Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 04, 2017

China PMI surveys signal weakest growth for ten months at start of Q2

The upturn in China's economy lost further momentum at the start of the second quarter. Business activity growth slowed further from December's recent peak in April, while hiring fell for the first time this year. Moreover, there were some indications to suggest that growth could decelerate further in coming months.

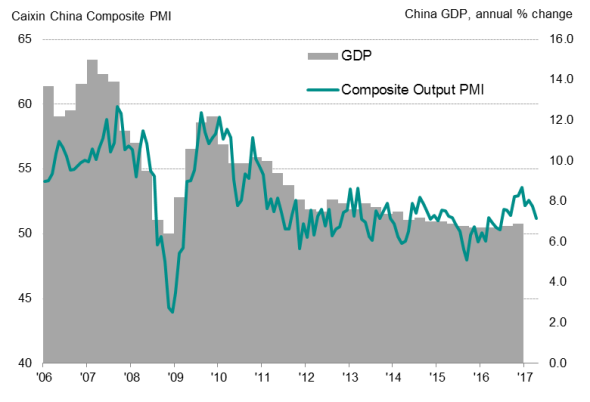

Caixin China PMI and GDP

Weaker growth

At 51.2 in April, down from 52.1 in March, the seasonally adjusted Caixin China Composite Output Index signalled a further slowdown in output growth. The latest reading indicated the weakest pace of expansion since June 2016.

The easing in growth during April reflected a further loss of momentum in both manufacturing and service sectors. Production growth across the manufacturing sector decelerated to the slowest since September 2016, fuelled in part by a softer expansion of new export orders. The services economy meanwhile recorded the slowest rate of growth in 11 months.

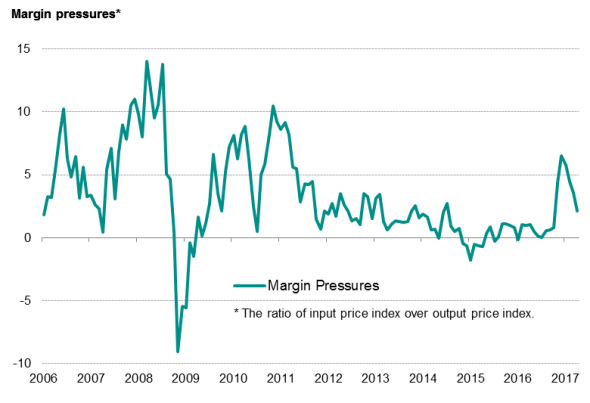

Pressure on operating margins

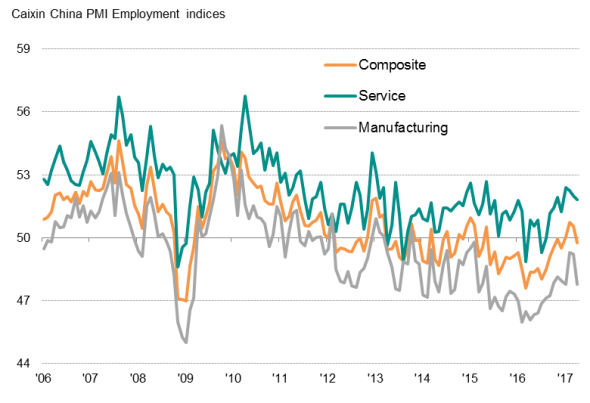

Job cuts and inflation

The slowdown in total business activity has fed through to the labour market. After two months of marginal gains, overall employment fell in April, albeit only slightly. A combination of a pick-up in manufacturing job shedding and another step-down in the pace of hiring in the service sector was recorded.

Facing an ongoing squeeze on operating margins in recent months, PMI data indicate that Chinese manufacturers initiated cost-cutting measures through reducing staff numbers. That said, the surveys signalled a further moderation in inflation rates during April. Input cost pressures continued to ease from the peaks seen in recent months, with composite input price inflation down to the lowest since September 2016.

Softer input price inflation allowed Chinese firms to increase their charges only modestly, and at the slowest pace since August 2016. As a corollary, margin pressures, which are measured as the difference between input prices and output prices, have eased from the near six-year record seen in December, reaching the lowest in six months at the start of the second quarter.

Employment

Sources: IHS Markit, Caixin, Datastream.

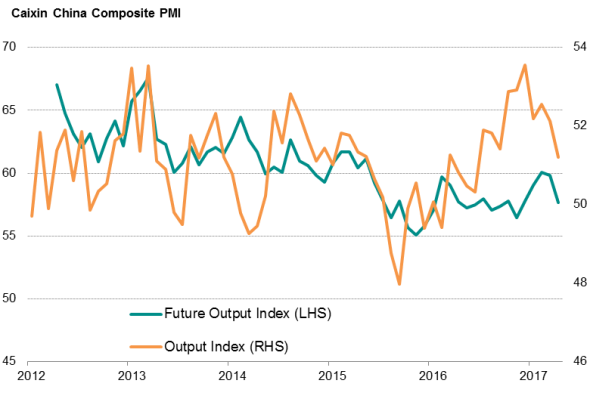

Clouded outlook

While companies indicate that the economy remains on a stable growth footing, there are some worrying signs that the recent slowdown could persist in coming months. First, inflows of new business softened further in April, growing at the weakest rate in seven months. Second, the renewed drop in employment suggests firms are cautious about the outlook. Finally, business optimism about the year ahead moderated to the lowest level in 2017 to date. In fact, the latest Future Output Index reading remained below its historical average.

Lower optimism

Sources: IHS Markit, Caixin,

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-China-PMI-surveys-signal-weakest-growth-for-ten-months-at-start-of-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-China-PMI-surveys-signal-weakest-growth-for-ten-months-at-start-of-Q2.html&text=China+PMI+surveys+signal+weakest+growth+for+ten+months+at+start+of+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-China-PMI-surveys-signal-weakest-growth-for-ten-months-at-start-of-Q2.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys signal weakest growth for ten months at start of Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-China-PMI-surveys-signal-weakest-growth-for-ten-months-at-start-of-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+signal+weakest+growth+for+ten+months+at+start+of+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-China-PMI-surveys-signal-weakest-growth-for-ten-months-at-start-of-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}