Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 04, 2017

Eurozone starts second quarter with PMI at six-year high

The final PMI data for April add to a developing picture of a eurozone economy that is enjoying a strong start to 2017. The headline PMI came in at 56.8, its highest since April 2011.

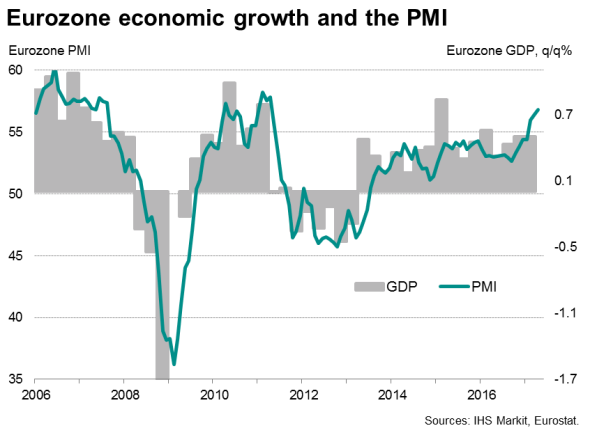

The PMI numbers come on the heels of official data that confirmed the robust pace economic growth at the start of 2017. At 0.5%, the rate of expansion recorded by Eurostat's flash estimate of first quarter GDP is slightly below that indicated by the PMI, suggesting the final figures could be revised higher, perhaps to 0.6%.

More importantly, the fact that the PMI signals a further upturn in momentum in April suggests that second quarter GDP growth could be even stronger. Historical comparisons suggest that the April Eurozone PMI is consistent with a GDP growth rate of 0.7%.

The PMI strength suggests there's potentially significant upside risk to IHS Markit's current forecast of a mere 0.3% GDP rise in the second quarter.

Narrowing growth differentials

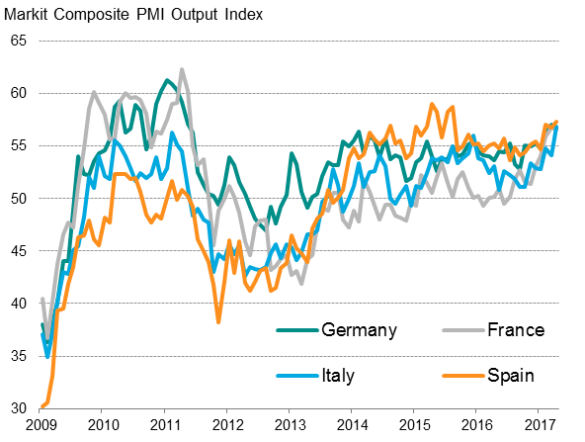

While there is no detail yet in the official growth numbers, the PMI data depict an upturn that has not only gained strength but has also become increasingly broad-based.

Similar 0.7% rates of economic growth were signalled for both Germany and France. Even faster GDP gains are being indicated in Spain and Ireland, while Italy saw a sharp pick-up in its rate of output growth to a near ten-year high. The spread between the headline PMI readings for Germany, France and Italy was in fact the joint-lowest in the euro area survey history.

Strong growth in all big-four euro nations

Elevated price indices

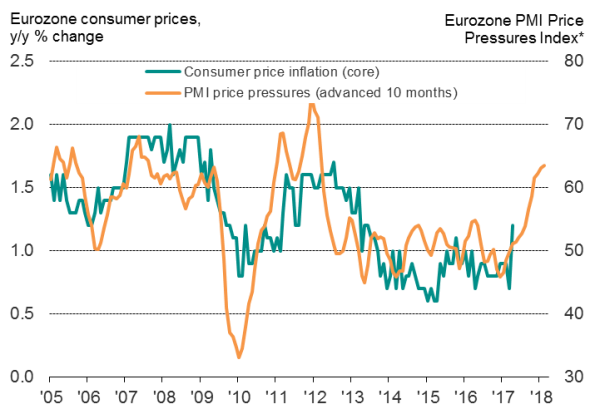

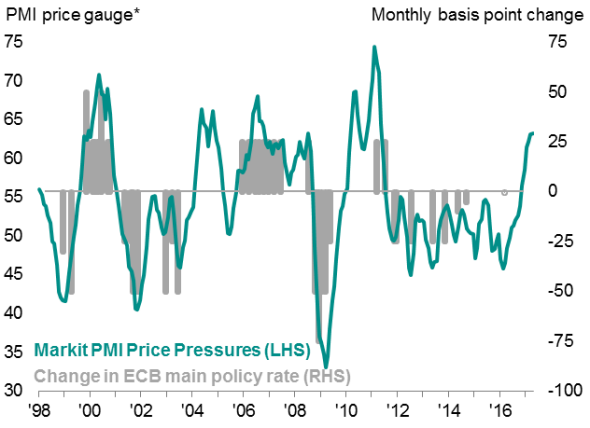

Price pressures meanwhile remained elevated, and the survey's price indices suggest that core inflation will trend higher in coming months.

Rising global commodity prices, the weak euro and tightening supply chains all contributed to higher input cost inflation, which average selling prices rose at a pace close to March's near six-year high.

Eurozone inflation

* Based on input prices and supplier delivery times indices

Strong labour market adds to upbeat tone

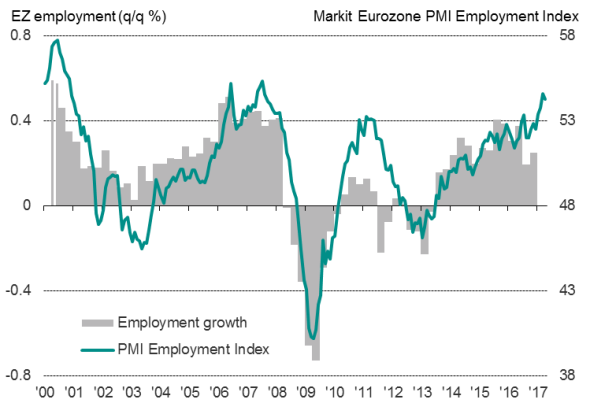

The upturn is also continuing to be accompanied by a stronger labour market, which should in turn help boost consumer spending. Employment rose across the region again in April as firms expanded capacity. Although the rate of job creation slowed slightly, it was still one of the best seen over the past decade.

Eurozone employment

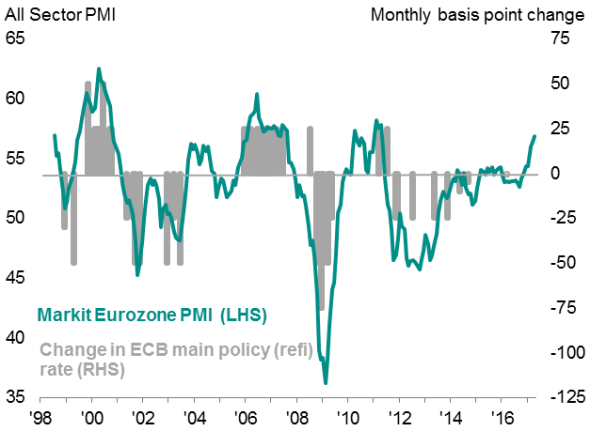

The encouraging picture from the survey data is likely to help raise many forecasters' expectations of eurozone economic growth in 2017, and will also no doubt add to speculation that ECB rhetoric will turn increasingly hawkish and that risks are moving from the downside to a more balanced situation.

ECB policy and PMI business activity

ECB policy and PMI price pressures

* Based on input prices and supplier delivery times indices

Sources for charts: IHS Markit, ECB, Eurostat.

Growth drags

Political risks remain the main threat to growth, and could subdue the expansion in coming months. Similarly, rising prices are likely to put increasing pressure on household budgets, and could curb spending. However, for now, the official and survey data paint a picture of a reassuringly solid-looking economic upturn.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-Eurozone-starts-second-quarter-with-PMI-at-six-year-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-Eurozone-starts-second-quarter-with-PMI-at-six-year-high.html&text=Eurozone+starts+second+quarter+with+PMI+at+six-year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-Eurozone-starts-second-quarter-with-PMI-at-six-year-high.html","enabled":true},{"name":"email","url":"?subject=Eurozone starts second quarter with PMI at six-year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-Eurozone-starts-second-quarter-with-PMI-at-six-year-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+starts+second+quarter+with+PMI+at+six-year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052017-Economics-Eurozone-starts-second-quarter-with-PMI-at-six-year-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}