Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 03, 2015

UK PMI surveys signal solid growth but stagnant prices in fourth quarter

A welcome upturn in service sector expansion helped counter slower growth in manufacturing and construction in November, suggesting the UK continues to enjoy the 'Goldilocks' scenario of solid economic growth and low inflation. However, signs of an upturn in earnings growth raise question marks over just how long inflation, and therefore interest rates, will remain low for.

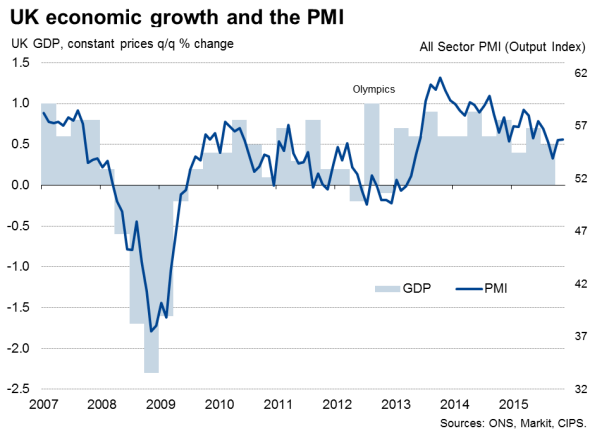

GDP rising at 0.6% pace

The three UK PMI surveys are so far are pointing to 0.6% GDP growth in the fourth quarter, up from 0.5% in the three months to September[1]. This puts the economy is on course to have grown by 2.4% in 2015.

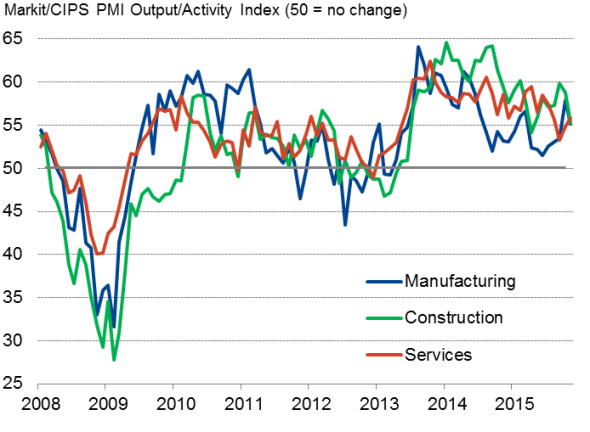

Business activity by sector

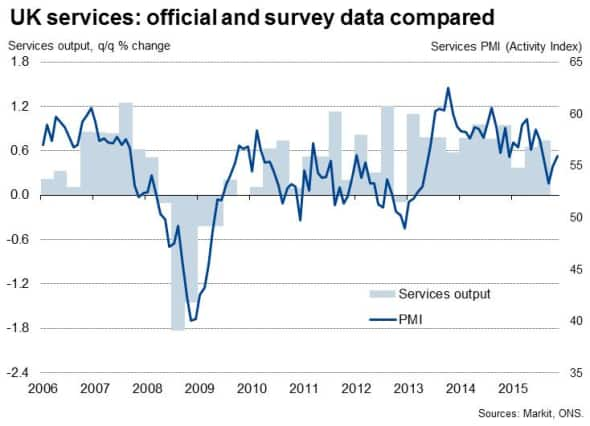

Growth is being fuelled by faster service sector activity, which gathered momentum for a second successive month in November. Services growth is being led by computing & IT, financial services and transport & communications, with signs of weakness evident in consumer-oriented services such as hotels & restaurants.

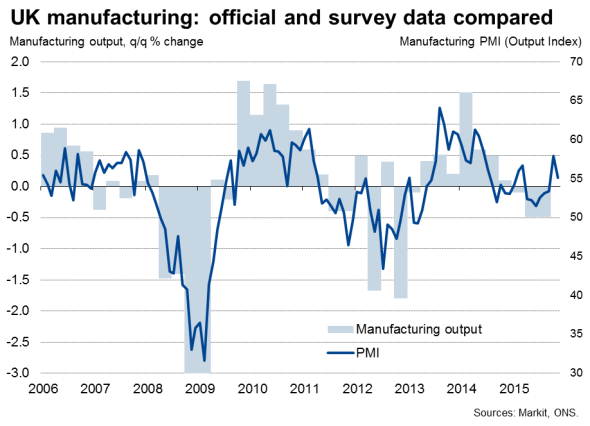

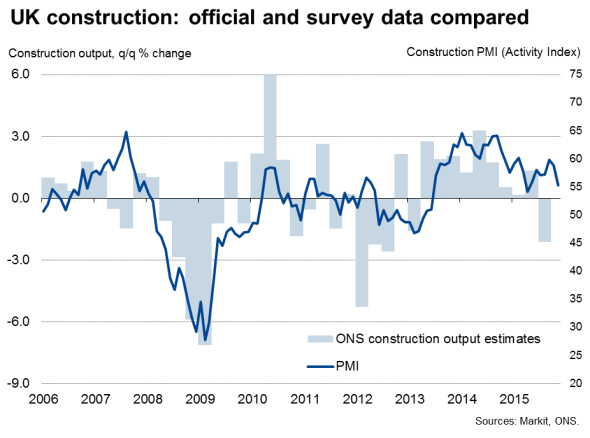

Manufacturing and construction both saw slower rates of expansion, though continued to show robust growth. The weighted Output Index from the three Markit/CIPS PMI surveys consequently held steady at 55.7.

The rise in the services PMI suggests that the sector is on course to expand by around 0.5% in the fourth quarter, though that's down from 0.7% in the three months to September. However, this rise will be accompanied by a solid expansion in construction output and a 0.3% increase in manufacturing, both sectors reviving from downturns suffered in the third quarter.

Encouragingly, growth of new business hit a four-month high in November, led by rising demand for services, suggesting that the pace of expansion could pick up further as the year comes to an end. New orders in the manufacturing and construction sectors also rose, though at slower rates than seen in October.

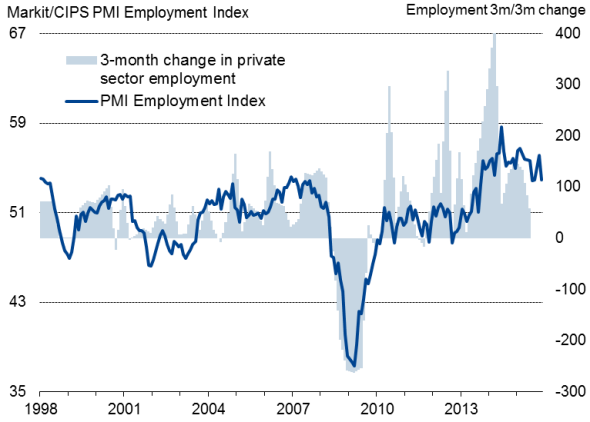

Tighter labour market

The overall rise in employment signalled during the month was the one of the weakest seen over the past two years, as headcounts fell slightly in manufacturing and hiring slowed in services and construction. The overall rate of job creation nevertheless remained resiliently robust despite widespread reports of difficulties finding suitable staff and worries about the introduction of the National Living Wage, in turn leading to reports of rising wages.

Employment

No change in prices charged

Input costs across the three sectors rose only modestly, as falling oil and energy costs offset rising wage growth. Manufacturing raw material prices fell especially sharply, but service sector costs (which are wage-heavy) grew at the fastest rate for four months (albeit by a small margin).

The weak growth of input costs and tough competition meant average prices charged for goods and services were unchanged during the month, contrasting with the modest increases seen in prior months. A slight rise in charges for services was accompanied by the steepest drop in factory gate prices since August 2009.

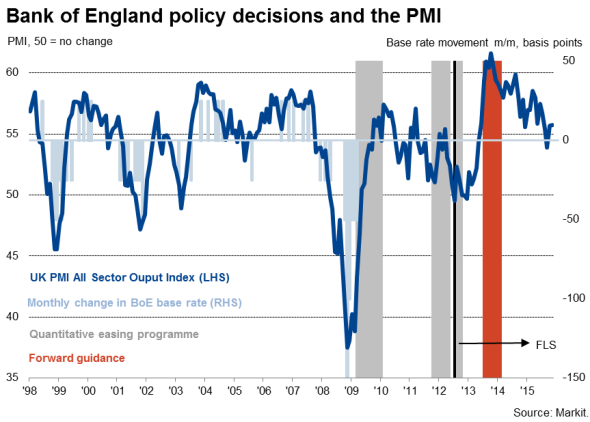

Policy on hold

The solid performance of the service sector keeps the 'all-sector' PMI in territory that would normally be associated with a possible tightening of monetary policy (see chart), but only just. Moreover, the sustained weakness of selling price inflation suggests that policymakers will be in no rush to tighten policy.

In its latest Inflation Report, the Bank of England sees only a small risk that consumer price inflation will breach its 2% target over the next two years even on the basis of rates remaining on hold throughout 2016. This forecast assumes a modest increase in wage growth, but any surprise sharp acceleration in pay growth could result in rates rising as soon as May, especially if the Fed leads the way with a rate rise at its December meeting.

[1]See our research note explaining how to interpret the PMI readings for economic growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-UK-PMI-surveys-signal-solid-growth-but-stagnant-prices-in-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-UK-PMI-surveys-signal-solid-growth-but-stagnant-prices-in-fourth-quarter.html&text=UK+PMI+surveys+signal+solid+growth+but+stagnant+prices+in+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-UK-PMI-surveys-signal-solid-growth-but-stagnant-prices-in-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys signal solid growth but stagnant prices in fourth quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-UK-PMI-surveys-signal-solid-growth-but-stagnant-prices-in-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+signal+solid+growth+but+stagnant+prices+in+fourth+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-Economics-UK-PMI-surveys-signal-solid-growth-but-stagnant-prices-in-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}