-further-GDP-growth-in-Q3.html&text=German+PMI+rises+to+five-month+high+and+signals+further+GDP+growth+in+Q3","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-German-PMI-rises-to-five-month-high-and-signals-further-GDP-growth-in-Q3.html","enabled":true},{"name":"email","url":"?subject=German PMI rises to five-month high and signals further GDP growth in Q3&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-German-PMI-rises-to-five-month-high-and-signals-further-GDP-growth-in-Q3.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+PMI+rises+to+five-month+high+and+signals+further+GDP+growth+in+Q3 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Economics-German-PMI-rises-to-five-month-high-and-signals-further-GDP-growth-in-Q3.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}